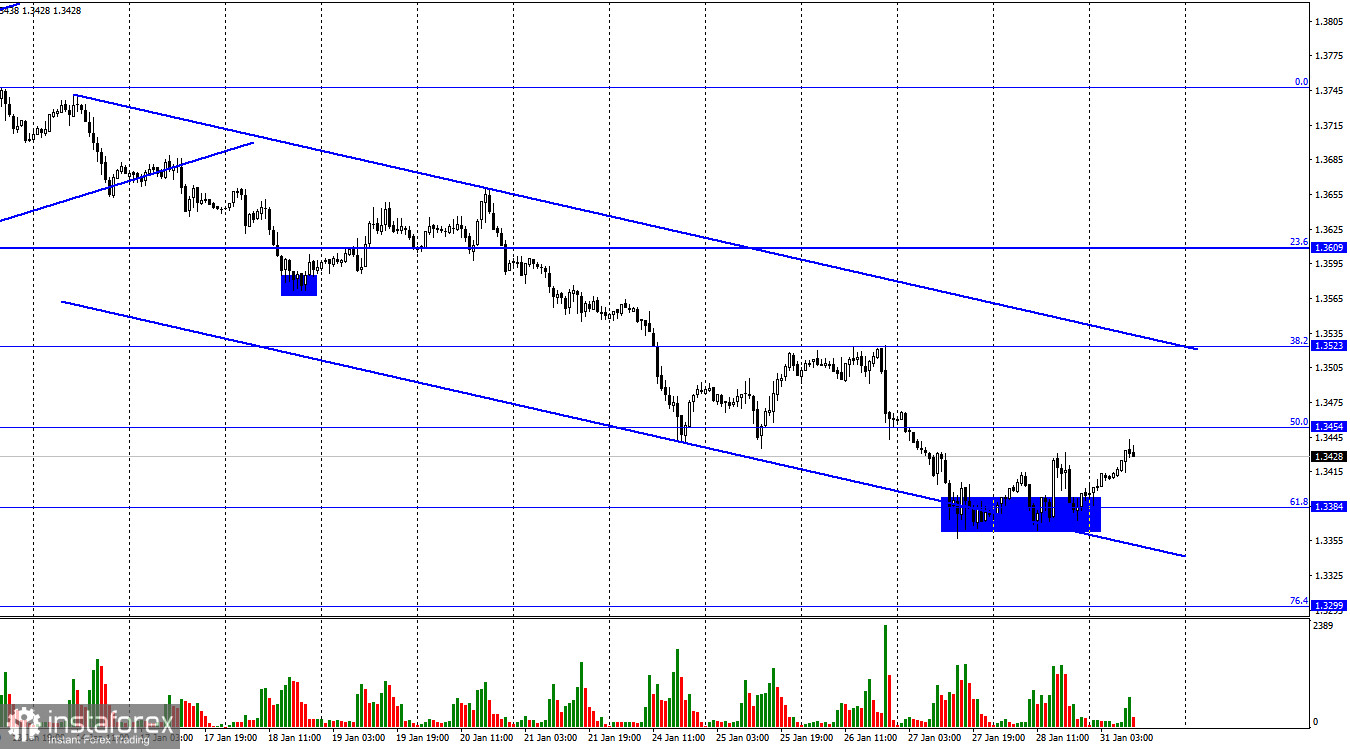

According to the hourly chart, the GBP/USD pair on Friday performed a rebound from the corrective level of 61.8% (1.3384), a reversal in favor of the British currency and began to grow, which continues today, in the direction of the Fibo level of 50.0% (1.3454). The rebound of quotes from this level will work in favor of the US currency and the resumption of the fall in the direction of 1.3384 and below. Closing the pair's rate above the level of 50.0% will increase the probability of continued growth towards the next corrective level of 38.2% (1.3523). The downward trend corridor continues to characterize the mood of traders as "bearish". Meanwhile, there is a slight lull in the UK. There is no information background on Monday and the same in the USA, but during the week, there will be many interesting events that will affect the mood of traders. The most important event is the meeting of the Bank of England, which will be held on Thursday.

Most forecasts suggest that the regulator will raise the interest rate for the second time in a row, by 0.25%. Thus, the Bank of England can greatly overtake the Fed in this matter, which previously happened extremely rarely. Well, the Briton on this news can start new strong growth. What the bank's governor, Andrew Bailey, will say at the press conference will also matter. Traders will be waiting for information from him on further changes in monetary policy, as rumors persist that the bank may raise the rate to 1% this year. Such news can also increase the demand for the pound. Well, on Friday, reports on nonfarm payrolls, unemployment, and wages for January will be released in the United States. During this week, the activity of traders may go through the roof, which will result in strong movements of the pair. And it is not necessary that only in one direction.

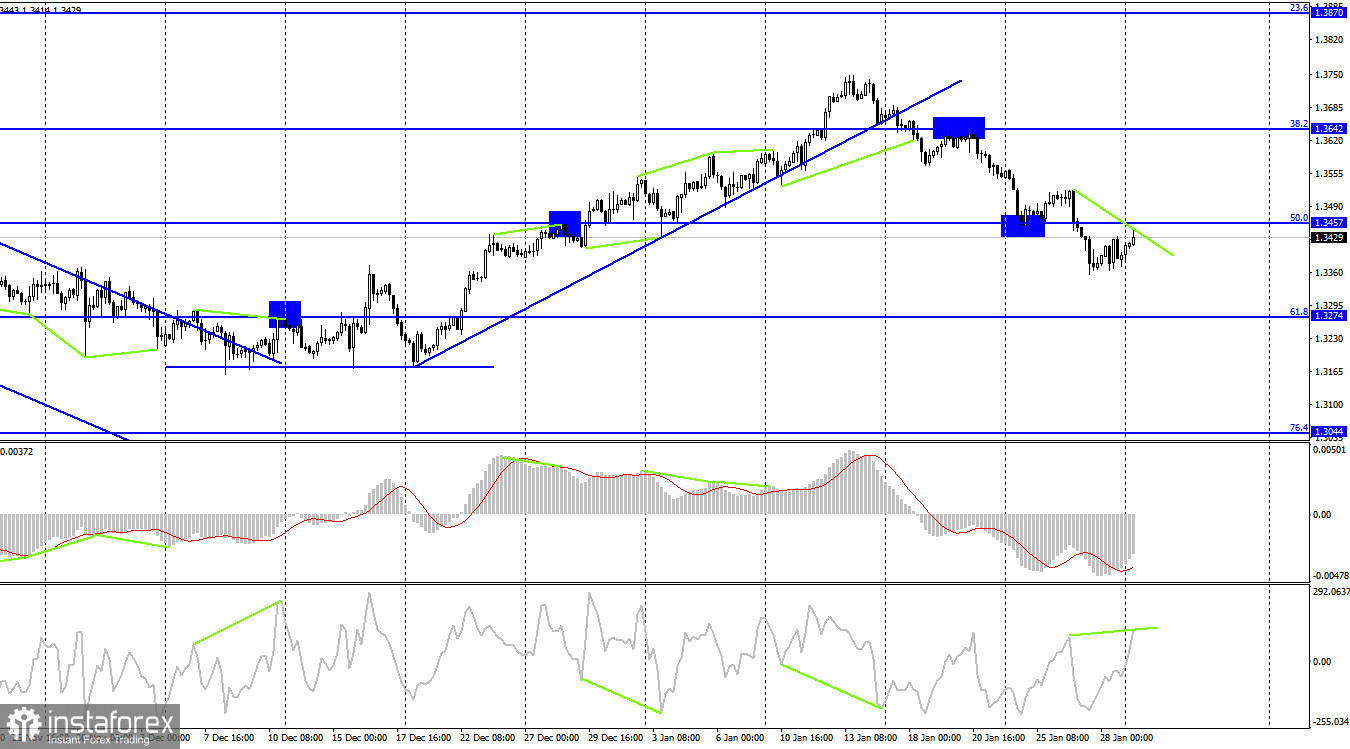

On the 4-hour chart, the pair performed a reversal in favor of the British and began the process of returning to the Fibo level of 50.0% (1.3457). The rebound of quotes from this level will allow us to expect a new reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 61.8% (1.3274). A "bearish" divergence is also brewing for the CCI indicator, which increases the probability of a rebound from the level of 1.3457. Fixing the pair's rate above this level will work in favor of continuing growth towards the next corrective level of 38.2% (1.3642).

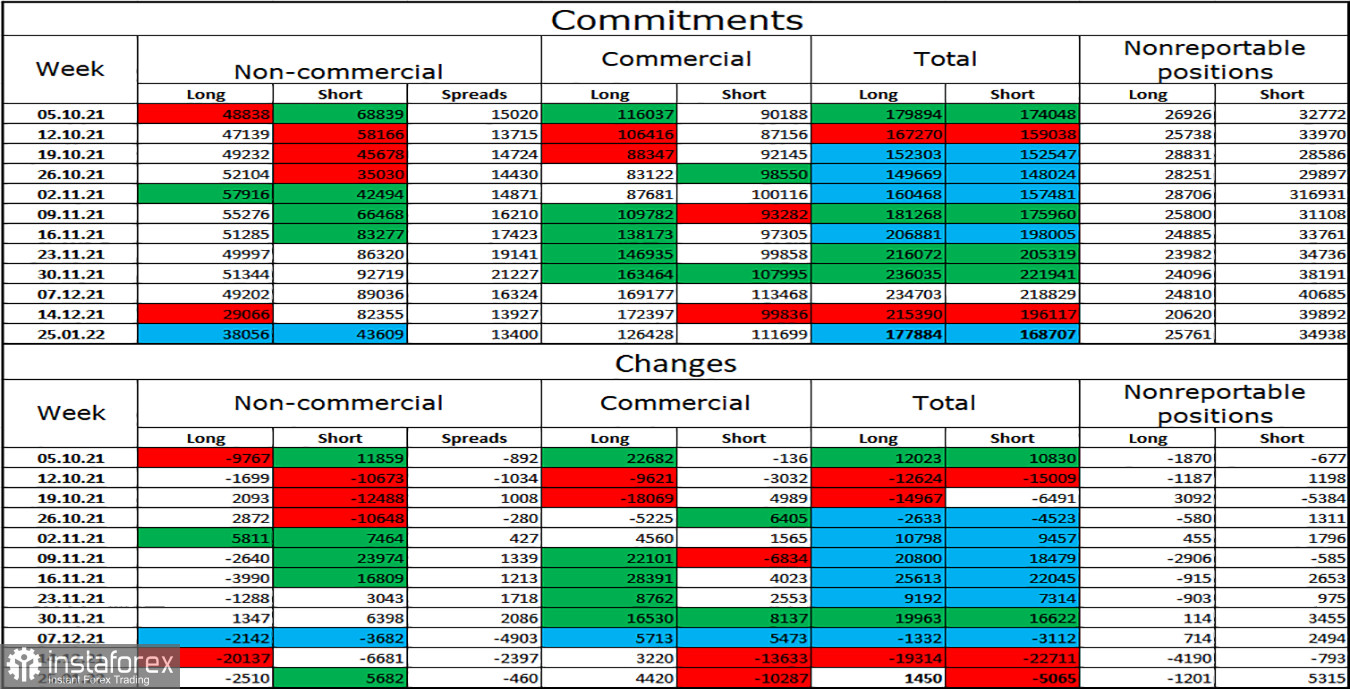

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders is now almost "neutral". The number of short contracts concentrated in the hands of speculators only slightly exceeds the number of long contracts. That is, the pound sterling is just more likely to continue falling. But, as in the case of the euro currency, the Fed meeting and its results have not yet been taken into account in the figures of the report, and this week will be a meeting of the Bank of England, which can also greatly affect the mood of speculators and their actions in the market. Therefore, I will conclude after the COT reports are received after all three meetings of the central banks.

News calendar for the US and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. Thus, nothing today will affect the mood of traders. There will be no information background today.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British in case of a rebound from the level of 1.3454 on the hourly chart or the level of 1.3523. I recommend buying the pound if a closure is made over a descending corridor on the hourly chart, not earlier.