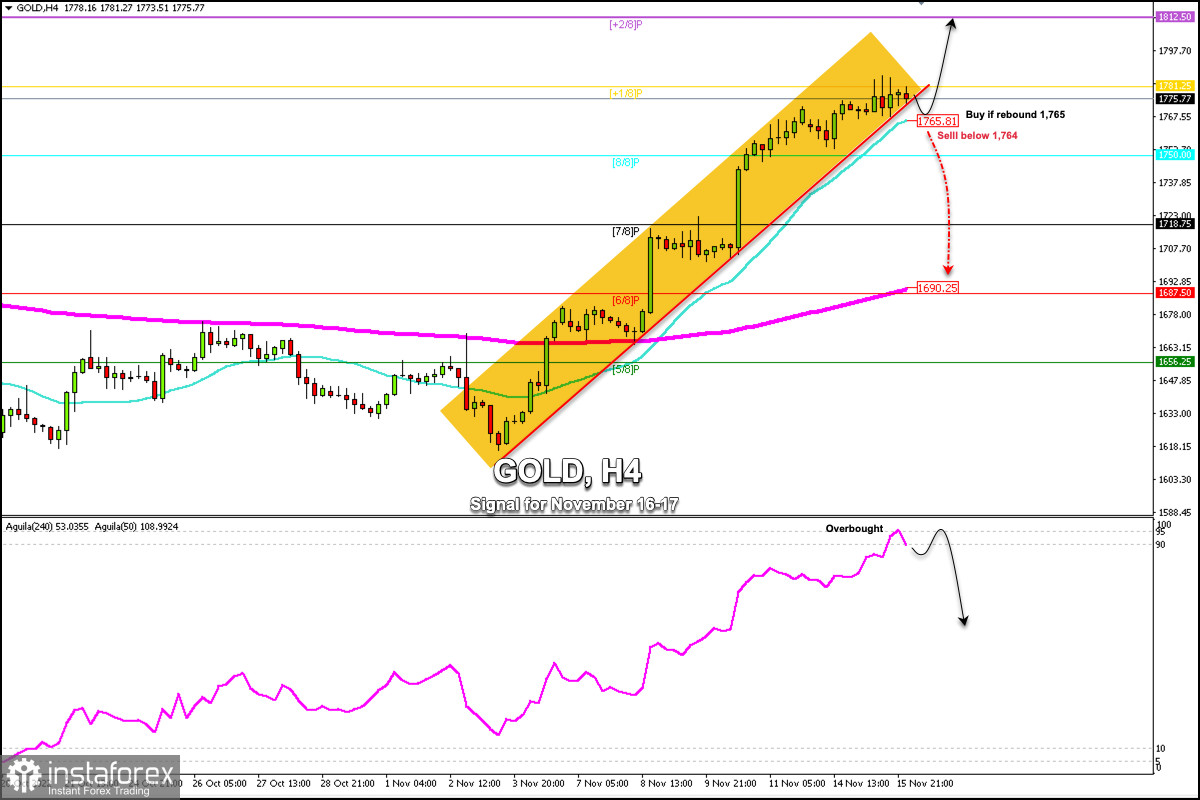

Early in the European session, Gold is trading at around 1,775.77 above the 21 SMA and below the +1/8 Murray. XAU/USD is showing some exhaustion of the bullish force but still holds the uptrend channel which has been in progress since early November.

Gold extended its recovery to 1,786.34. This is due to the fact that the market continues to digest the US inflation data unveiled last week. This fall from its peak of 9.1% makes investors believe that there could be a further relaxation of inflationary pressures in the country. In consequence, this is driving investors to invest in risky assets.

A sharp break of the uptrend channel formed on the 4-hour chart and a daily close below the 21 SMA located at 1,765 could be the start of the trend change and the metal could fall towards the psychological level of 1,700 and could even reach the 200 EMA located at 1,690.

Yesterday, the eagle indicator reached an extremely overbought level at 95-points. It is likely that there will be a technical correction in the next few days but for this, we should wait for gold to fall below 1,765 to sell.

With XAU/USD trading above the 21 SMA around 1,765, we could expect a technical bounce in this area and the price could resume its bullish cycle and it could reach 1,781 and may even go as high as + 2/8 Murray at 1,812.50

On the other hand, a daily close below 1,764 will be a clear signal to sell with targets at 1,750, 1,718 and towards 1,690 (200 EMA).

Our trading plan for the next few hours is to sell below 1,781, with the target at 1,765. Additionally, we should wait for a sharp break below 1,764 to resume selling, with targets at 1,718 and 1,687. The eagle indicator is giving a negative signal which supports our bearish strategy.