The U.S. dollar continued to strengthen during today's Asian trading session after the Fed meeting ended on Wednesday and its signal of a tendency to more aggressive interest rate hikes.

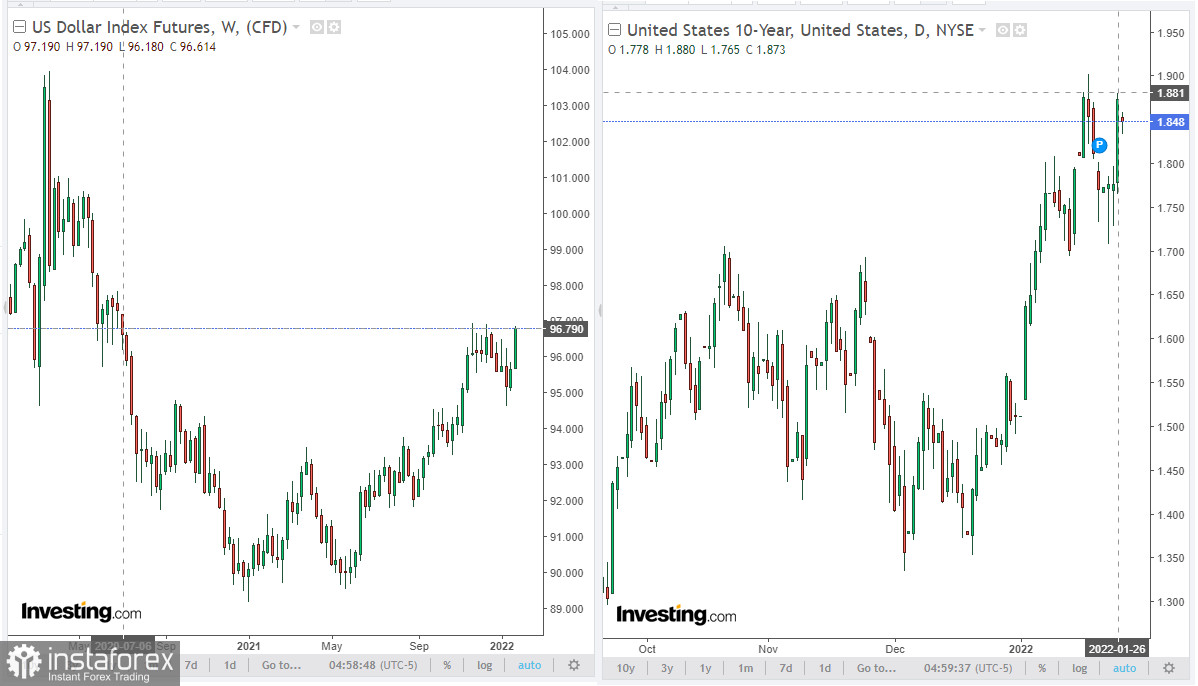

At the time of writing, the DXY dollar index was at 96.79, in line with July 2020 levels, while the yield on 10-year U.S. government bonds jumped yesterday to 1.880%, returning to the highs of 2 years ago.

At the end of the two-day meeting, Fed officials left the target range for federal funds rates unchanged, but hinted that they could start raising rates in March. Fed Chairman Jerome Powell also said there is room for rate hikes without hurting the labor market. According to him, "there's room to raise interest rates without threatening the labor market," as "labor market conditions are already largely consistent with maximum employment." At the same time, the situation with U.S. inflation worsened after the Fed's December meeting, Powell acknowledged, stating that "Fed policy will need to respond in the event of a further deterioration in the environment."

Now, many economists are strengthening the opinion that Fed leaders can immediately raise the rate in March by 0.50%, and the number of rate hikes in 2022 may increase from 3 to 6. According to the CME Group, investors take into account 100% chance of at least a quarter of a percentage point first rise in March and nearly 70% chance of a second rise in May.

After the end of the cycle of raising interest rates, the Fed's balance sheet, which currently stands at almost $9 trillion (about 40% of U.S. GDP), is likely to begin to shrink. This will also be a positive factor for the dollar.

Next week there will be meetings of 3 more of the world's largest central banks: Australia, the Eurozone and the UK. It is expected that at this meeting, which will end on Thursday with the publication of the interest rate decision at 09:00 UTC, the Bank of England will raise it by 0.25% to 0.50%, thus outstripping its main competitors in this process, the Fed and the ECB.

This is positive news for the British pound. However, it may come under pressure if market expectations that interest rates in the UK will be raised four times this year do not materialize.

A similar reaction of market participants was to the interest rate increase by the central bank of New Zealand. At the end of November, RBNZ executives raised the interest rate to 0.75%. However, this decision did not cause a significant strengthening of the NZD. Moreover, in the following weeks, the New Zealand dollar came under pressure: the RBNZ leaders signaled that they would now take a wait-and-see position to assess the impact of the rate hike on the New Zealand economy.

Economists say the BoE has a "limited set of tools" to curb inflation, driven mainly by external factors, including rising energy prices and supply chain disruptions. The Bank of England kept rates flat from 2010 to 2013 when inflation was high and could do so again, economists say, given government uncertainty and risk aversion amid rising tensions with Russia over events in Ukraine and as well as the ongoing threats from the coronavirus (despite the vaccination campaign, the UK continues to have a high infection rate).

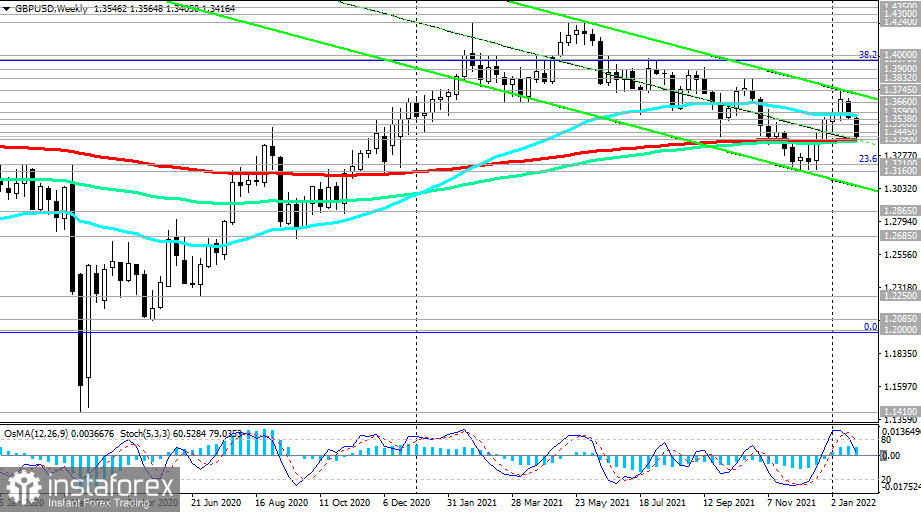

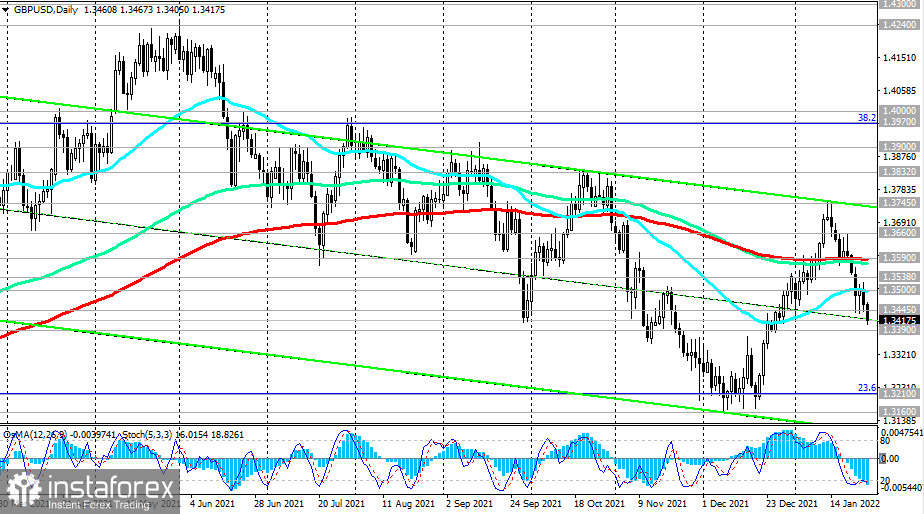

On the weekly chart, GBP/USD came close to the key support level of 1.3390 (200-day MA). If the rhetoric of the statements of the Bank of England's leaders regarding the prospects for monetary policy is considered soft by market participants, then the pound may react by weakening, and the breakdown of the support level of 1.3390 may accelerate further decline in GBP/USD, especially if the divergence of the trajectories of the monetary policies of the Fed and the Bank of England will increase.

Today, the focus of market participants will be on a block of important macroeconomic statistics from the U.S., including reports on annual GDP dynamics for the 4th quarter, the number of claims for unemployment benefits and the volume of orders for durable goods in December. These data will be published at 10:30 UTC, which is why a sharp increase in volatility is expected in the financial market at this time, primarily in dollar quotes, and especially if the data differs greatly from the forecast values.

Technical analysis and trading recommendations

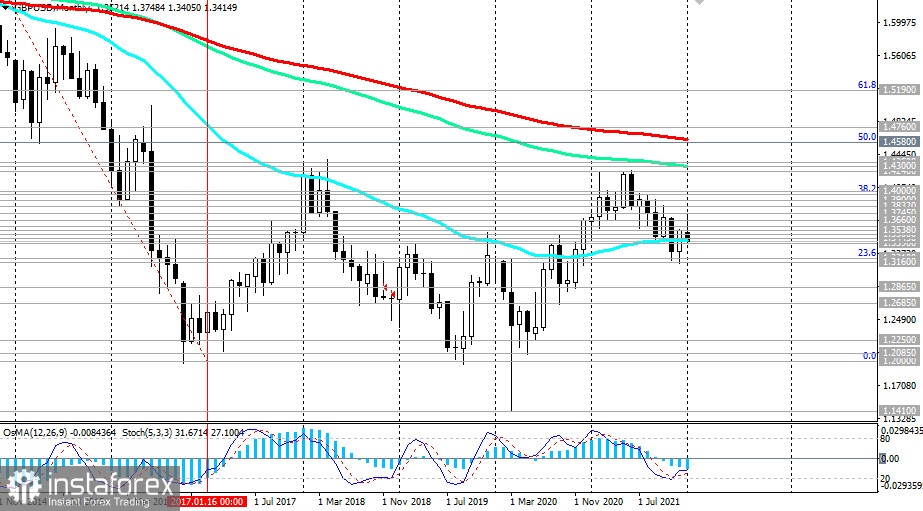

Despite the upward correction that has been observed since mid-December, the GBP/USD is in a global downward trend, which is clearly visible on the monthly price chart.

A breakdown of support levels 1.3210 (23.6% Fibonacci retracement level to the decline of the GBP/USD pair in the wave that began in July 2014 near the level of 1.7200), 1.3160 (2021 lows) can finally return GBP/USD to the bear market zone and send the pair deep into the descending channel on the weekly chart with targets at local support levels 1.2865, 1.2685. More distant decline targets are at 1.2100, 1.2000.

In an alternative scenario, the first signal for the beginning of a new wave of upward correction will be a breakdown of the local resistance level of 1.3445, and the confirming one will be a breakdown of the resistance level of 1.3500 (50 EMA on the daily chart). The first target of the upward correction is the key resistance level 1.3590. A breakdown of the local resistance level of 1.3745 may again increase the risks of breaking the GBP/USD bearish trend, sending it towards the highs of 2021 and the level of 1.4200.

However, so far this is only an alternative scenario. In the current situation, short positions on GBP/USD are preferable.

Support levels: 1.3390, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Resistance levels: 1.3445, 1.3500, 1.3538, 1.3590, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000

Trading recommendations

Sell Stop 1.3385. Stop-Loss 1.3455. Take-Profit 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Buy Stop 1.3455. Stop-Loss 1.3385. Take-Profit 1.3500, 1.3538, 1.3590, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000