The euro-dollar pair is showing increased volatility today. Initially, the price updated the intraday low, reacting to the release of data on European GDP growth, and then soared up, reacting to German data on inflation growth. EUR/USD bulls are taking advantage of the moment to try to test the area of the 12th figure, after a significant price decline last week. At first glance, traders formed a low, from which they successfully pushed off and organized a large-scale pullback. However, in my opinion, the bears have not yet completed the "downward campaign": the euro may soon fall under the roller of the European Central Bank's dovish thesis, while the dollar may receive support from Nonfarm. In addition, key data on the growth of European inflation will be published the day after tomorrow, which will not necessarily repeat the trajectory of German figures. And if we talk about today's release, then everything is not so rosy here either: inflation growth in Germany has de facto slowed down, but not as much as experts expected. Therefore, it is quite risky to open long positions in the current conditions, since the growth of EUR/USD is shaky.

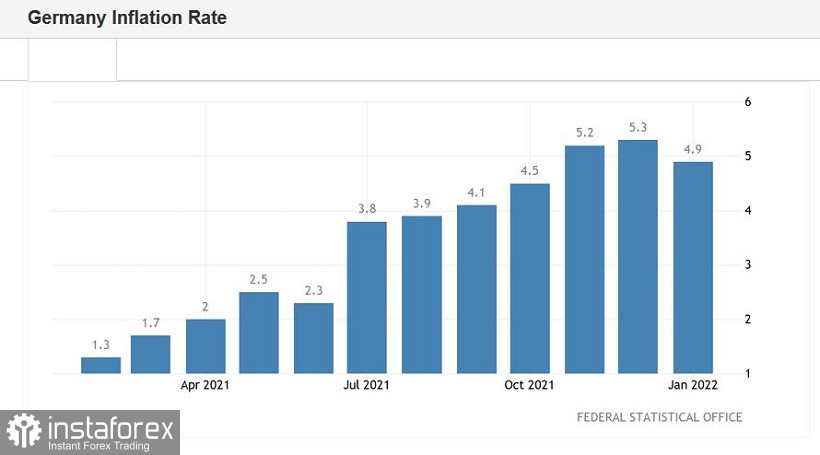

So, according to the data published today, the overall consumer price index in Germany in annual terms came out at 4.9%, whereas in the previous month (December) it was at 5.7%. The indicator slowed its growth for the first time after a 6-month consecutive ascent. The harmonized CPI showed similar dynamics. However, in this case, the indicator has been declining for the second consecutive month. After reaching a 6% peak in November, it turned down and is gradually sliding: in December it came out at 5.7%, in January - at 5.1%. All published components of the release came out in the green zone - experts expected to see a more significant decline. But the fact remains that German inflation is gradually slowing down, as if confirming the assumptions of the ECB's doves. This is a "wake-up call" for EUR/USD bulls, as literally the day after tomorrow - on Wednesday - data on the growth of pan-European inflation will be published. According to preliminary forecasts, the CPI in the eurozone will also slow down its growth. The overall consumer price index should reach 4.4% (inflation in the eurozone countries will slow down for the first time after a 12-month consecutive ascent), and core inflation will slow down to 1.8%. despite the fact that in December and November, the core index was at 2.6%.

EUR/USD traders reacted "instinctively" to the "green color" of the German release today, although in fact there were no clear reasons for the growth of the euro either. Let me remind you that ECB President Christine Lagarde, Chief Economist Philipe Lane and many other representatives of the central bank repeat the mantra with enviable regularity that the increase in inflation in the eurozone is temporary. Only five out of twenty-five members of the Board of Governors defend the opposite position – in their opinion, inflation will continue to rise, contrary to the forecasts of central bank economists. On this basis, there was a split in the ECB camp – for the first time in a long time, the central bank could not make a decision unanimously (the five members of the ECB voted against).

On Wednesday, the pendulum will swing either towards the doves or towards the hawks. If European inflation shows a breakthrough growth again, the single currency will receive significant support. And vice versa – if the release is at least at the forecast level, the euro will fall under a wave of short positions. It should be noted here that German data quite often correlates with pan-European data, so it can be assumed that the January increase in inflation in the eurozone will also be contradictory. This will be quite enough for the ECB to maintain a dovish mood on Thursday and refute rumors that the interest rate may be increased at the end of this year.

High inflation has not "scared" the ECB before. On the eve of the December meeting, it became known that inflation in the eurozone has reached its historical high, having been designated at 4.9%. The strongest CPI growth was recorded in all major economies of the European Union. However, the ECB, contrary to hawkish expectations, did not get ahead of events, announcing the completion of the Pandemic Emergency Purchase Program in March next year (that is, as originally planned). Moreover, the ECB has extended the terms of reinvestment of proceeds from redeemable bonds under this program - "at least until the end of 2024." ECB members also decided to strengthen the traditional stimulus program: From the second quarter of this year, the ECB will double the volume of asset repurchases under the APP program – from 20 to 40 billion euros per month.

Given this background, it can be assumed that the ECB will take an unambiguously dovish position at the end of the January meeting if inflation growth in the eurozone slows down at least minimally. Such a scenario is very, very likely, against the background of slowing German inflation.

That is why at the moment, for the EUR/ USD pair, you can either take a wait-and-see position (observing the price behavior in the area of the 1.1200 mark), or consider the option of short positions. The first downward target is 1.1150 (the lower line of the Bollinger Bands indicator on the daily chart), the main target is 1.1100 (the lower line of the Bollinger Bands indicator on the weekly chart).