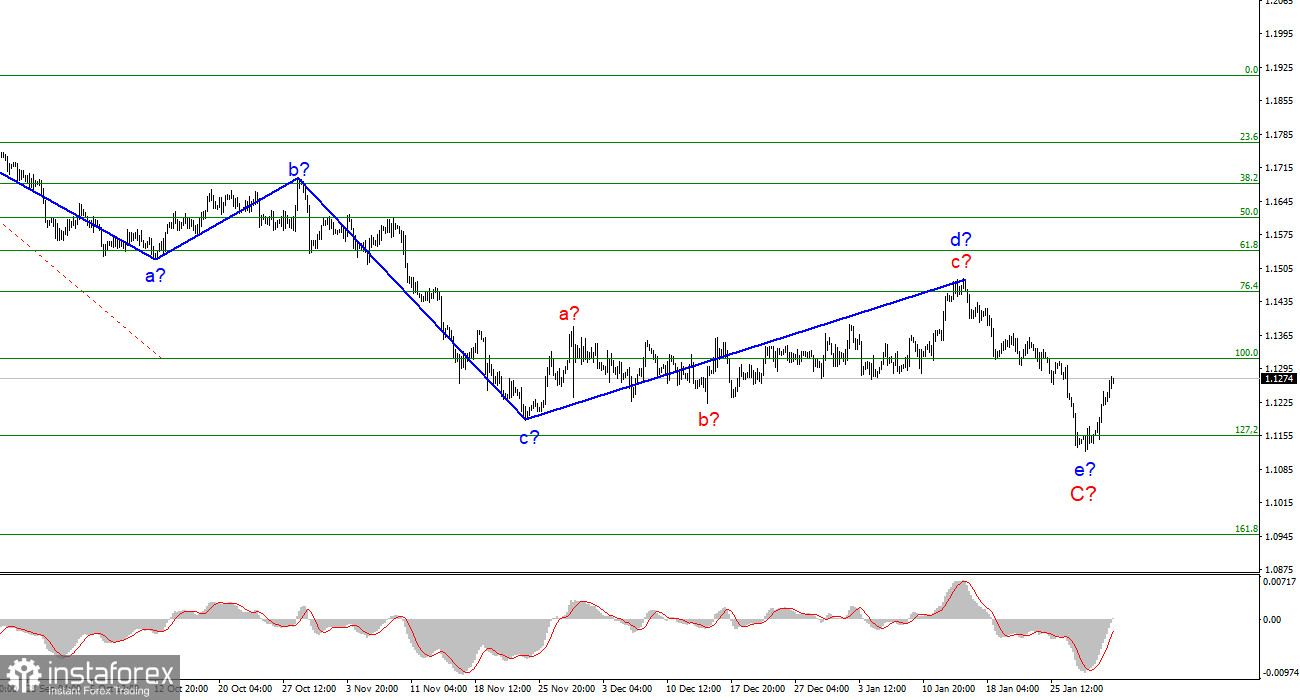

The wave layout on the 4-hour chart for EUR/USD remains clear. The d wave has been completed. In the course of a decline over the recent weeks, the quote has broken through the low of the wave c in C. So, as I assumed earlier, the current descending wave is definitely wave e in C. Consequently, the entire wave C took a five-wave form. So far, not a single internal wave can be seen inside the wave e. Thus, this can also turn out to be a five-wave structure with a much more extended form. A successful attempt to break through 1.1152, which corresponds to 127.2% Fibonacci, will indicate that the market is ready to sell the instrument. Since this attempt has failed, it is still possible that the correctional wave consisting of e in C can be built. In an alternative scenario, the C wave will complete its formation and a new upward section, or the wave D, will be formed.

EUR openes this week on a positive note

The EUR/USD pair appreciated by 85 points on Monday and by another 40-50 points on Tuesday. So in just two days, when the news background was weak and not favorable for the euro, the instrument managed to grow by about 130-140 points. I did not expect to see such a move. The existing wave layout suggested such a scenario, but I cannot say for sure whether the current rise is a correctional wave inside e in C or a new wave D. However, let us pay attention to a more important factor. On Thursday, the ECB will sum up the results of its first meeting this year, and market participants do not expect any surprises from it. In particular, analysts at Rabobank said that 2022 could be a "year of change." Obviously, they were talking about a change in terms of the policies that were adopted during the pandemic, and not in terms of monetary tightening. Experts believe that the ECB will not be too eager to achieve 2% inflation as soon as possible and curtail all monetary easing. The bank also said that geopolitical tensions with Russia could cause a new increase in energy prices, which, in turn, could inflate consumer prices in the EU. The situation around inflation is very unstable. It might have slowed down in January but in February or March, it will start to grow again. Christine Lagarde also said that this year the ECB would not raise interest rates. Rabobank believes that 2022 will be a year of a slow exit from the policy induced by the pandemic, but it will not bring any changes to the monetary policy.

Conclusion

Based on the analysis above, I can conclude that the construction of the ascending wave d is completed. It is better to sell the instrument on each sell signal by the MACD indicator, considering the construction of wave e in C with targets located near 1.0948, which corresponds to 161.8% Fibonacci. An unsuccessful attempt to break through the 1.1152 level pushed the quotes away from the previous lows. Now we need to wait for the completion of the current wave to decide which higher wave it belongs to. However, it is still possible to sell the instrument.

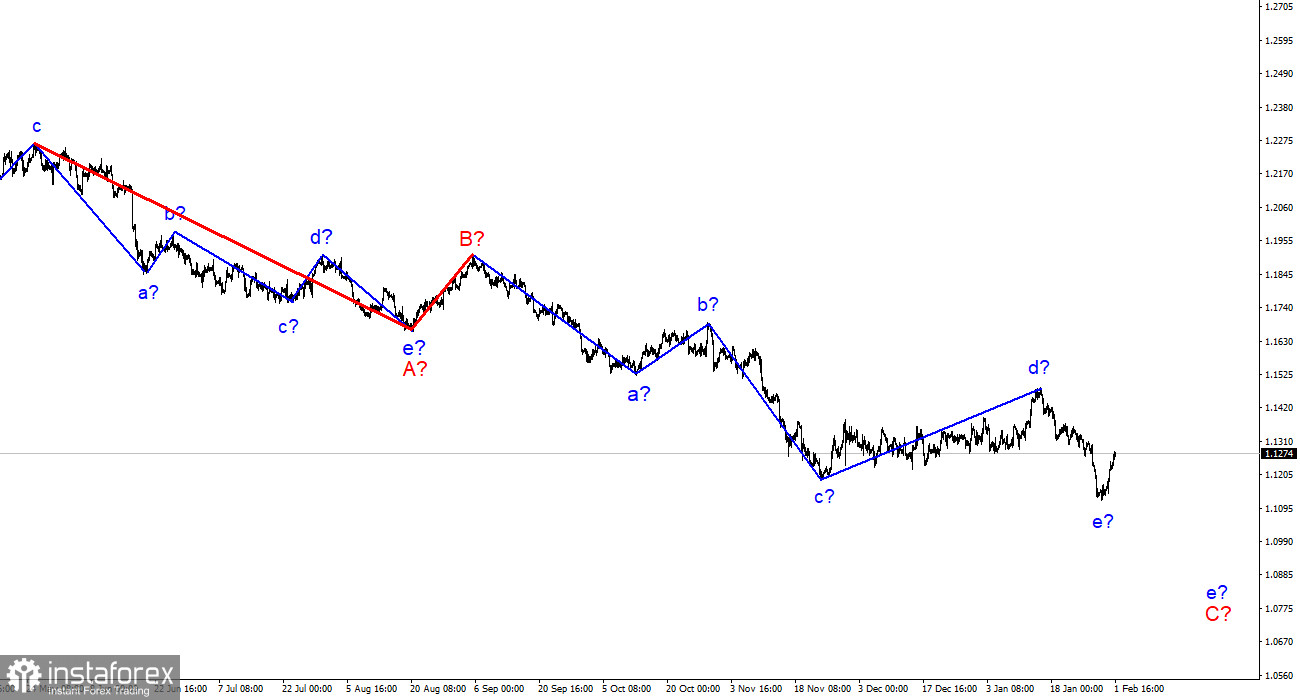

On a larger time frame, the assumed wave e in C continues its formation. This wave may turn out to have a five-wave structure or it may have a shortened form. Considering that all previous waves were not too large and were approximately of the same size, the current wave may not differ much. It is more likely that this wave has completed its formation rather than building three more waves in the C wave.