US income and spending data for December were released last Friday. PCE's core spending deflator rose from 4.7% to 4.9%. It is worth noting that US real interest rates are likely to continue rising in the coming weeks, and the interest rate curve will continue to flatten as the Fed is unlikely to give up its hawkish rhetoric. If the costs of hedging exchange rates in US dollars increase faster, the outflow of investors from assets denominated in US dollars should accelerate, which will mean an increase in demand for assets in euros.

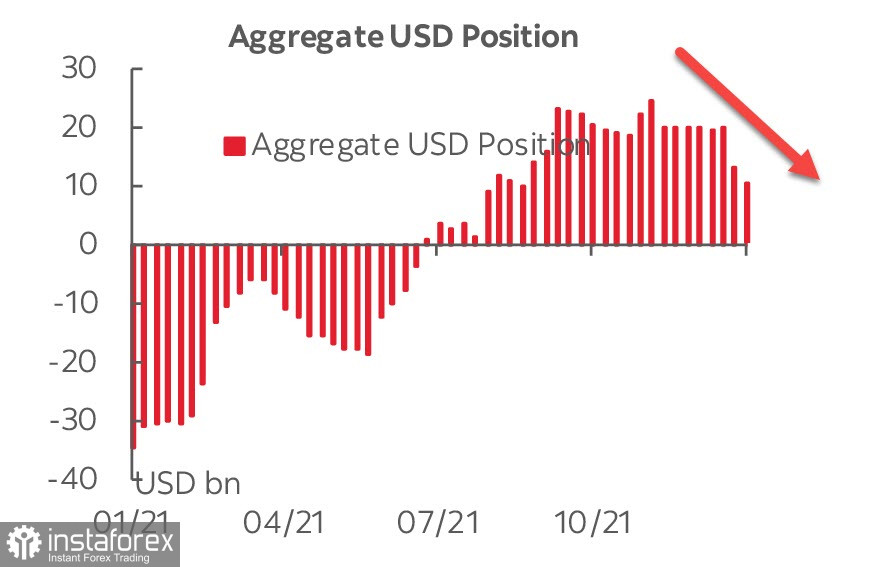

It is possible that we are already seeing the beginning of this process. Friday's CFTC report noted a reduction in dollar positions, with a weekly decrease of 2.4 billion. The net bullish position declined to 10.6 billion, which is the lowest level since mid-September and half as much as just 2 weeks ago.

Everything will be revealed this week – ISM indices will be released on Tuesday and Thursday, while Nonfarms for January will be released on Friday. Now, since inflation is at the top of the list of threats, the Fed will not change its position. The only question is where is the level at which the US economy does not begin to slide into recession.

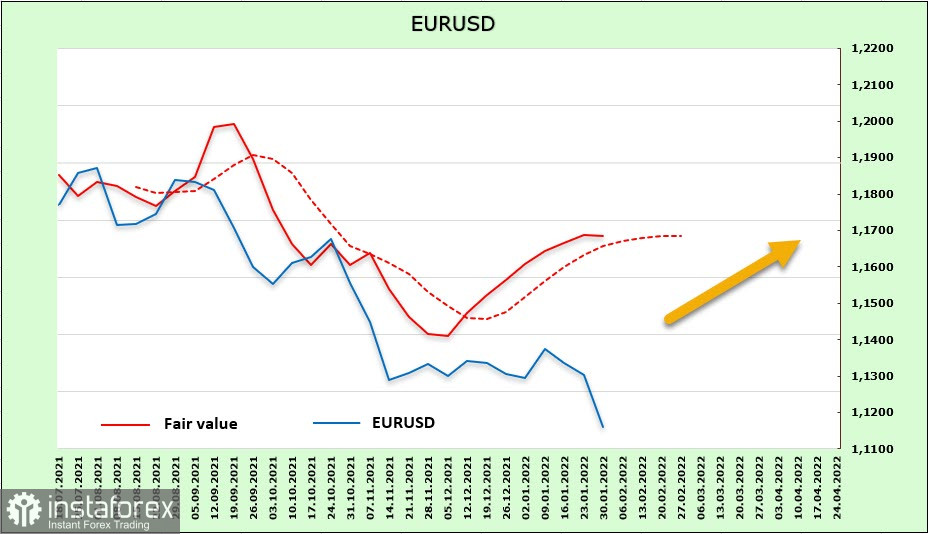

EUR/USD

The euro's net long position increased again during the reporting week, rising from 978 million to 4.458 billion. This is already the highest level since mid-August 2021, although it is still far from last year's 25 billion. The settlement price has lost momentum, although it remains above the long-term average.

The growth of the euro is objectively limited by two factors. The first factor is energy prices. Gas is consistently above $1 per cubic meter, which reduces the competitiveness of the European economy. The second one is geopolitical. In terms of economy, the EU's inflation is lower than in the US, and it is expected to start declining in the first half of the year. However, there is no such certainty about the US economy.

Selling dollars on the CME may indicate that investors are focused on longer-term prospects, and they are not so clear. The strength of the US economy is clearly not enough to withstand 4-6 increases without damage this year alone, so we should expect a rapid increase in the budget deficit, which will lead to an acceleration in the growth of debt.

On Thursday, the ECB meeting will take place. This is a "check-through" meeting, which means there will be no new forecasts, but there will be a press conference by C. Lagarde, although it is not clear what she will focus on. Most likely, the focus will be on gas prices as one of the main factors of high inflation. In any case, the ECB's action will lag behind the Fed by about a year, so we should just wait for the market reaction to the Fed rate hike.

The support level of 1.1186 has been updated, but the uncertainty has increased significantly. The euro is currently trading near the middle of the channel and may find new support here, but we must note that the technical picture differs from the fundamental one and there are no reversal signals yet. The decline may continue until the channel border is around 1.08, but taking into account the fact that the US economy may show a slowdown as early as Friday when Nonfarm data is published, it can be assumed that the euro will still find support at the current levels.

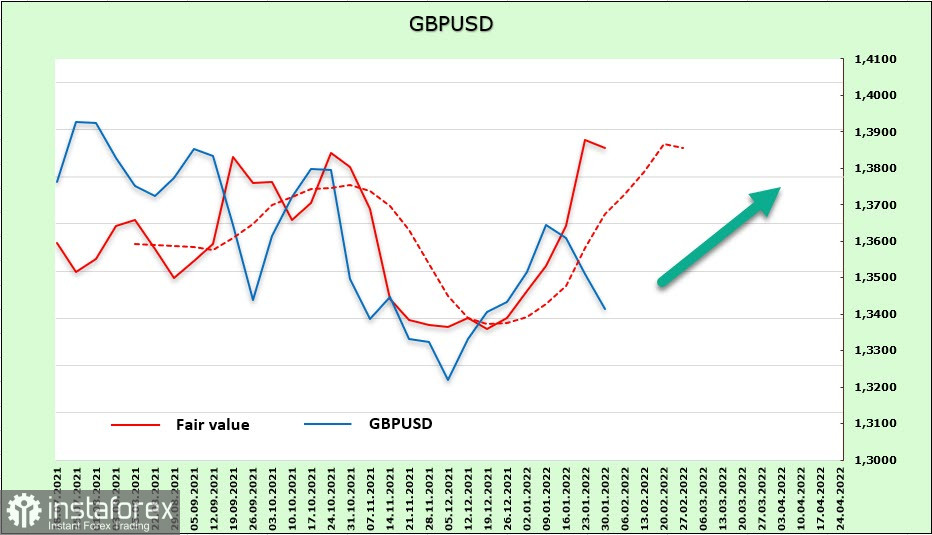

GBP/USD

The Bank of England's meeting will also take place on Thursday. It is expected to raise the rate to 0.5%, with votes tentatively split at 8 to 1. This is quite a strong bullish factor for the pound. The BoE usually remains in its actions from the Fed for several months, but a strong increase in inflation (NIESR assesses the outlook for inflation as very bad and does not see an opportunity to take it under control in the coming months) forces it to act proactively.

If the rate is raised, then the formation of a base at 1.3357 and the pound's upward reversal can be expected, in which it is likely to retest the upper limit of the channel and move to the level of 1.3750. But if the BoE leaves the rate at the current level, then the pound will decline to the lower border of the channel regardless of the rhetoric of the Cabinet members. In this case, the target will be the level of 1.30. It is assumed that the first scenario is more likely.