Bitcoin's recent plunge, which caused the major cryptocurrency's drawdown to 54%, is more disastrous than it was during the 2017 bear market. Short-term bitcoin holders have been hit hard.

Short-term positions are risky due to bitcoin's volatility

Glassnode data indicates a sharp rise in losses for short-term bitcoin holders. According to the company, the returns of such BTC holders have fallen to record lows. Relative unrealized profit reached a 15-month low of 0.491.

This situation is underscored by several other key indicators of the bitcoin network. Bitcoin's net exchange inflow hit its 4-week high on Wednesday. This fact confirms that bitcoin holders are moving their digital assets to cryptocurrency exchanges to sell.

Glassnode stated that short-term holders (STH) are now incurring historically large unrealized losses. It said that the STH-NUPL metric tracked the aggregate unrealized loss of the STH cohort in proportion to market capitalization. Glassnode noted that the -40% value coincided with one of the deepest sell-offs in history. It also added that as BTC was trading 50% below its all-time high, investor profitability had declined and large losses were occurring online.

Conversely, long-term holders are buying bitcoin

Moreover, the opposite trend is prevalent among long-term bitcoin holders. While short-term buyers are forced to sell their coins, long-term holders are buying them back.

Glassnode notes that the supply of short-term bitcoin holders has hit multi-year lows. However, their counterparts who bought the cryptocurrency for the long term are not frustrated by this drawdown. Long-term holders' supply is now returning to a smooth upward trend. This fact indicates they have no intention of selling their coins. Some of them are probably being held in cold storage.

Market is maturing

These indicators and trends support a recent statement by the Ark Capital fund that most bitcoin investors have matured and are holding assets for long-term gains rather than short-term speculative gains. Fund analysts evaluated network data and metrics such as the long-term holder base and the aggregate value base.

Both of these remain at record high levels. The second long-term holder base is the basis for Ark's claim that the bitcoin market is turning from speculative to long-term, which means it can be considered a maturing one.

The dominance of long-term holders in the market creates margin of safety for the major cryptocurrency and increases the likelihood of recovery from corrections.

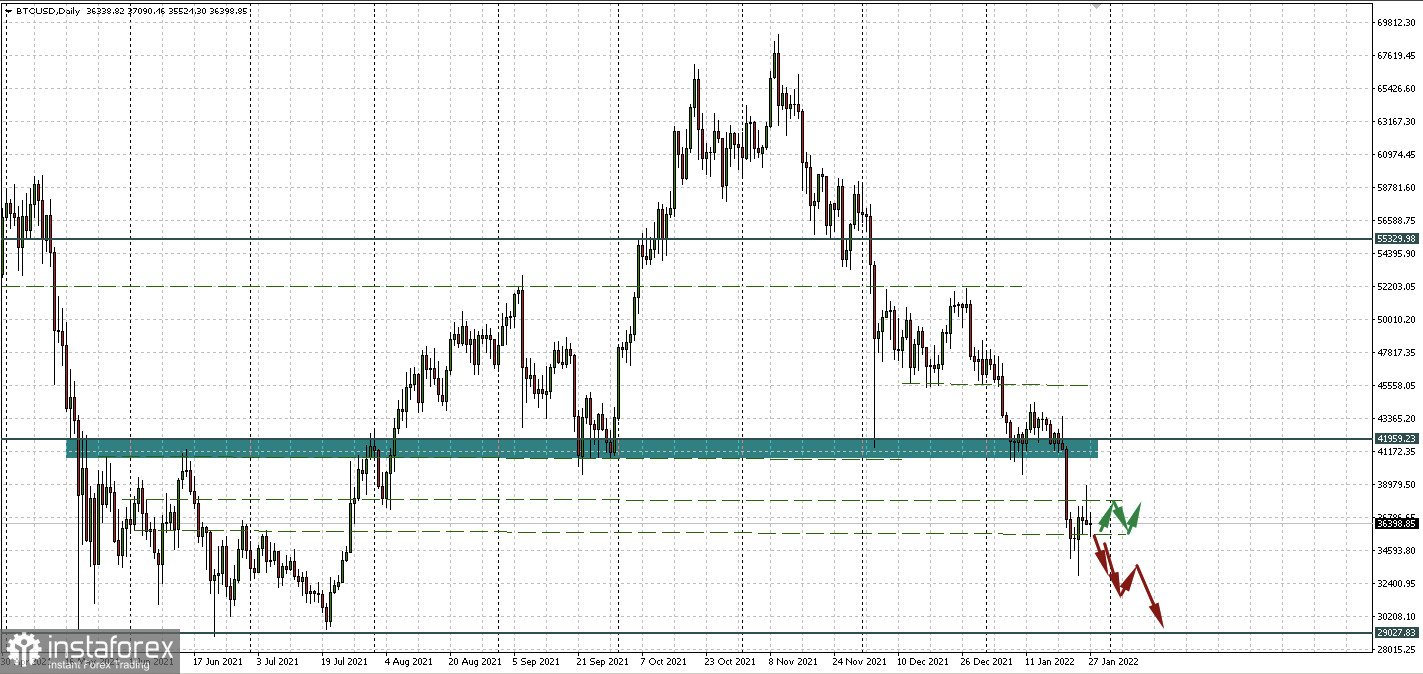

Shaky equilibrium on BTC/USD chart

At the same time, bitcoin's recovery has failed so far. The Fed's hawkish rhetoric and expectations of higher interest rates hit risk appetite on Wednesday. Consequently, BTC/USD reversed in the corridor of 35915.72 - 37903.51. In the best-case scenario, it will probably continue to consolidate in it. Otherwise, the major cryptocurrency will return to its Monday's lows and it could even reach $29,000 per coin.