To open long positions on GBP/USD, you need:

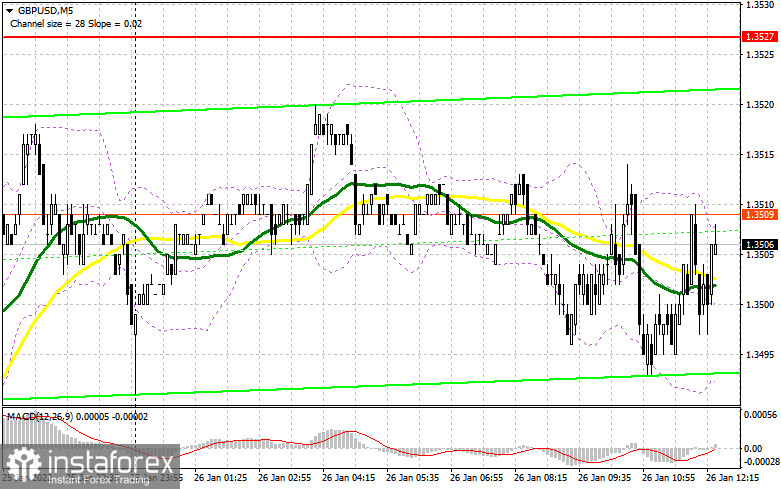

In my morning forecast, I paid attention to several levels and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Very low volatility and the lack of fundamental statistics for the UK - all this led to GBP/USD trading in a narrow side channel of 20 points. As a result, there were no signals to enter the market, since we did not reach the necessary levels. The upcoming results of the US Federal Reserve meeting are also deterring major players from making decisions. From a technical point of view, nothing has changed for the second half of the day. And what were the entry points for the euro this morning?

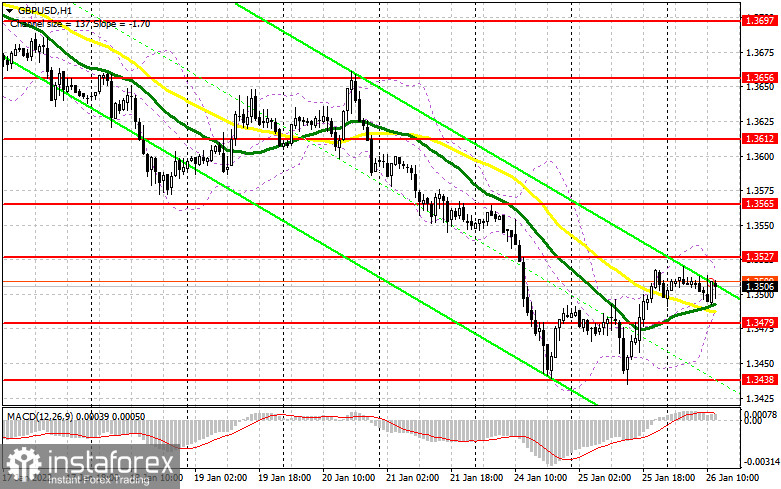

In my opinion, the bulls are ready to build a larger upward correction after a prolonged downward trend observed since January 12. The only "but" is today's meeting of the Federal Reserve System. Several fundamental statistics on the American economy are also coming out in the afternoon, but it is unlikely to be of serious importance. An important task for buyers today remains the support of 1.3479, on which the moving averages are located, playing on the buyers' side. Weak data on the volume of sales in the primary housing market in the United States and the balance of foreign trade will help the bulls cope with the pressure of sellers.

A false breakout at 1.3479 forms the first buy signal with the prospect of recovery to the area of 1.3527, on which the buyers of the pound will place a certain emphasis today. Only a breakdown and a test of this level from top to bottom will give an additional entry point into long positions to return to the maximum of 1.3565. A more difficult task will be the test of the 1.3612 area, where I recommend fixing the profits. A sharp jump of the pair to this level can occur only after the publication of the results of the Federal Reserve meeting.

Under the scenario of a decline in GBP/USD during the US session and a lack of activity at 1.3479, and judging by how the markets are afraid of the decisions of the US central bank on monetary policy, it is better not to rush with purchases of risky assets. I advise you to wait for the test of the next major level of 1.3438 and only the formation of a false breakdown there will give an entry point to long positions. You can buy the pound immediately on a rebound from 1.3409, or even lower - from a minimum of 1.3389, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Sellers of the pound are also not very active yet, which indicates the wait-and-see nature of the market. The primary task for today remains to protect the level of 1.3527, from which the pound could not bounce far down during the European session. A fairly large number of stop orders pass above this range, the triggering of which will lead to an instant jump of the pound up. Only the formation of a false breakdown at 1.3527 and strong statistics on the USA form the first entry point into short positions, followed by a decline in the pair to the area of 1.3479, for which we will have to fight very hard. A more aggressive policy of the Federal Reserve System will help with the breakdown of this key area.

The 1.3479 tests from the bottom up will give an additional entry point into short positions in the expectation of a further decline in GBP/USD by 1.3438 and 1.3409, where I recommend fixing the profits. If the pair grows during the American session and sellers are weak at 1.3527, it is best to postpone sales until the next major resistance at 1.3565. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from 1.3612, or even higher - from this month's maximum in the area of 1.3656, counting on the pair's rebound down by 20-25 points within a day.

The COT reports (Commitment of Traders) for January 18 recorded an increase in long positions and a reduction in short positions - which indicates the continued preservation of the attractiveness of the pound after the Bank of England raised interest rates at the end of last year. Expectations have increased quite seriously that at its next meeting, the regulator may again resort to another increase in interest rates by 0.25 points, which will only strengthen the pound's position. However, the observed fundamental picture creates several more serious moments that limit the upward potential. First of all, we are talking about inflation, which is "eating up" everything that the UK labor market can offer at the moment with cosmic speed. Despite high wages and falling unemployment, high inflation leaves nothing from household incomes, and high prices for energy and other services make their well-being even lower than the level that was observed during the coronavirus pandemic. If you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. In any case, the Bank of England's decision to raise interest rates further this year will push the pound to new highs. It is worth recalling that this week everyone is waiting for the results of the meeting of the open market committee, at which a decision on monetary policy will be made. Some traders expect that the US central bank may decide to raise interest rates already during the January meeting, without postponing this issue until March. A reduction in the Fed's balance sheet will also be announced. The COT report for January 18 indicated that long non-commercial positions increased from the level of 30,506 to the level of 39,760, while short non-commercial positions decreased from the level of 59,672 to the level of 40,007. This led to a change in the negative non-commercial net position from -29,166 to -247. The weekly closing price rose from 1.3579 to 1.3647.

Signals of indicators:

Moving Averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by bulls to turn the market around.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the average border of the indicator in the area of 1.3517 will act as resistance. A break of the lower limit in the 1.3500 area will lead to a new wave of decline in the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.