While the UK is investigating the gatherings of government officials that happened during the lockdown, the British pound is going through a correction against the US dollar. Obviously, GBP shows little reaction to external factors and is mainly trading according to technical analysis. Monday was the last day of the month, so let us first sum up the results of yesterday's trading.

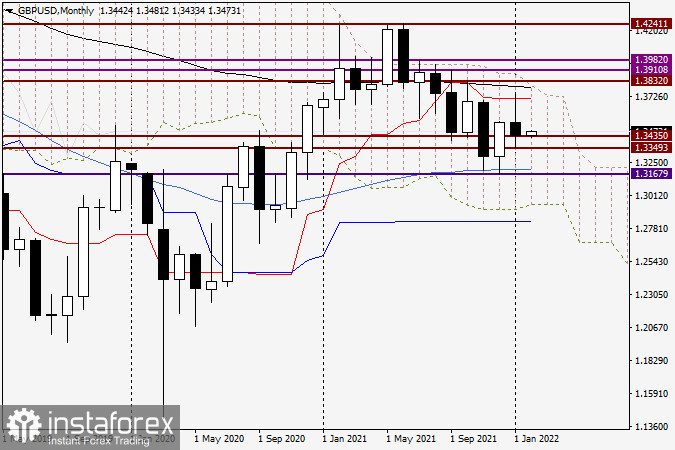

Monthly chart

In the first month of the year, the British pound depreciated against the US dollar. However, the January candlestick has a small bearish body and a very long upper shadow. Besides, the pair closed the last month's session within the Ichimoku Cloud indicator. An attempt to break above this line was limited by the red Tenkan line. On the other hand, the pound bulls managed to keep the quote above the strong technical level of 1.3400 and closed the monthly session above this level, at 1.3442. I also recommend paying attention to the support zone of 1.3193-1.3167 where the lows of the previous two months are located. You should also keep an eye on the 50-day simple moving average, which coincides with the important technical level of 1.3200. I believe that the bearish scenario will continue only after a real breakout of support at 1.3167. For the bullish trend to continue, the pair needs to retest January highs at 1.3747 and settle above this mark in February. In my opinion, both bulls and bears have a difficult task to fulfill. So, it is hard to draw any clear conclusion for the month ahead.

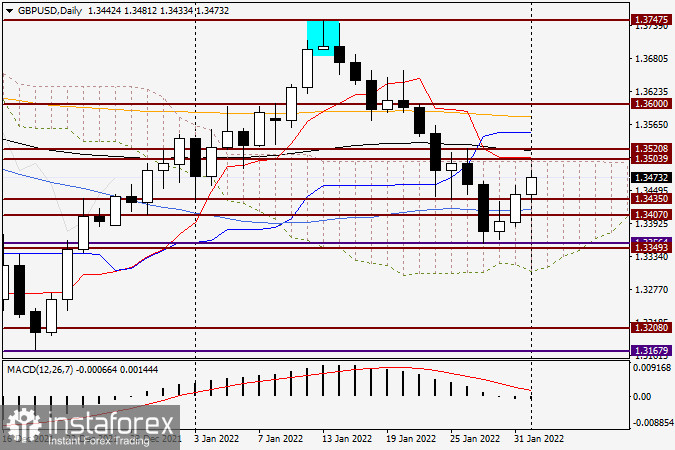

Daily chart

On the daily time frame, the pair is trading within the Ichimoku Cloud which is considered an area of uncertainty. Nevertheless, the pound bulls have made several attempts to push the quote to the upper boundary of the cloud and break through it. After yesterday's growth, the pair returned above the blue 50-day simple moving average, and this was a good bullish signal for traders. As of today, the pound/dollar pair has been rising for the third day in a row. If bulls do not loosen their grip and continue to move upwards, they will eventually reach a significant psychological level of 1.3500. By the way, this is where the upper boundary of the Ichimoku Cloud is located. Its breakout will pave the way towards new highs for GBP/USD.

The current situation looks uncertain, so I would advise you to focus on the level of 1.3500. If the price breaks through this significant level on this or lower time frames, you can buy the pound on a pullback. If a reversal candlestick pattern appears below 1.3500, it will create an opportunity to sell the pair. You should also keep in mind such key event for GBP/USD as the Bank of England's policy meeting and the data on the US labor market on Friday. Ahead of these events, it is better to open positions with closer targets.

Good luck!