US stocks remained bearish on Thursday as tech giants continued to weigh heavily on the market. Traders were also reluctant to buy shares amid early rate hikes from the Fed.

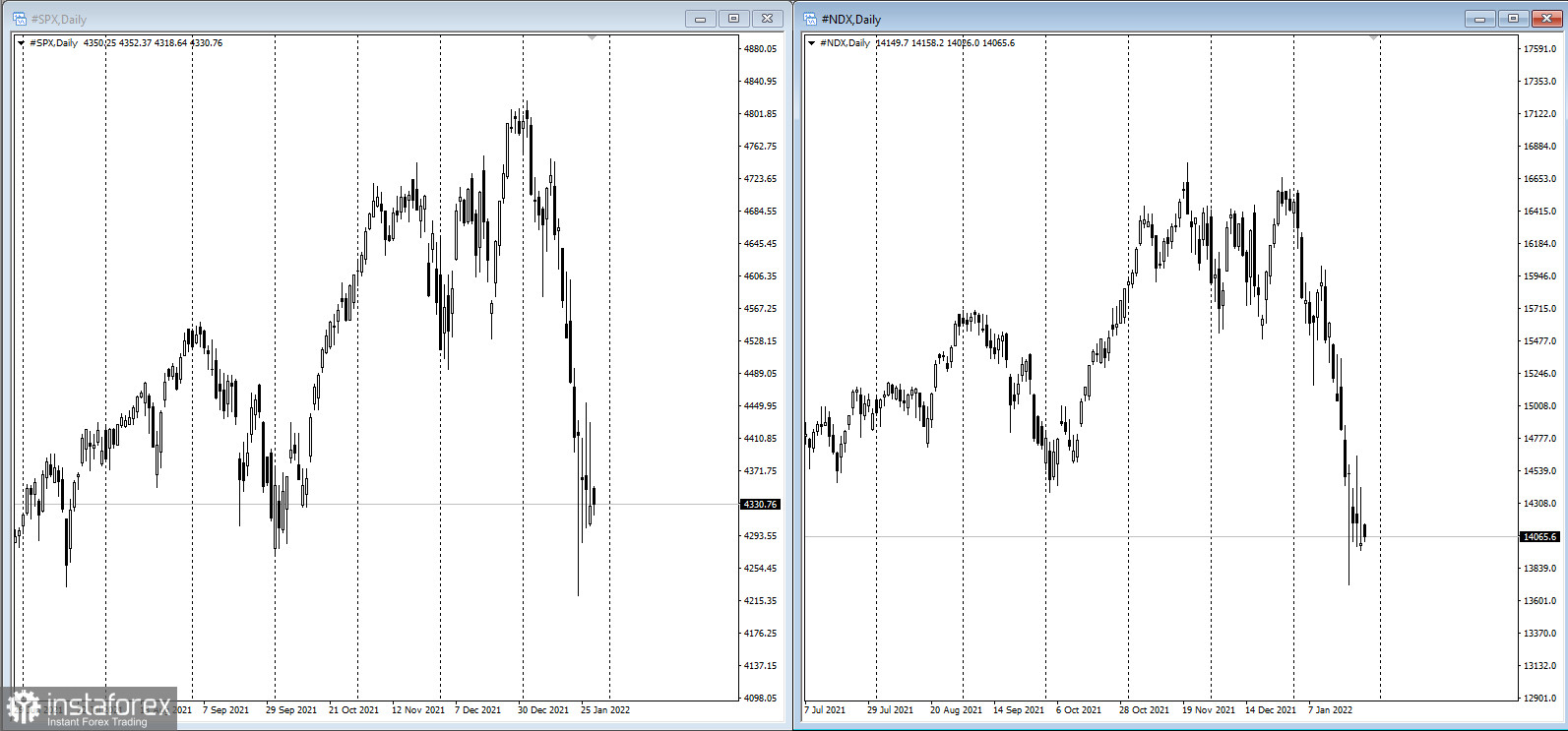

The S&P 500 closed 2% lower than the previous day, while the Nasdaq 100 lagged behind other indices. The reasons were the 9% dip in Tesla shares after cautious comments about supply chain problems and disappointing profit forecasts from Intel Corp. Apple also posted a loss ahead of the release of its earnings report.

On the bright side, dollar rates rose along with two-year Treasury yields.

It appears that more than $5 trillion has been stripped from stock values this year as traders struggled to gauge the outlook for monetary policy. Markets had been expecting four rate hikes in 2022, but they changed it to five after Fed Chairman Jerome Powell said the economy and labor market could handle faster pace if warranted. After all, US GDP for the 4th quarter expanded more than expected, while jobless claims fell for the first time in four weeks.

Morgan Stanley strategist Andrew Sheets is betting that US equities are becoming laggards as they try to adjust to an era of policy tightening. He stepped up his forecast that inflation-adjusted yields will rise from wildly negative levels back to pre-pandemic norms, threatening new pain for the interest-rate-sensitive growth stocks that drive US megacap indices.

Another strategist, Mike Loewengart said: "When you look at the market, investors are still .trying to digest the Fed's path forward, so some ups and downs are likely to persist."

Other reports to look forward to are:

- GDP of Germany

- US income and consumer sentiment