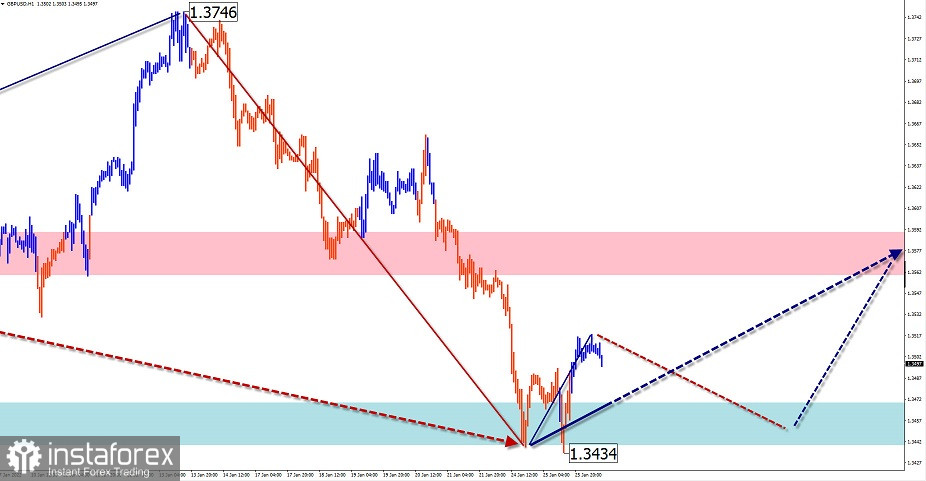

GBP/USD

Analysis:

On the chart of the British currency, the trend direction since last November is set by the algorithm of an incomplete ascending wave. The price has formed a complex correction in the shape of a stretched plane since early 2022. Currently, its structure looks completed. The upward price section from January 24 has a reversal potential.

Outlook:

The price movement to the area of settlement resistance is expected during the forthcoming days. A short-term decline, not further than the support zone is likely at the nearest trading sessions.

Potential reversal zones.

Resistance:

- 1.3560/1.3590

Support:

- 1.3470/1.3440

Recommendations:

Today, it is recommended to monitor the emerging signals of trading systems to buy the instrument in the pound market around the support zone.

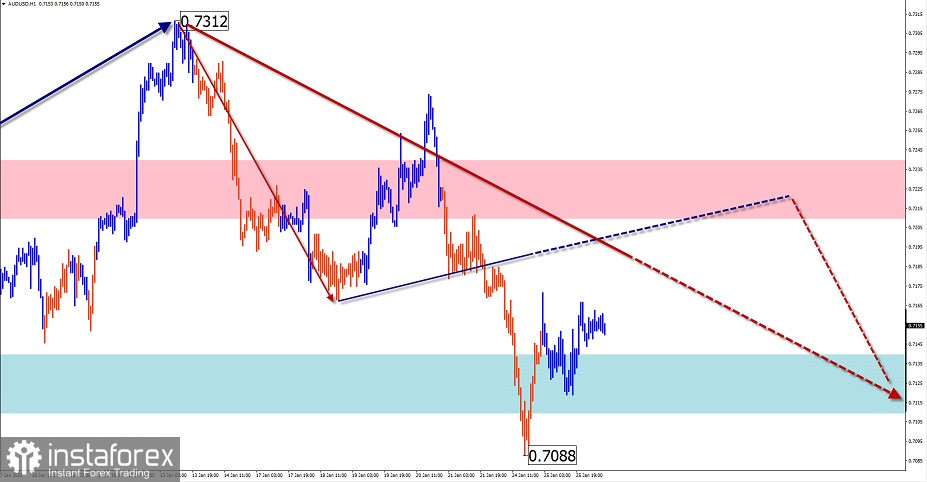

AUD/USD

Analysis:

Daily fluctuations of the Australian currency are set by the algorithm of the incomplete upward wave from December 3, 2021. The price has been correcting downward for the last two weeks. Currently, its structure does not look complete.

Outlook:

A flat is expected in the pair's market today. The pressure on the support zone is possible in the first half of the day. Reversal and price growth is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 0.7210/0.7240

Support:

- 0.7140/0.7110

Recommendations:

Today, selling may lead to losses and is not recommended. Short-term purchases in small lots from the support area are possible.

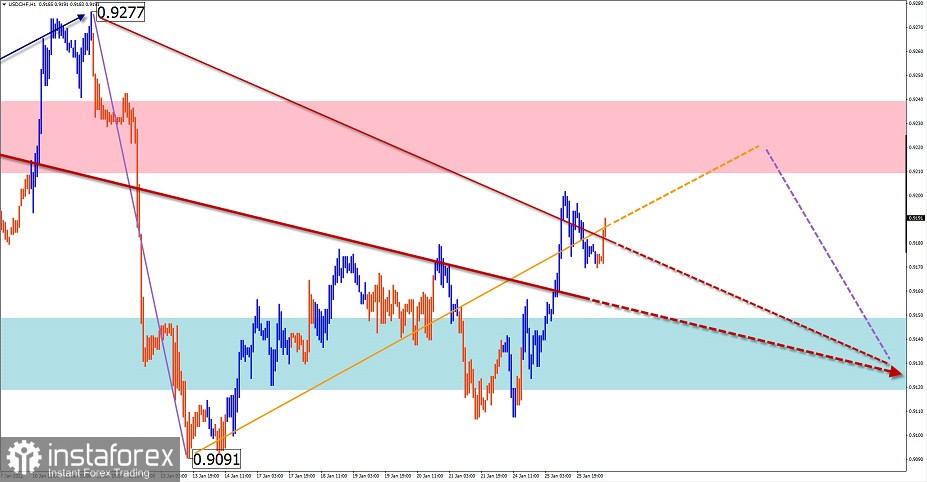

USD/CHF

Analysis:

On the chart of the Swiss franc, the dominant course for the price movement is set by the descending plane. The incomplete section dates back from January 10. In the last decade, quotes are moving upwards, forming a pullback.

Outlook:

Today, the pair is expected to move in a general sideways direction today in a price corridor between the closest encounter zones. An upward vector is likely in the first half of the day. A change of trend and the start of the decline are possible by the end of the day.

Potential reversal zones

Resistance:

- 0.9210/0.9240

Support:

- 0.9150/0.9120

Recommendations:

Today, trading the Swiss franc is possible using short-term transactions within individual trading sessions. Selling from the resistance area is more promising.

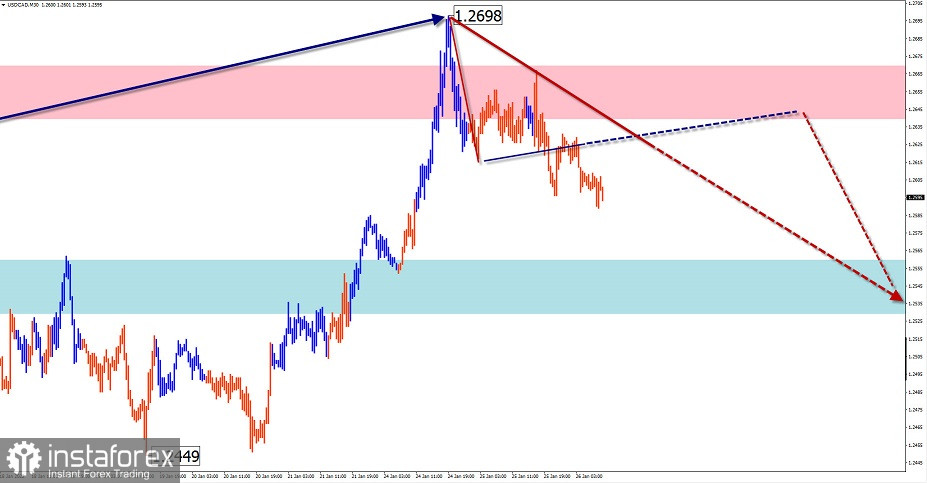

USD/CAD

Analysis:

The Canadian dollar is trading with a downtrend channel. The price has been correcting since last May. The incomplete part of this wave from December 20 is downward. The price forms an upward pullback within its framework. The price decline from January 24 has a reversal potential.

Outlook:

An uptrend is more likely in the first half of the day. A breakout of the upper boundary of the resistance zone is possible, but unlikely. A reversal and resumption of decline can be expected at the end of the day.

Potential reversal zones

Resistance:

- 1.2640/1.2670

Support:

- 1.2560/1.2530

Recommendations:

Trading the USD/CAD pair may lead to losses within a flat. It is recommended not to enter the pair's market until there are confirmed sell signals near the resistance zone.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!