Fed meeting's aftermath

Hi, dear traders!

The US dollar is on the rise, as investors continue to digest the results of the January meeting of the Federal Reserve and the speech of Fed chairman Jerome Powell. It is unclear how long it would influence the markets at this point. Yesterday, USDX rose to the highest level since July 2020, supported by strong US GDP data. The US economy increased by 6.9% in the fourth quarter of 2021. Economists expected the US GDP to rise by 5.5%. This data release and the hawkish rhetoric of the Fed helped USD advance significantly against major currencies yesterday.

On the European side, the ECB's plans remain unclear. The Omicron strain continues to spread rapidly in the EU. Although it is less severe compared to earlier strains, it is significantly more infectious, particularly among children, teenagers and young people who were not affected by Delta and other strains. The number of COVID-19 cases is on the rise across Europe. The European Medicines Agency has approved the use of Pfizer's coronavirus antiviral drug Paxlovoid, which is currently used in the US and the UK.

Today's data releases that could influence EUR/USD are Germany's GDP data, US personal income and spending reports, and the US core PCE price index data.

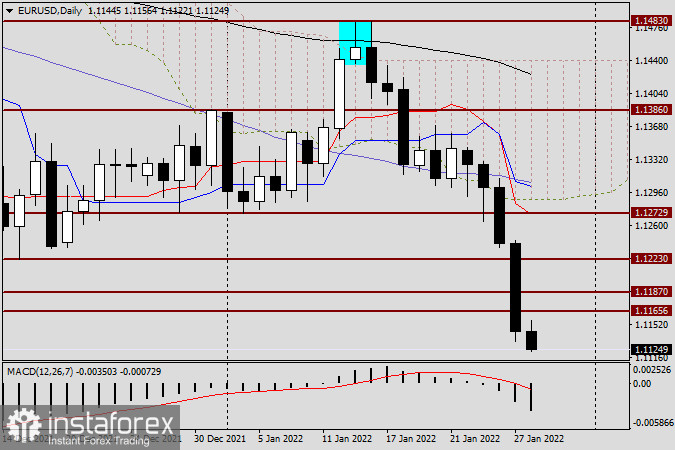

Daily

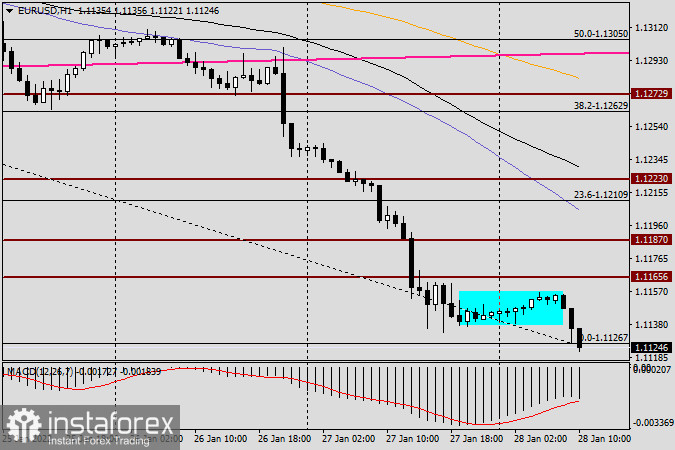

H1

The quote's retracements are taking place in horizontal price channels similar to the one highlighted above, and are followed by renewed drops. EUR/USD is approaching the strong technical level of 1.1100. The pair could briefly halt its dive in the 1.1100 area or undergo a retracement, giving an opportunity to open short positions. However, the strong downtrend at the end of the trading week suggests traders should stay out of the market until Monday.

Good luck!