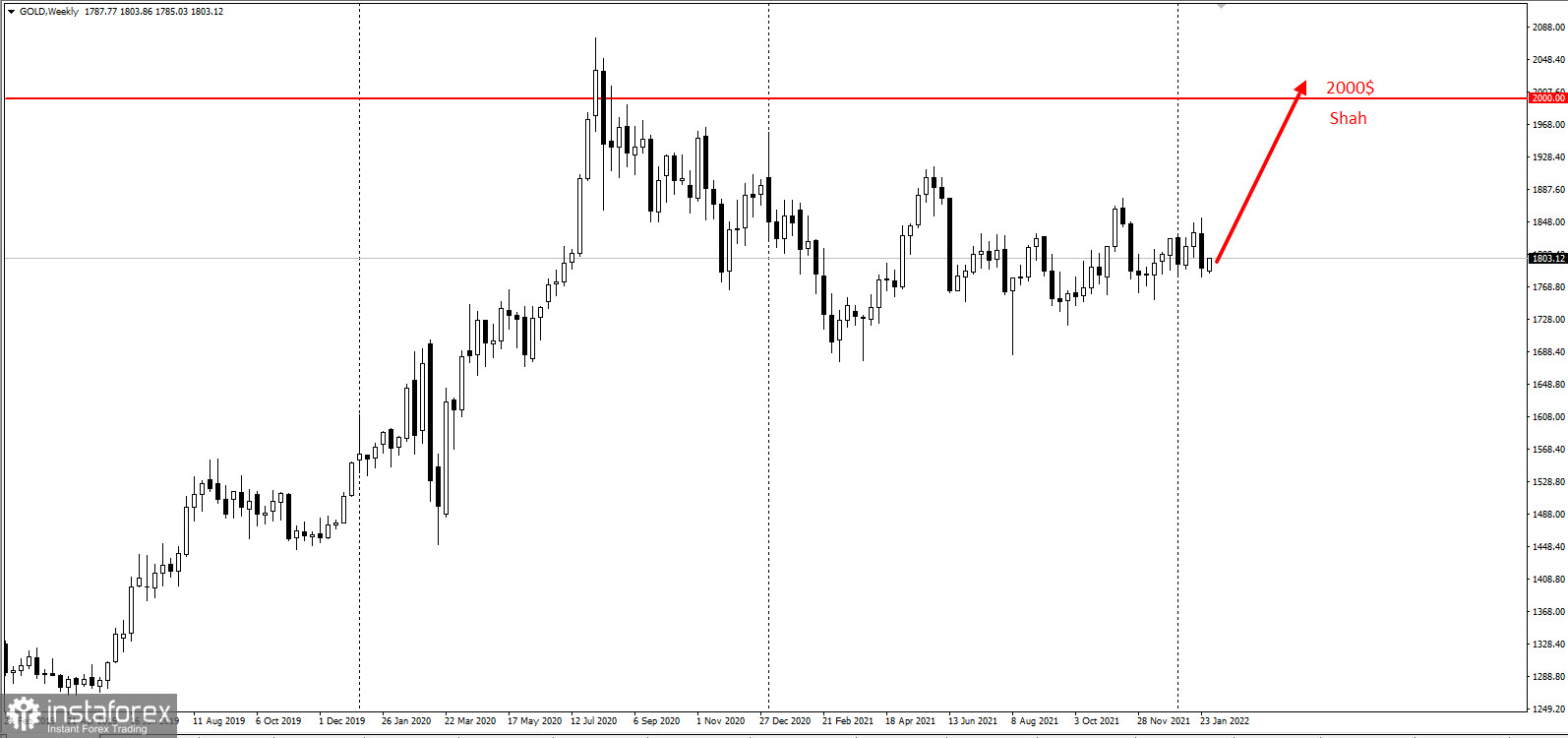

According to Nitesh Shah, director of commodity research at WisdomTree, gold prices should be well over $2,000 amid soaring global inflation.

Shah noted that consumer inflation was currently at 7%, its highest level in 40 years. The Inflation rate in Europe rose to 5%.

In his opinion, one of the reasons why gold prices do not respond to growing inflationary pressures is that current inflation is of a different type. Prices are mostly driven by a global supply crisis.

Along with gold, the expert has a bullish outlook for the entire commodities market, which posted its highest return in 20 years in 2021. He highlighted industrial metals in the broad commodities basket as countries seek to rebuild deteriorating infrastructure and use clean renewable energy sources.

Some of the commodities he is betting on in 2022 are copper, nickel, and palladium.

Even though gold has been lagging behind the broader commodities market, it remains an essential part of in his investment portfolio.

It is important to have a wider choice of commodities in your investment portfolio, especially when the world is moving towards green energy. Nevertheless, precious metals should be present as well, since gold is a strategic part of every portfolio as it helps reduce the risks.