The FOMC meeting is the key event for today, which is expected to announce the end of the asset purchase program and perhaps, the readiness to start a rate hike cycle at the next meeting in March. If the FOMC confirms the market's expectations, then the US dollar will continue rising by the end of the day across the entire spectrum of the currency market.

USD/CAD

Today, the Bank of Canada will announce its changes in monetary policy, which is four hours ahead of the announcement of the results of the FOMC meeting. It is expected to act faster, which will ultimately give the Canadian dollar an advantage due to the growing rate differential.

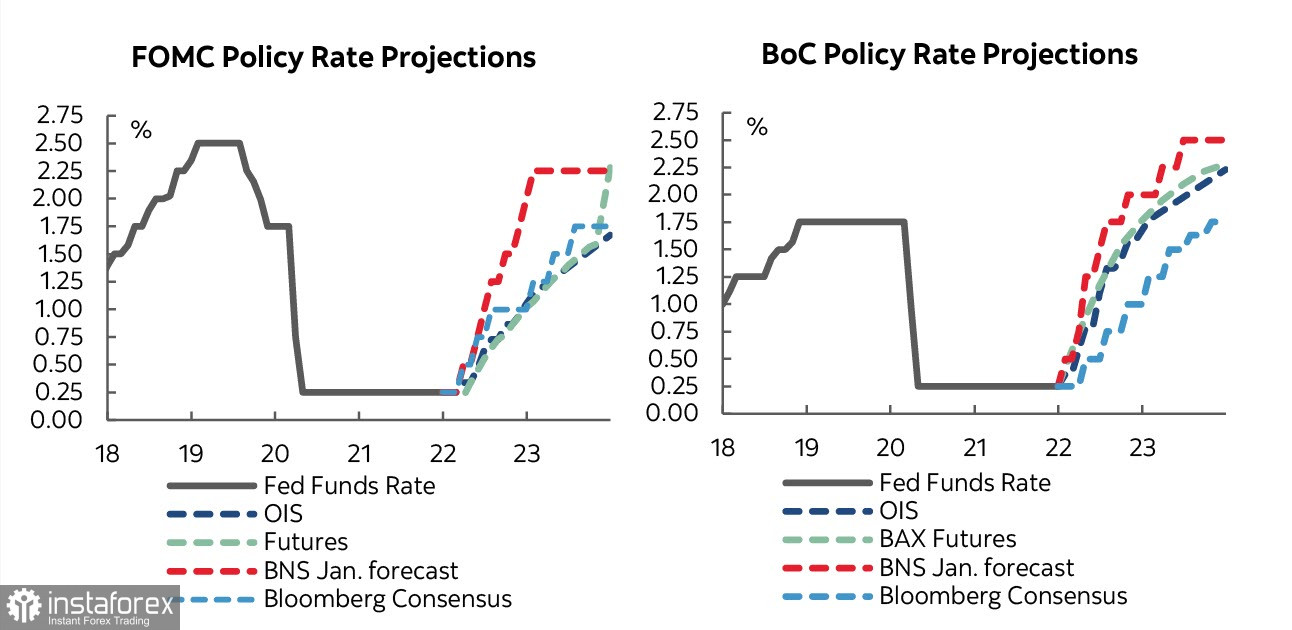

In fact, the BoC is already ahead of the Fed, maintaining good chances to increase this gap. If the Fed's forecast is that the first rate hike may occur in March, simultaneously with the end of QE, then for the Bank of Canada, the forecast is much more noticeable – a 0.25% rate increase today (70% market forecast) and a certain probability of an increase by 0.5% immediately. Four increases are predicted for the Fed this year, but for the BoC, the forecast is more radical and allows a cumulative rate increase of 2% until the end of the year under some scenarios.

With regard to balance sheet reduction and reinvestment of funds from the redemption of securities, the Fed is expected to consider this issue in the second half of the year, and the Bank of Canada may do so today. In any case, BoC management has repeatedly stated that they will reinvest flows from maturing securities "at least until we raise the discount rate", which can happen in the very near future, that is, the condition from failure reinvestment can be performed.

BoC has already completely stopped net purchases back in October last year, and it became clear that time that such a step had a minimal impact on profitability. Markets are waiting for more radical steps. In any case, the forecast is that the Bank of Canada will be ahead of the Fed, which means that the yield differential will change in favor of the Canadian dollar.

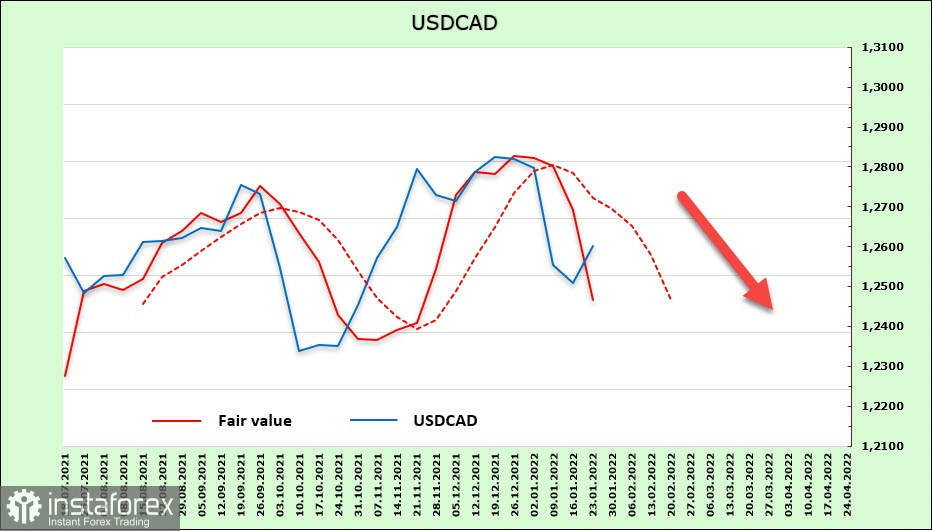

The CFTC report for the Canadian dollar is bullish – net weekly purchases amounted to +1.185 billion and a net long position of +599 million was formed. The settlement price is confidently directed downwards.

The pullback from the support level of 1.2454 is corrective in nature. In case of disappointment, growth may continue to 1.2800/20, but such a scenario is unlikely. A downward reversal from the current levels and updating the local low with the target of 1.2280 are more likely.

USD/JPY

The yen does not have its own drivers for course correction in anticipation of the FOMC decision. The economic situation, as well as the policy of the Bank of Japan, which continues QQE, are stable.

If changes in monetary policy are planned, they will be huge in the near future. Mizuho Bank gives examples of such possible changes, such as adjusting the yield forecast, abandoning negative rates, expanding the corridor of yields, and reorienting from long to short-term bonds. All this looks frivolous amid the expected steps from the Fed, and even more so from the side of the BoC or the RBNZ. The yen will react to changes in global risks as the main protective currency, which is currently the main factor for it.

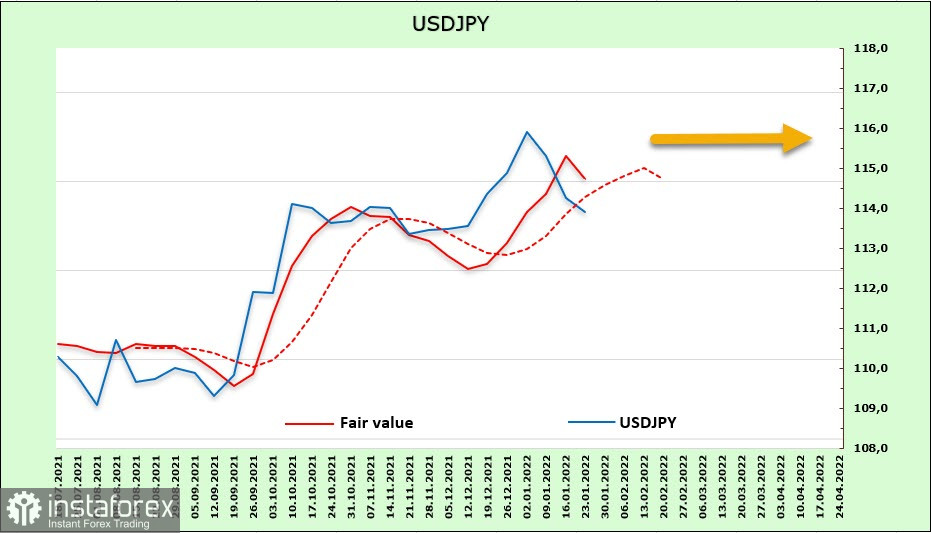

According to the CFTC, the net short position of the yen slightly fell to -8.821 billion (+668 million). The bearish preponderance is obvious. The estimated price turned down but remains above the long-term average, which does not allow one to choose a clear direction.

It can be assumed that the Japanese yen will remain within the ascending channel. The downward correction will end near the lower border of channel 112.70/90, and if the market considers the FOMC decision aggressive enough, the USD/JPY rate may start rising directly from current levels. The nearest target is a local high of 118.60. We expect the yen above the level of 120 in the future.