The GBP/USD currency pair has broken its upward trend. The reason was the extremely hawkish speech of US Federal Reserve (Fed) Chair Jerome Powell at the press conference that followed the announcement of the interest rate decision. It sometimes happens in the market when important fundamentals or archival speeches from the world's leading central bankers change or break the technical picture of a particular currency pair. That is exactly what happened yesterday. In his speech, Powell was extremely positive about the growth of the world's leading economy, while emphasizing the Fed's determination to move to a tightening of monetary policy. Powell believes that the first federal funds rate hike is likely to take place in March this year. However, the excellent labor market indicators, particularly employment, should not be negatively affected by the COVID-19 omicron strain, which the Fed Chair considers to be short-lived. Although no specific timeframe for a rate hike was announced, he did not rule out the possibility of a rate hike at any of the next Fed meetings.

Macroeconomic statistics are expected to be released in the US today. I would recommend focusing on GDP data, durable goods orders and initial jobless claims. Now, let's take a look at the GBP/USD price charts.

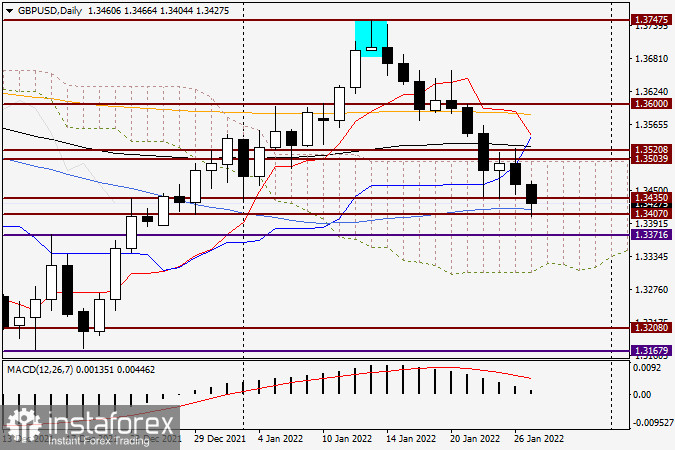

Daily

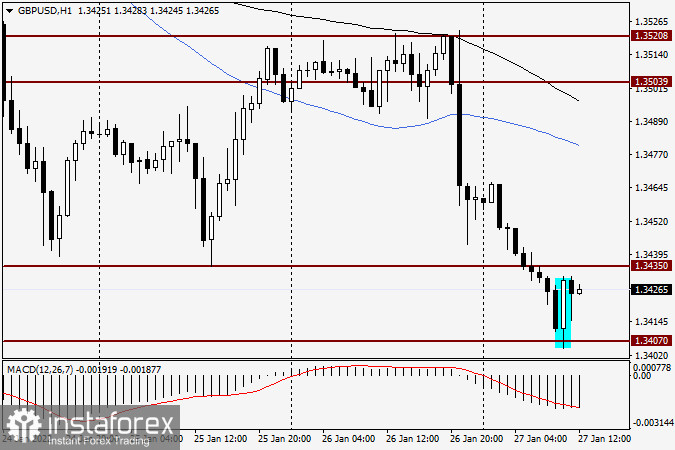

The pair dropped in yesterday's trading. Taking into account the harsh rhetoric of the Fed chair, it was quite reasonable. However, the Pound's decline has been rather subdued, as can be seen by the fact that the previous lows of 1.3450 have not been hit and the trading ended at the strong technical level of 1.3460 on January 26. However, the strengthening of the US dollar continues today, and the GBP/USD is already trading near 1.3425. As we can see, blue 50 simple moving average is keeping the pair from further declines, but we do not know how long it will last, as the pressure of the bears is not weakening. Should that situation persist, the pair will probably test the 1.3400 level, where it might find support, at least for the short term.

H1