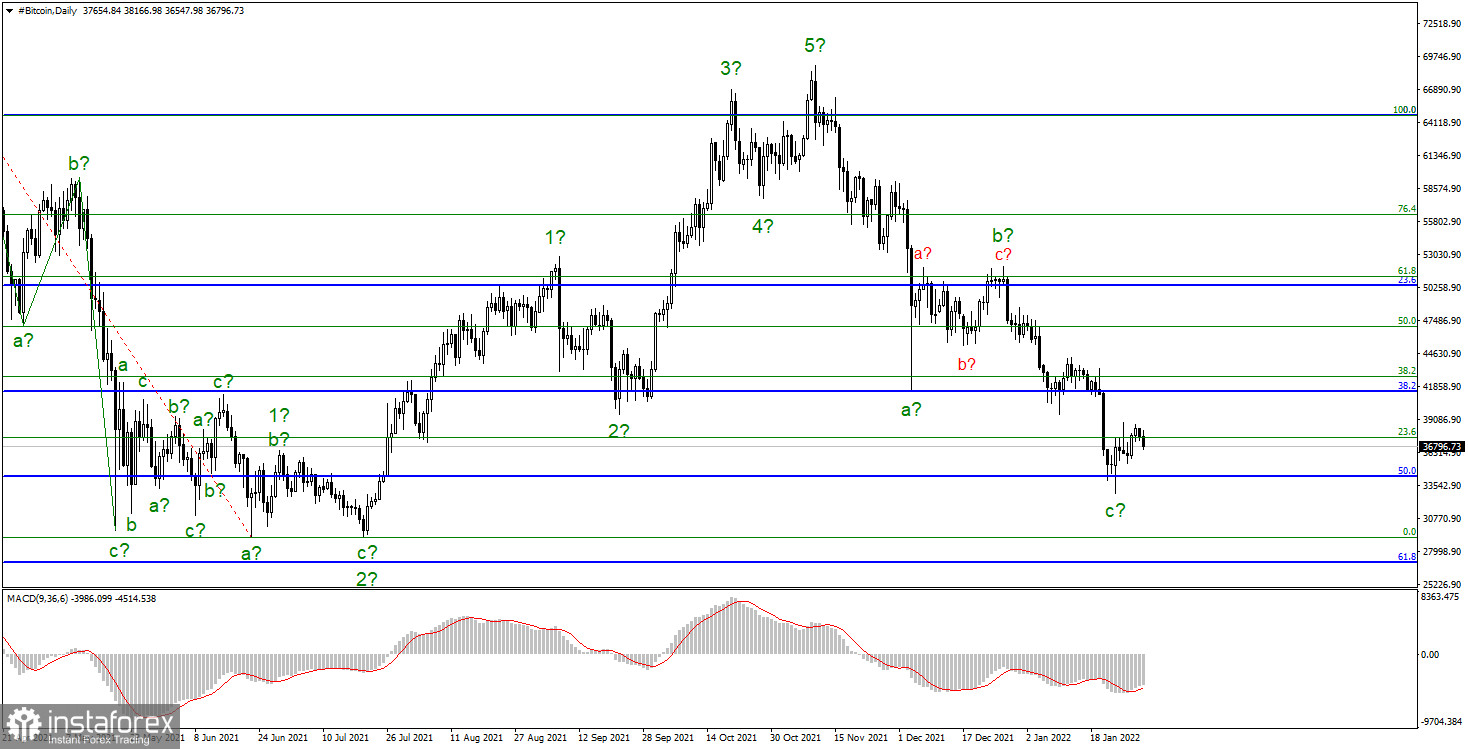

Recently, Bitcoin has been rising after bouncing off from the 50.0% level on the upper Fibonacci grid. This growth is very weak, but the current wave pattern suggests that the formation of the downward corrective section of the trend has ended already. Everything is too similar to the classic three-wave structure a-b-c. Therefore, it can be assumed that the downward trend is complete. However, the news background does not suggest a strong growth of Bitcoin. Over the past month and a half, it has not changed for the better. The Fed may start raising the rate in March. The Bank of England started raising it back in December and may continue to do so this year. Moreover, all major central banks are set to halt stimulus programs in 2022. All this is bad news for Bitcoin and other cryptocurrencies. There is currently no outright negativity, but there is no positivity either. Therefore, we believe that the first cryptocurrency will slightly increase only due to market factors. After all, investors can start buying cryptocurrencies not based on the news background, but around some strong level. So, why can't $34,238 be such a level?

- SkyBridge Capital's director predicts 1 billion bitcoin users in 2024

According to SkyBridge Capital's founder Anthony Scaramucci last Friday, Bitcoin has a great future and has already overtaken its time as a technology. He considers this cryptocurrency to be the technology of the future, which is gaining popularity day by day. The head of the fund believes that the number of bitcoin network users will grow to 1 billion by 2024, which means that approximately every seventh inhabitant of the planet will have a wallet with bitcoins.

He also compared the long-term development of the first cryptocurrency with Amazon shares. Scaramucci noted that the price of Amazon stock has regularly fallen over its history, and sometimes very much – by more than 50%. However, if one had invested only $10,000 in the company's shares during the IPO, then it would now be worth $22 million.

The founder of SkyBridge Capital also did not give a short-term forecast for the price of Bitcoin, saying it doesn't make any sense. He said that neither he nor anyone else could have predicted that China would completely ban mining in 2021 and Elon Musk would buy $3 billion worth of bitcoins, and similarly, neither he nor anyone else can predict what will happen in 2022. He just clearly said that the number of netizens will continue to grow. Earlier, Scaramucci expects Bitcoin to rise to $500,000.

The downward trend section continues to form. An unsuccessful attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward trend and its wave c. This wave could continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci. But inside wave c, an internal corrective wave can be built. So far, the internal wave counting of the expected wave c looks too holistic, the corrective waves are very small and difficult to distinguish. However, the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. In order to sell Bitcoin, new signals to decline are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator.