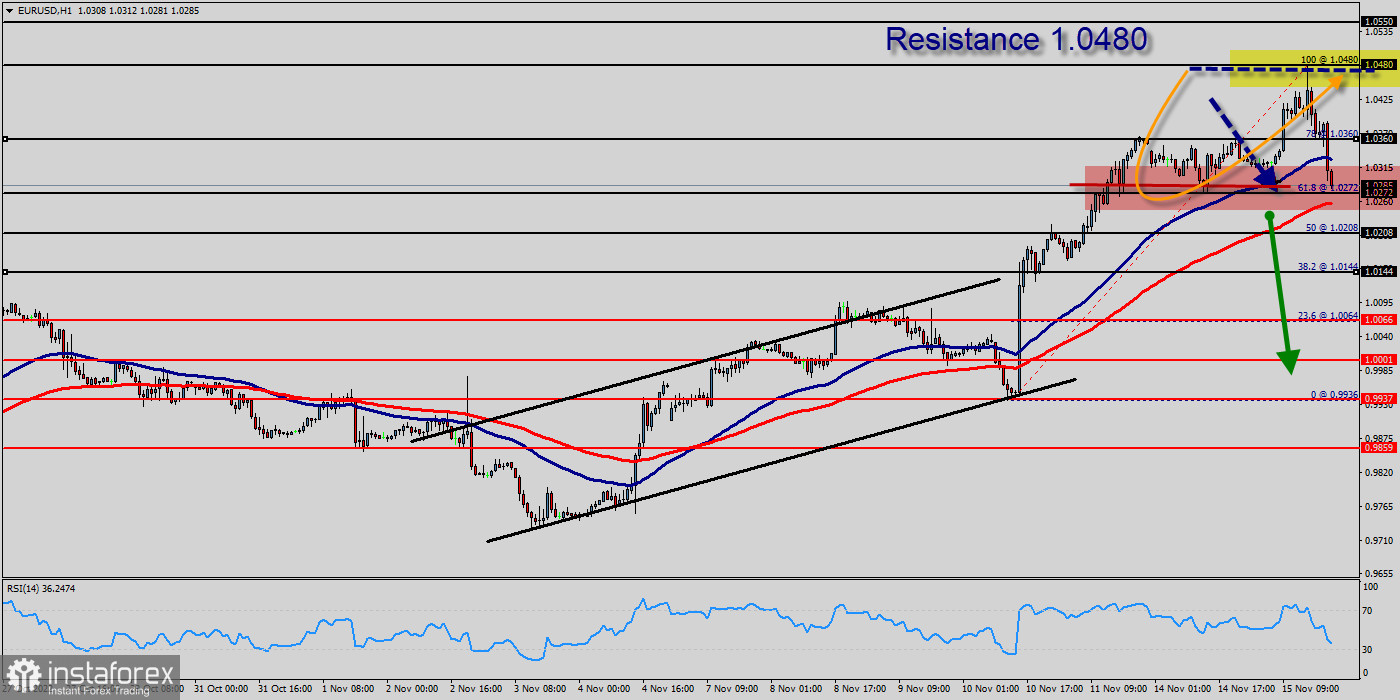

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0480 and 1.0208, so it is recommended to be careful while making deals in these levels because the prices of 1.0480 and 1.0208 are representing the resistance and support respectively. Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market. It should be noted that the volatility is very high for that the price of the EUR/USD pair is still trading between the prices of 1.0480 and 1.0208 in the coming hours.

Furthermore, the price has been set below the strong resistance at the levels of 1.0480 and 1.0360 which coincide with the 100% and 78% Fibonacci retracement levels respectively. In other words, sell deals are recommended below the price of 1.0360 with the first target at the level of 1.0272. From this point, the pair is likely to begin an descending movement to the price of 1.0208 with a view to test the daily bottom at 1.0208.

Additionally, currently the price is in a bearish channel. According to the previous events, the pair is still in a downtrend. From this point, the EUR/USD pair is continuing in a bearish trend from the new resistance of 1.0360.

Thereupon, the price spot of 1.0360 and 1.0480 remains a significant resistance zone. Therefore, the possibility that the Pound will have a downside momentum is rather convincing and the structure of the fall does not look corrective.

The market indicates a bearish opportunity below 1.0480 and 1.0360 it will be a good signal to sell below 1.0480 and/or 1.0360 with the first target of 1.0272. It is equally important that it will call for downtrend in order to continue bearish trend towards 1.0206.

Besides, the weekly support 2 is seen at the level of 1.0206. However, traders should watch for any sign of a bullish rejection that occurs around 1.0206. The level of 1.0206 coincides with 50% of Fibonacci, which is expected to act as a major support today. Since the trend is above the 50% Fibonacci level, the market is still in an uptrend. Overall, we still prefer the bearish scenario.

Forecast:

If the pair fails to pass through the level of 1.0480, the market will indicate a bearish opportunity below the strong resistance level of 1.0480 or/and 1.0360. In this regard, sell deals are recommended lower than the 1.0480 or/and 1.0360 level with the first target at 1.0272. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.0208. On the other hand, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.0480 (notice that the major resistance today has set at 1.0480).