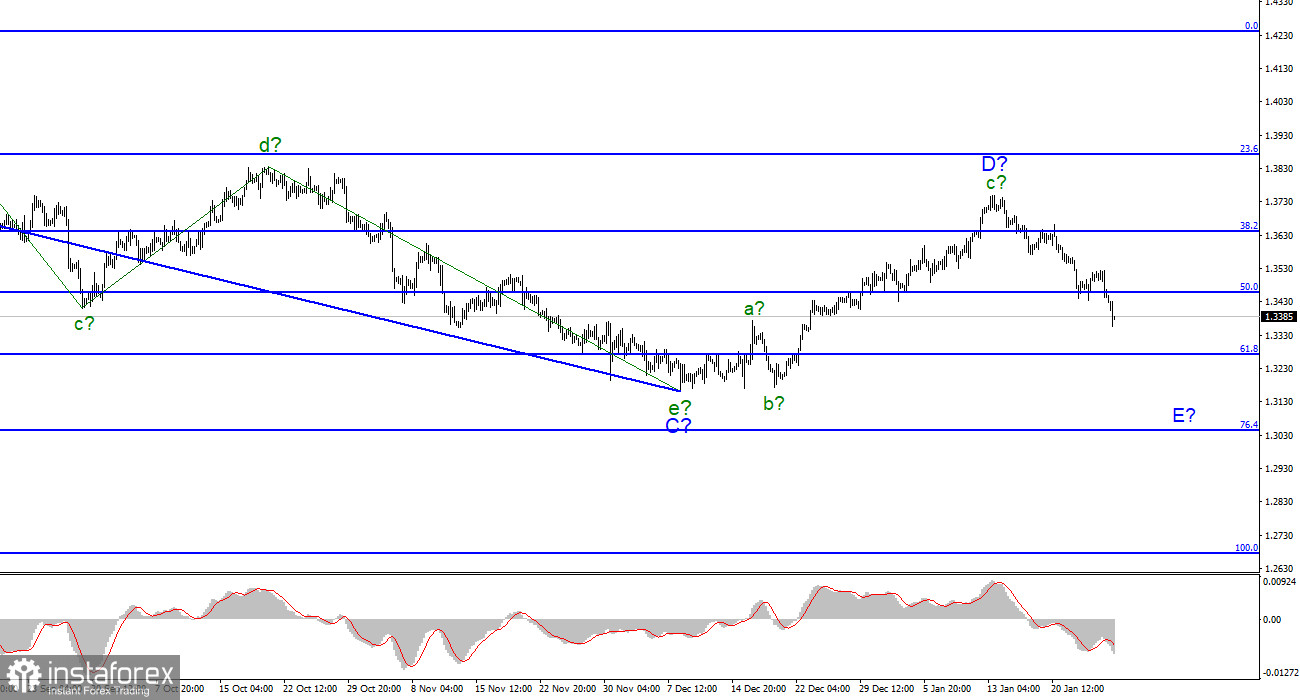

For the pound/dollar pair, the wave markup continues to look quite comprehensive. In the last few weeks, the pair has been trying to build an upward wave, which may be wave D of the downward trend segment. However, if the current wave markup is correct, then this wave has completed its construction and the development of wave E has begun. Thus, the entire downward section of the trend may take on an even more extended form. Wave D has taken a clear three-wave form and its internal wave marking does not cause any questions now. If the pair breaks through the Fibonacci retracement level of 50.0%, which corresponds to 1.3458, the pound sterling is likely to face a sell-off. Correction waves are practically not visible inside the supposed wave E. So, it may be longer than it seems. Therefore, the euro and the pound sterling are likely to drop significantly in the coming months as analysts forecast a sharp downward movement for both currencies.

GBP lost momentum following the FOMC meeting and strong US GDP data

The pound/dollar pair decreased by only 50 pips on January 26. However, it lost 80-90 pips today. Thus, its trajectory is quite similar to one of the euro/dollar pair. Trading volumes are also almost the same for them as well as fundamental factors. Yesterday, demand for the US dollar rose considerably amid the hawkish rhetoric of Jerome Powell. Today, the number of long positions on the US dollar also increased. Just a few hours ago the US unveiled three economic reports that facilitated its further rise. The main driver was strong GDP data that considerably exceeded forecasts. The report on durable goods orders, on the contrary, turned out to be much worse than expected. Initial and continuing jobless claims data was in line with the forecast. The greenback has been growing steadily since Thursday. It means that traders ignored negative reports. This is hardly surprising as the GDP report is much more important than the other two. If US GDP coincided with the forecast, investors would probably pay attention to durable goods orders and labor market reports. GDP turned out to be 1.6% higher in the fourth quarter than expected. The economic calendar for the UK remains empty today and until the end of the week. This is why traders are selling the pound sterling. I believe that it is crucial to pay attention to wave markup, especially during news releases. Currently, it is better to follow the trend.

Conclusion

The wave pattern of the pound/dollar pair signals the construction of wave E. After the price broke through the 1.3458 mark, traders opened new short positions on the pair with the target level of 1.3271, the Fibonacci retracement level of 61.8%. The MACD indicator also signaled short positions. Currently, there is no alternative scenario as there are no reasons or fundamental factors for it. Wave E may get a clear five-wave structure.