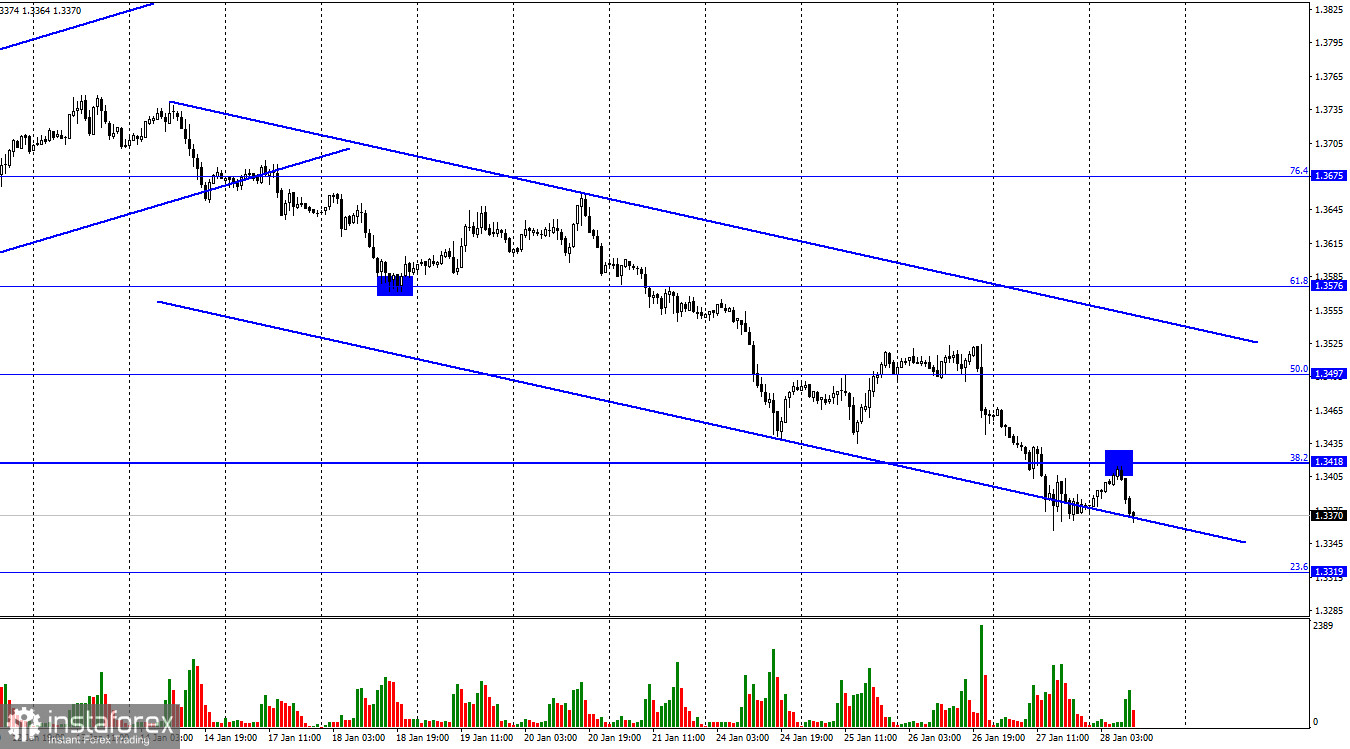

Hello, dear traders! On the hourly chart, the GBP/USD pair continued to decline yesterday after consolidating under the Fibo level of 38.2% at 1.3418. Today, the pair returned to this level and made a pullback from it. Therefore, the fall of the quotes may continue towards the next correctional level of 23.6% at 1.3319. The descending trend corridor continues to indicate traders' bearish sentiment. The US dollar has an obvious advantage over the British pound. The reasons are the same as in the case of the euro. Bears have had many grounds for buying the US currency during the last two days. Currently, they are engaged in this process. First, the Fed took a more hawkish stance compared to its past hawkish stance. Then a strong fourth-quarter US GDP report was released. It conferred power on the Fed without worrying about a possible slowdown in the economy amid an interest rate hike.

As for the UK, no news and reports are expected this week. Overall, the issue with Boris Johnson can be discussed. Many experts believe he could resign his post early due to the "wine time Fridays'' scandals. This incident is amusing and it does not affect the British pound. Notably, this week Boris Johnson lifted all coronavirus restrictions. Currently, the UK citizens do not have to wear face masks and can visit public places without COVID certificates. However, the British pound is not reacting to the coronavirus pandemic data at the moment. No more important economic reports are scheduled for the end of this week in the UK and the US. Thus, it will likely end quietly. Today, I see no reason for a strong rise or fall of the GBP/USD pair.

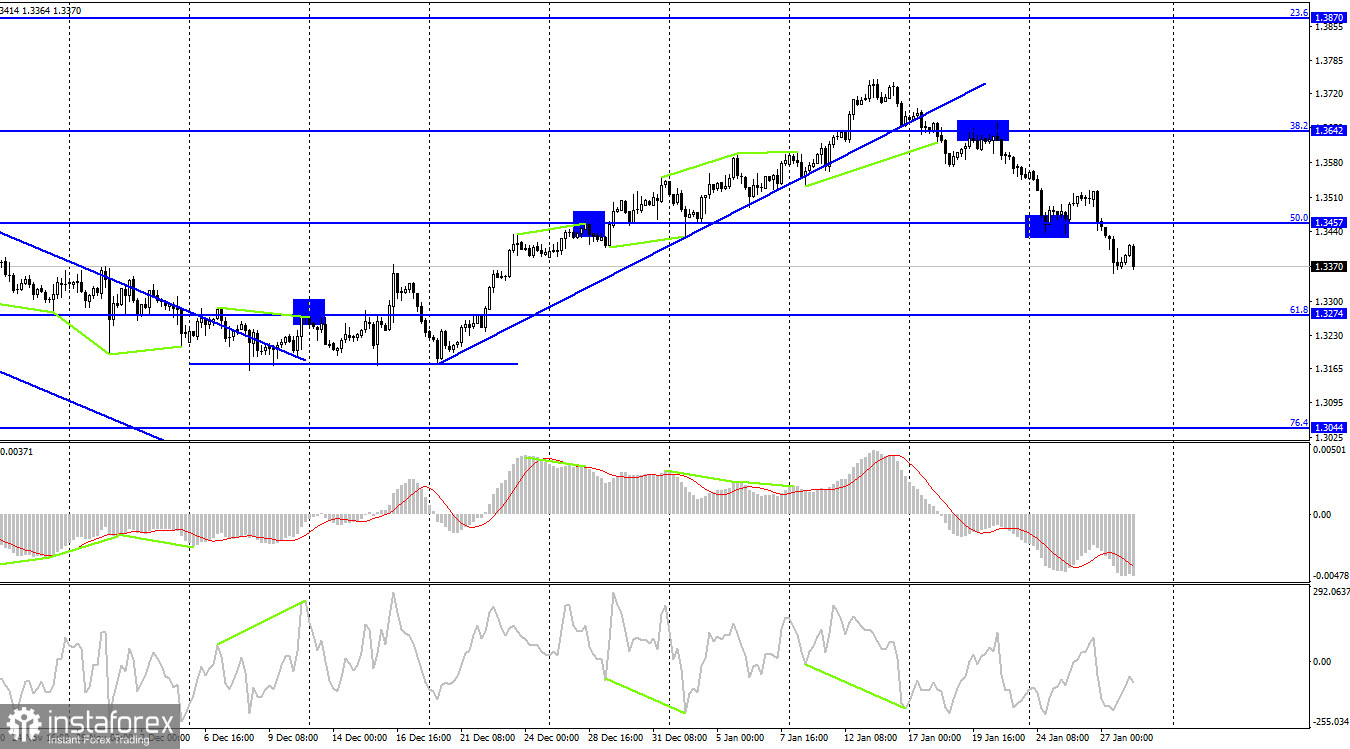

On the 4-hour chart, the pair made a new reversal in favor of the US currency and consolidated below the correctional level of 50.0% at 1.3457. Therefore, the fall of the quotes continues towards the next Fibo level of 61.8% at 1.3274. The bullish divergence has been canceled and there are no new emerging divergences today. The current week can be considered extremely favourable for the US dollar. Therefore, its further growth is possible today.

COT report:

Currently, the sentiment of "non-commercial" traders is almost neutral. The number of long and short positions held by traders is nearly the same: 40566 versus 37927. Last week, 19,500 short contracts were closed immediately, causing the equilibrium to recover. However, this report is already outdated. This week, the British pound made a significant drop. Therefore, the new report, which is due to release today, may indicate that the bearish sentiment of major players is getting stronger.

US and UK economic news calendar:

US - Core Personal Consumption Expenditures Index (13-30 UTC).

US - Personal Consumption Expenditures and Income Change (13-30 UTC).

US - University of Michigan Consumer Sentiment Index (15-00 UTC).

On Friday, the UK economic calendar is again completely empty, while several insignificant reports will be released in the US. Traders may focus on them. However, these reports are unlikely to cause a strong reaction. I consider today's information background to be weak.

GBP/USD outlook and recommendations for traders:

I recommended selling the British pound if there is a close below the level of 1.3497 with targets 1.3418 and 1.3319 on the hourly chart. The first target has been achieved. Thus, now it is advisable to stay in sales with the second target. I do not recommend buying the pound as it may be the beginning of the pair's new downtrend, and the descending trend corridor indicates the traders' bearish sentiment on the hourly chart.