EUR/USD

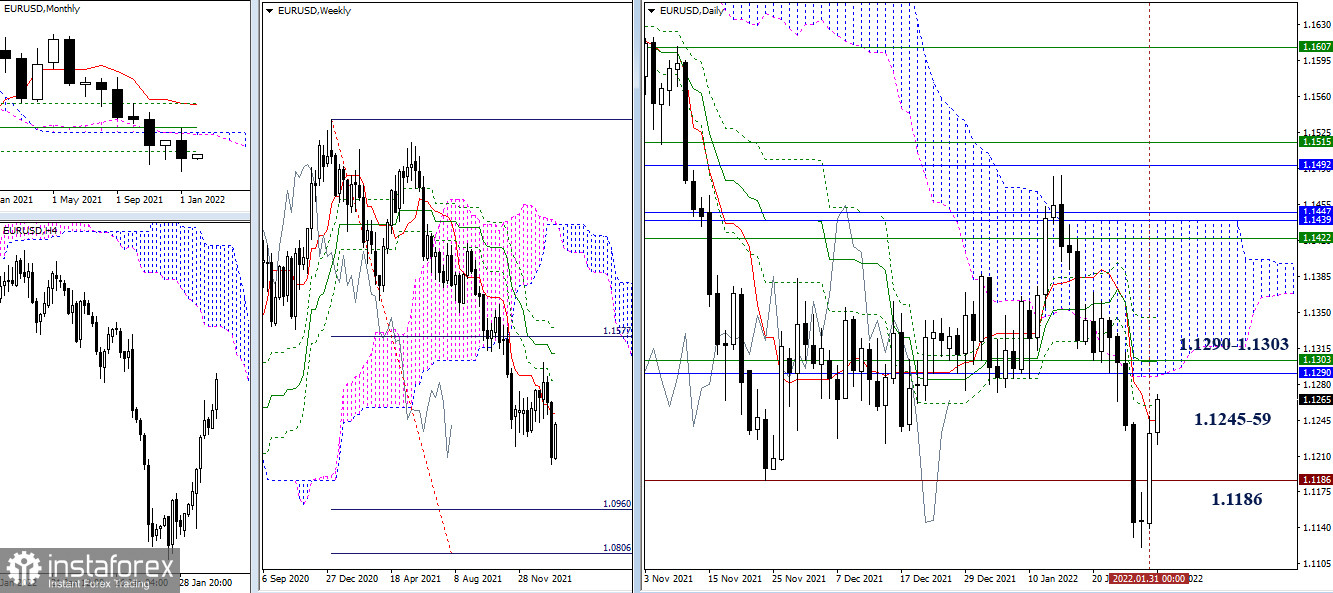

The bears did not manage to optimistically close January. As a result, only the long lower shadow of the January monthly candle was moved below the minimum extremes of the previous months. There is no clear superiority of forces right now, the struggle and confrontation will continue. The minimum extremum of 1.1186 remains an important border. A consolidation below it and updating the January low (1.1121) will allow us to consider bearish prospects and plans again.

On the contrary, trading above the level of 1.1186 will help the bulls to restore their positions. This task can be solved through testing and breaking through the resistance levels. The current resistances are located at 1.1245-59 (daily levels), then 1.1290 - 1.1303 (resistances of various timings) will act as an important zone.

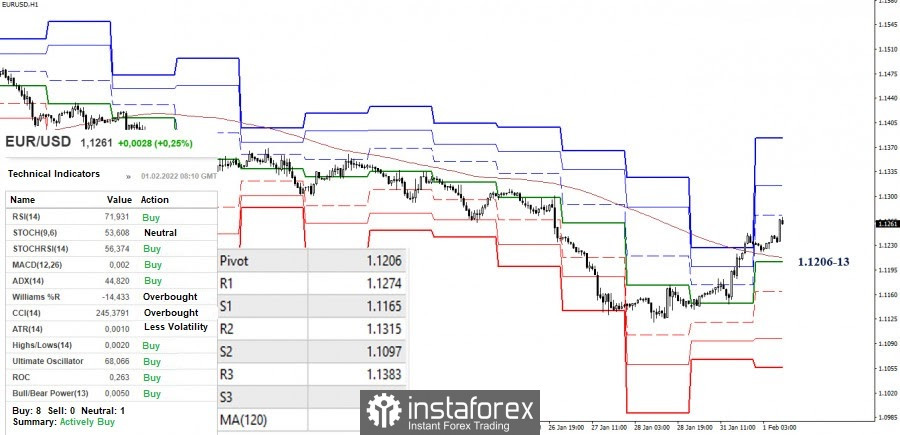

The bulls have the advantage in the smaller timeframes. They have consolidated above the key levels, which currently act as supports in the area of 1.1206-13 (central pivot level + a weekly long-term trend), and have obtained approval of purchases from most of the analyzed indicators and are testing the first classic pivot level of 1.1274 (R1). The next intraday upward pivot points can be noted at 1.1315 - 1.1383. If the key levels of 1.1206-13 are broken, the current balance of forces on the hourly chart can be changed. Here, it will be possible to consider the support of the classic pivot levels 1.1165 - 1.1097 - 1.1056 as downward pivot points.

GBP/USD

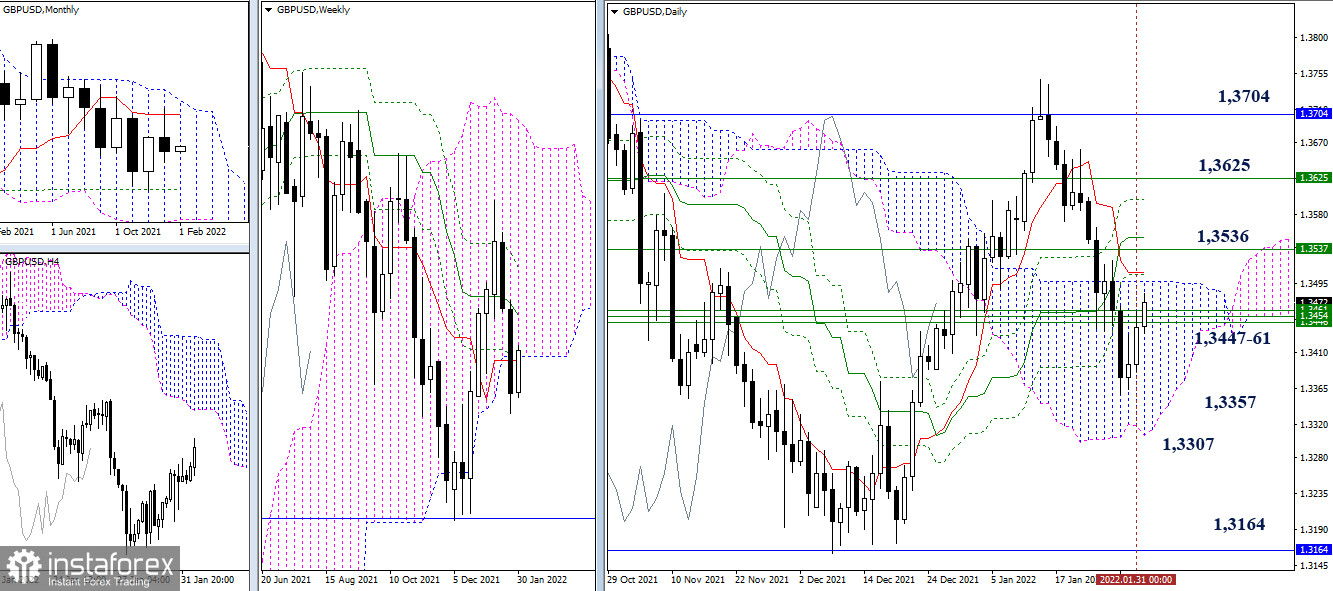

Last month, the bears managed to mark the monthly short-term trend retest that was broken earlier, with some kind of rebound. The long lower shadow weakens the character and preferences of the January monthly candle. If the bulls successfully regain several nearest resistances (1.3447-61 - 1.3536 - 1.3625) in the near future, the pound will begin its plan to test the monthly short-term trend (1.3704) again. However, if the bears manage to return to the market and update the January low (1.3357), this will lead to the prospects of leaving the daily Ichimoku cloud (1.3307) and continuing the decline. The next target of which is to overcome the support of the monthly Fibo Kijun (1.3164).

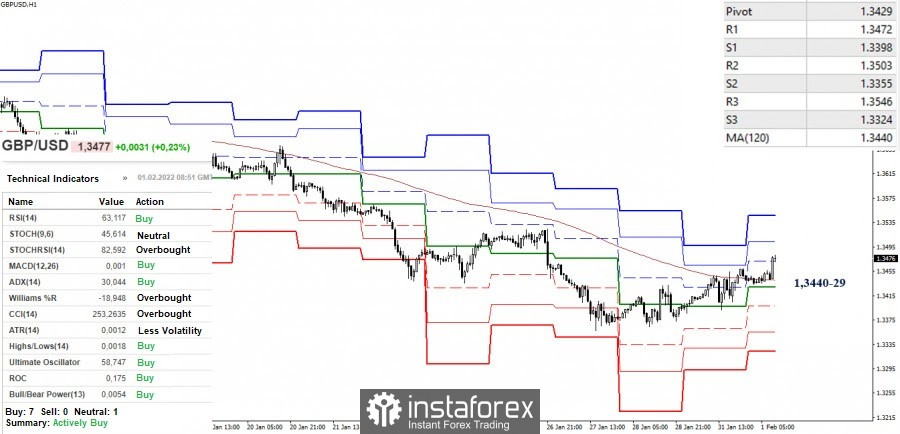

Yesterday, the bulls tried to hit the key levels in the smaller timeframes, which are responsible for the distribution of forces. As a result, the pair has now consolidated above the range of 1.3440-29 (central pivot level + weekly long-term trend), which provides an advantage for the bulls on the H1 chart. Today, the resistance of classical pivot levels can be noted at 1.3472 - 1.3503 - 1.3546. However, if the key levels (1.3440-29) are broken, the relevance will return to the support of the key pivot levels located at 1.3398 - 1.3355 - 1.3324.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.