January proved to be the best start month of the year for oil in at least 30 years. The North Sea grades added 17% amid rising demand, tight supply and declining stocks. Banks and investment companies believe Brent would rise to $100 a barrel, but the market looks too optimistic. Against this backdrop, as soon as any negative news appears, speculators will immediately start taking profits, triggering a pullback.

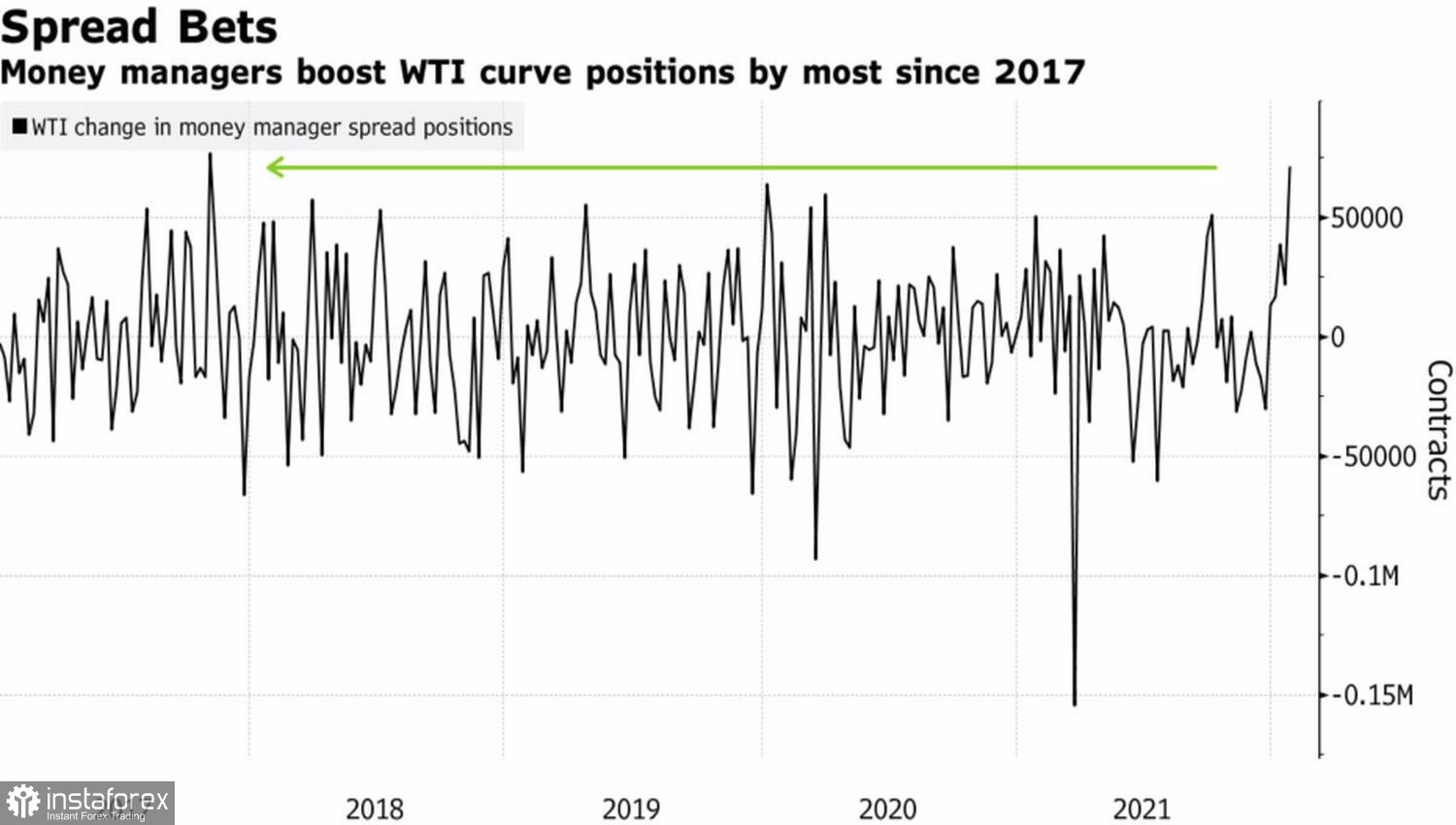

In fact, hedge funds have already started to do so. In the week to January 25, they sold the equivalent of 18m barrels of oil and oil products in 6 key contracts. Long positions have risen by 217m barrels equivalent over the previous five-day period, with the North Sea grades adding around 25% of their value over the past two months. At the same time, WTI net long positions have climbed to their highest level since late 2017 and the bullish oil market environment, known as backwardation, where contracts with near-term maturities are worth more than those with more distant maturities, is the most optimistic for the past eight years.

Backwardation dynamics in the oil market

Certainly, growing demand, the energy crisis in Europe, rising geopolitical risks in Russia-West confrontations over Ukraine as well as the UAE and Hussein militants, declining tanker stocks and the Arctic explosion in Texas are setting the Brent and WTI bulls on a major footing. Nevertheless, Goldman Sachs warns that the black gold market could soon face problems.

The main risks, according to a major bank, come from the Fed, which could slow down US and global GDP with aggressive monetary restraint, as well as from OPEC+. The alliance, at its summit on February 2, could make a decision for financial markets to increase production by more than 400,000 bpd. Investors are bound to be discouraged, as rumours had previously circulated in the market that the organisation was unable to meet its production expansion plans due to limited technical capacity.

However, Goldman Sachs, despite growing downside risks, remains optimistic about the medium- to long-term outlook for oil and predicts Brent to rise to $100 a barrel. I agree with this. With over-optimistic investors and over-stretched speculative net longs, a sudden change by OPEC+ could easily trigger a correction but not break the uptrend. Another trump card for the bears could be an increase in US black gold reserves.

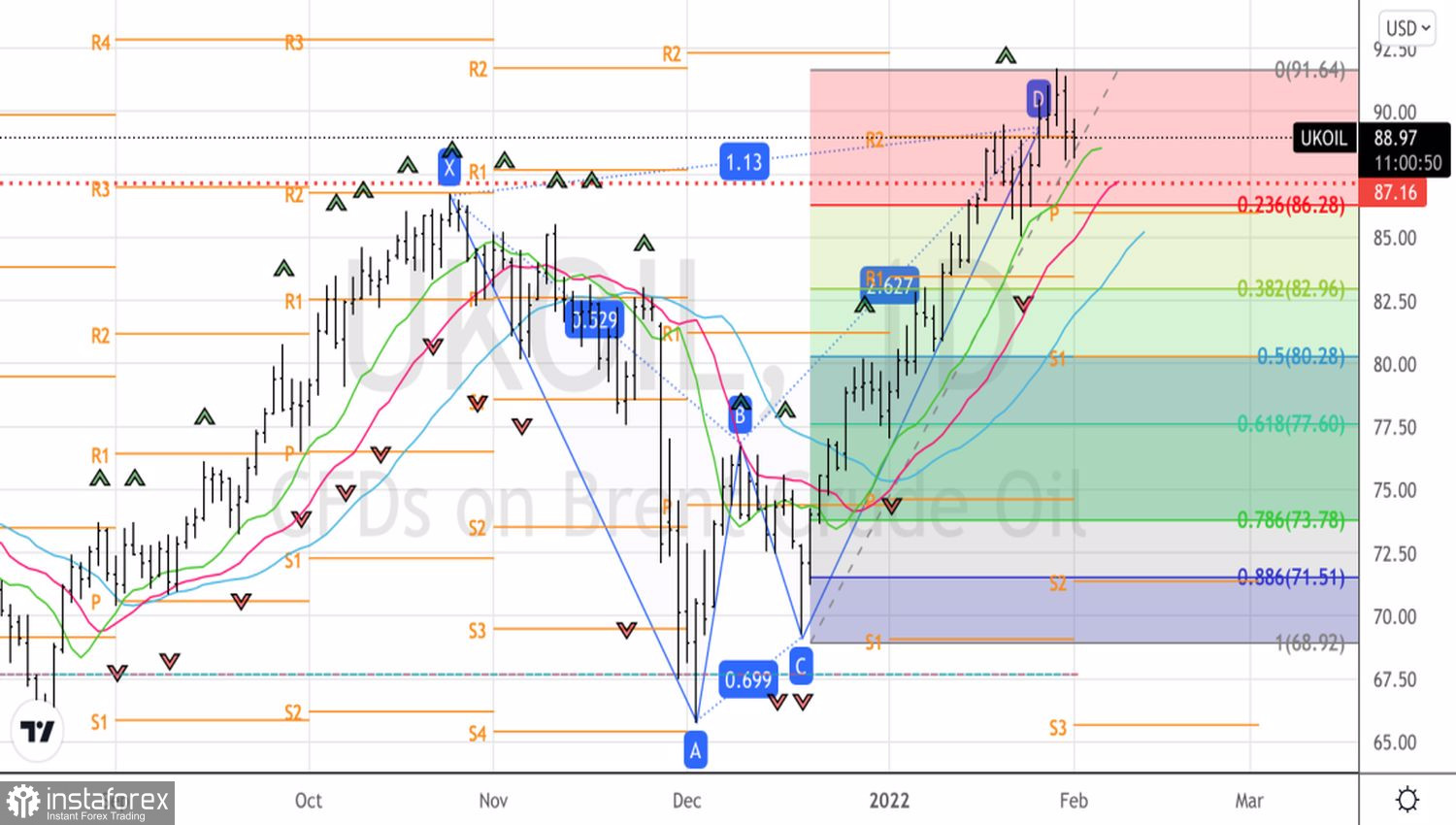

Technically, there is a Crab pattern on the daily Brent chart. The intermediate target near the 113% mark of the XA wave has been reached, which increases the risks of a pullback towards 23.6%, 38.2% and 50% of the CD wave. These levels correspond to $86.3, $83 and $80.3 per barrel. A rebound from these supports will allow the formation of medium-term long positions. In the meantime, oil can be sold in the short term.

Brent, daily chart