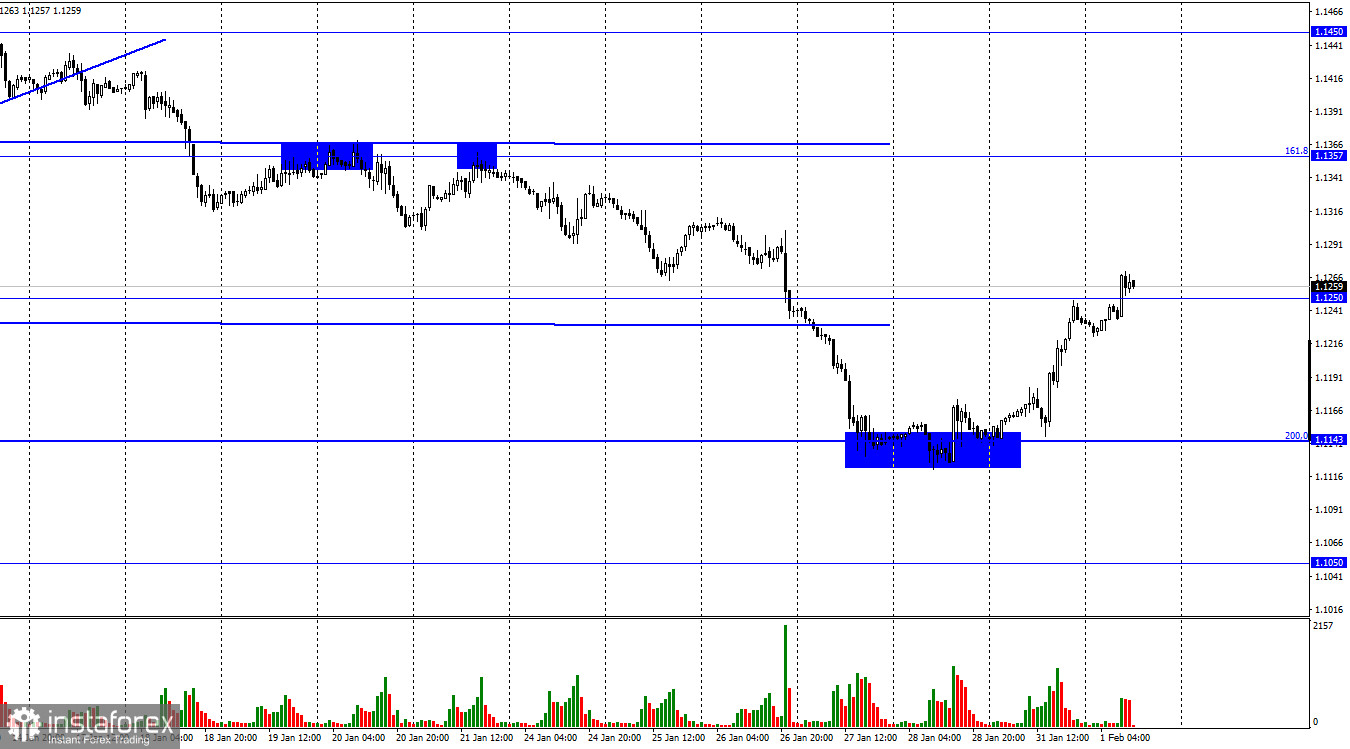

The EUR/USD pair continued the growth process on Monday after rebounding from the corrective level of 200.0% (1.1143). Yesterday, the pair's quotes performed an increase to the level of 1.1250, and today they performed a close above it. Thus, the growth process can now be continued in the direction of the next corrective level of 161.8% (1.1357). However, I can't help but draw readers' attention to the fact that the euro currency rose by 100 points yesterday against such an informational background, which should have caused its new fall, but not growth in any way. Let me remind you that in recent months, European statistics are not very strong and the euro currency as a whole is falling in tandem with the dollar deservedly. However, quotes cannot constantly move in only one direction. It is for this reason that from time to time we observe corrections of different scales. There are small corrections on the younger charts, and stronger ones on the older ones. But in general, these corrections are not based on a fundamental background.

News and reports are now coming in that should support the dollar constantly and continuously. Yesterday, the only report of the day on the growth rates of the European economy in the fourth quarter turned out to be weaker than market expectations. And I also want to draw readers' attention to the fact that the forecasts for this report were very low: only +0.4% q/q. In the third quarter, European GDP grew by 2.3% q/q. But even this forecast did not come true. And still, despite this report, the euro rose on Monday. And it has grown very much. I think that one of the technical corrections has begun, which may end tomorrow when the ECB announces the results of its meeting. Most likely, there will be nothing among them that could increase the demand for the euro currency. The European Central Bank is not in the mood to tighten monetary policy at this time. Only information of a "hawkish" kind can come from Christine Lagarde, but there is little hope for that either.

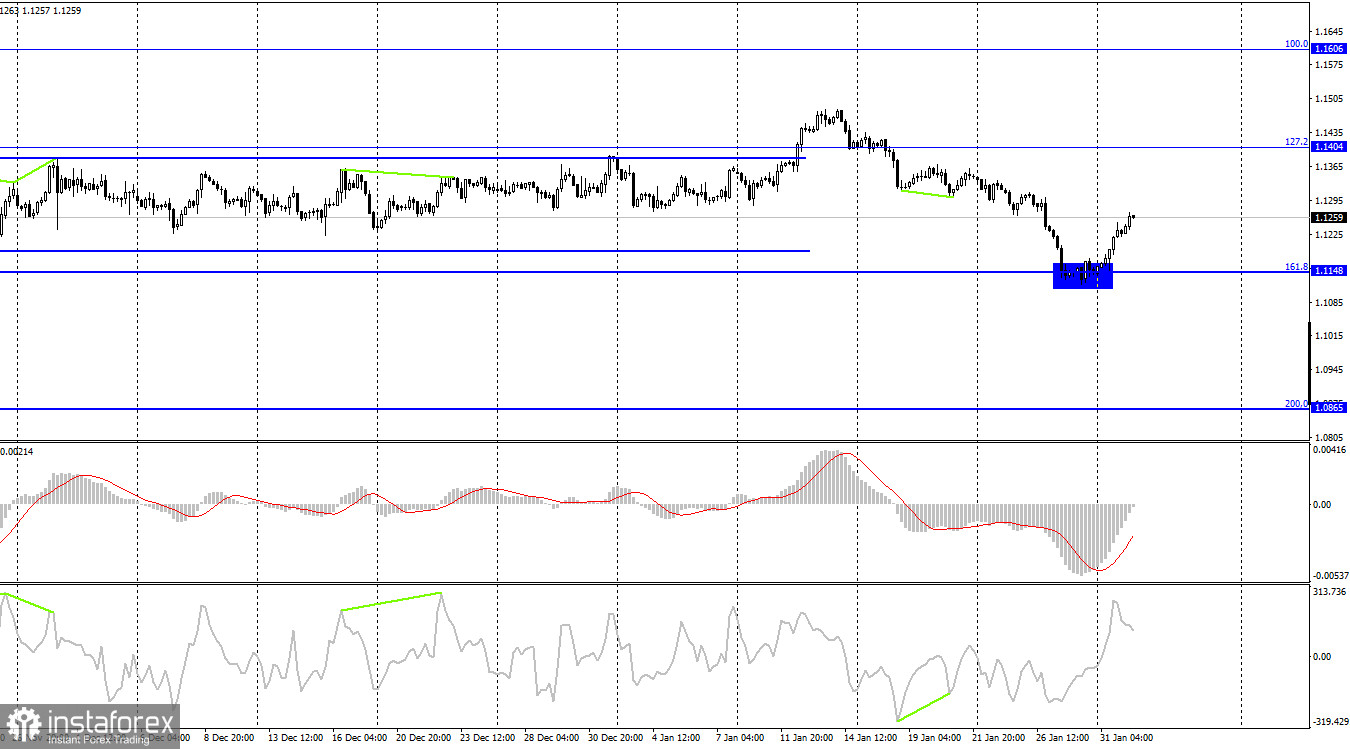

On the 4-hour chart, the pair's quotes performed a rebound from the Fibo level of 161.8% (1.1148), a reversal in favor of the European currency, and began the process of growth towards the corrective level of 127.2% (1.1404). Emerging divergences are not observed in any indicator today. Fixing the pair's exchange rate below the level of 161.8% will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 200.0% (1.0865).

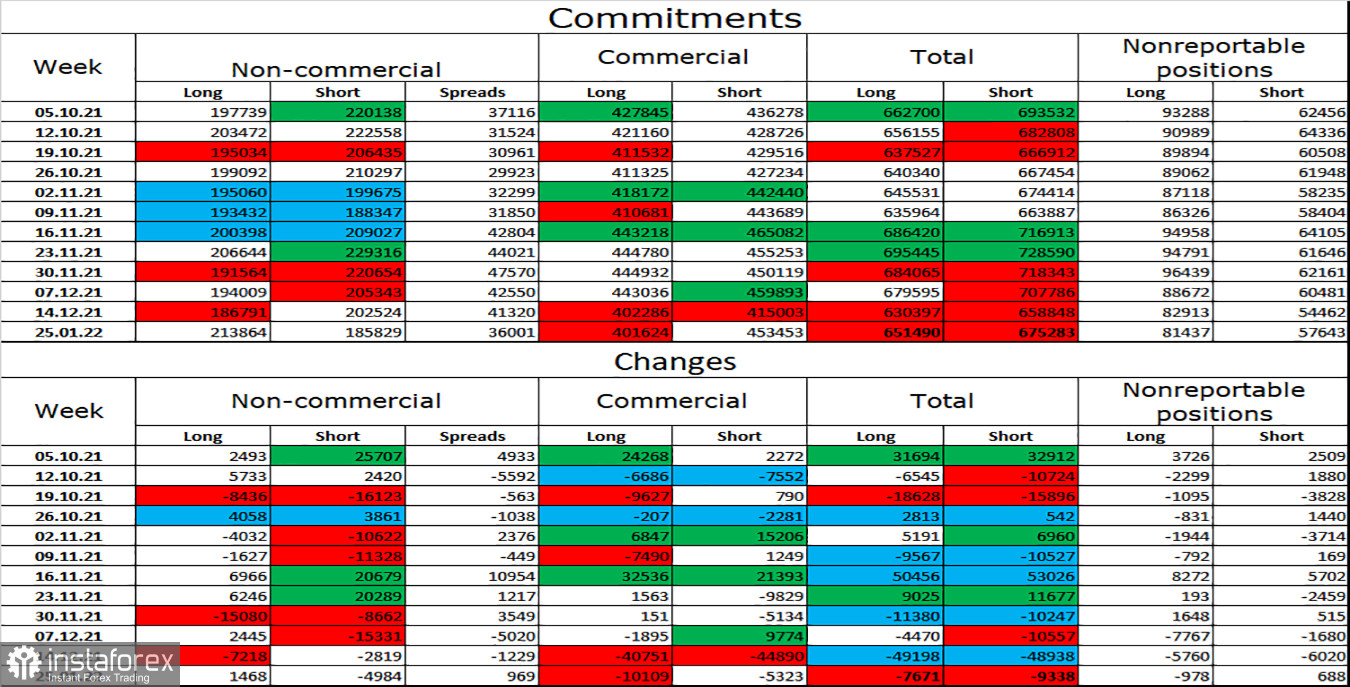

Commitments of Traders (COT) Report:

Last week, speculators opened 1,468 long contracts and closed 4,984 short contracts. This means that their mood has become more "bullish". The total number of long contracts concentrated on their hands is now 214 thousand, and short contracts - 185 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". Consequently, the euro currency can count on a certain growth, but the days when traders worked out the Fed meeting and when they will work out the ECB meeting have not yet been taken into account, and they can have a very strong impact on the mood of traders. The figures for the "Non-commercial" category can change a lot.

News calendar for the USA and the European Union:

EU - index of business activity in the manufacturing sector (09:00 UTC).

EU - unemployment rate (10:00 UTC).

US - ISM manufacturing index (15:00 UTC).

On February 1, the calendar of economic events of the European Union contains two reports, and both have already been released. However, traders continue to trade the pair without paying attention to the information background. Another ISM index in the USA will be released today, but I also expect a maximum local reaction to it.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair with a target of 1.1143 if a close is made below the level of 1.1250 on the hourly chart. I recommended buying the pair if the rebound from the 1.1148 level is performed on the 4-hour chart. The target of 1.1250 on the hourly chart has already been reached. Now you can stay in purchases with a target of 1.1357.