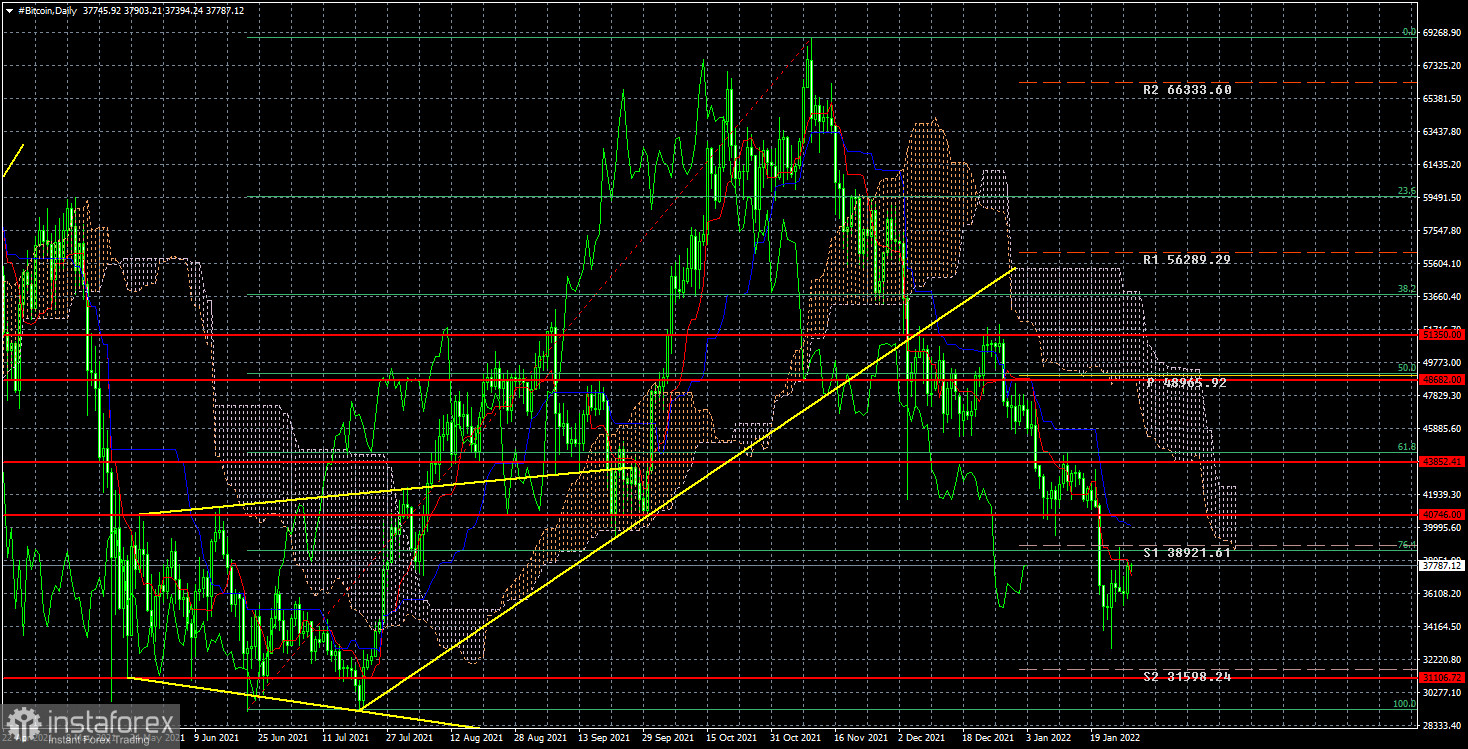

The technical picture of bitcoin on a 24-hour timeframe very eloquently shows that a "bearish" trend has now formed. All of it is perfectly visible in the illustration below. Moreover, now there is no reason to assume that this trend is over. The target level of $ 31,106 has not been worked out, the pullback to the top is so far scanty, the downward movement itself is very strong: bitcoin has lost about $ 30,000 in value in just 2.5 months. It has almost doubled in price. We cannot judge how many institutional and large investors continue to hold coins in their wallets, and which ones have begun to slowly get rid of them. We can only judge long-term fundamental trends. And here everything is quite simple and nothing changes.

Trend number 1.

The absolute majority of countries in the world and almost all large and developed countries in the world are tightening the rules of circulation and regulation of cryptocurrencies to one degree or another. Naturally, this is a negative factor. China has simply banned cryptocurrencies, their mining, and operations with them on its territory, showing the whole world that any government can do the same at any time. Other countries simply impose taxes on cryptocurrency transactions and on income from investing in digital assets. Why ban it if you can get additional income from it? But one way or another, the clouds are gathering over bitcoin.

Trend number 2.

Bitcoin is no longer the one and only. Every year the index of its dominance decreases, which indicates an increase in investments in alternative cryptocurrencies. Many believe that Litecoin or Ethereum have great growth potential, as these are younger cryptocurrencies. One way or another, bitcoin often shows less growth than other cryptocurrencies in the same period. And since most buyers use cryptocurrencies to make a profit, it does not matter to them what exactly these cryptocurrencies are. The main thing is that they bring maximum income.

Trend number 3.

In the last two years, bitcoin has been bought because the Fed and other central banks of the world have poured huge sums into stimulating their economies. The money supply was growing, so the excess money was deposited in the cryptocurrency, stock, and other markets. However, now the reverse process of withdrawing excess liquidity from circulation and tightening monetary policy is beginning. Thus, it is reasonable to assume that now the stock and cryptocurrency markets will go into a long correction. With what exactly the cryptocurrency market is threatened with a "classic collapse".

Trend number 4.

Inflation protection was one of the reasons why bitcoin has been getting more expensive in the last six months. After all, last summer, it also fell to $ 30,000, but then it went into growth again and broke the record of its value. It was at this time that inflation began to rise around the world, so the absolute majority of stocks, bonds, and other investment instruments were and remain below inflation in terms of their profitability. Naturally, this state of affairs did not suit investors, who again rushed to buy bitcoin and other digital assets. But now the central banks of the world are slowly taking a course to fight inflation.

On the 24-hour timeframe, the quotes of the "bitcoin" are fixed below the ascending trend line, so the "bullish" trend is broken. Bitcoin has fallen below the level of $ 40,746, so the road is open to $ 31,106 - the lows of 2021. Please note that bitcoin has been falling for 2.5 months and so far this fall is almost recoilless and very strong. This suggests that investors are getting rid of coins, and not increasing purchases in any way.