Analysis of Tuesday's trades:

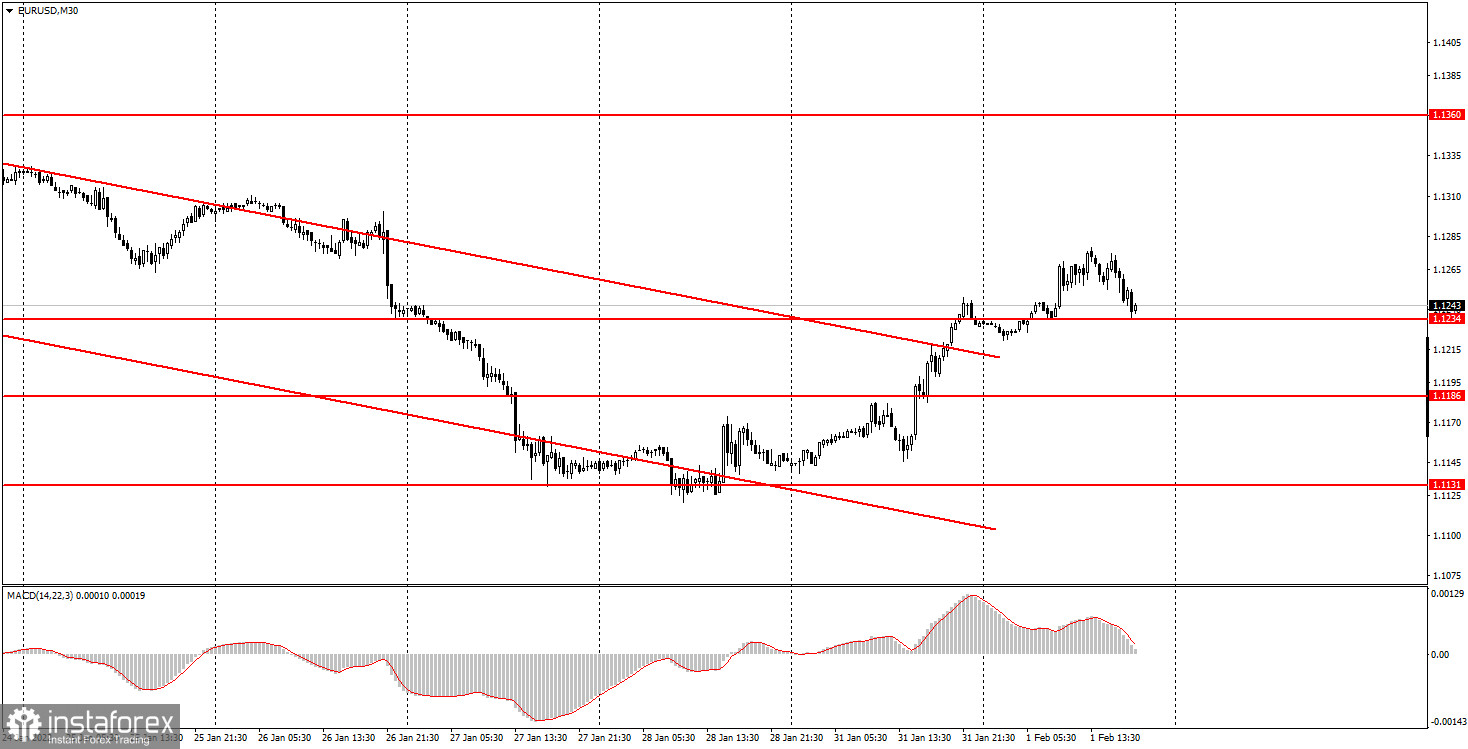

30M chart of EUR/USD

On Tuesday, trading on EUR/USD was again inconvenient for market players, especially for beginners. Several macroeconomic reports were published. They were either ignored by traders or came out too disappointing to somehow affect the market. Anyway, the euro/dollar pair started the day near the level of 1.1234 and ended it there. Volatility on Tuesday was 56 pips, which was not much. Nevertheless, the quote left the downward channel, canceling the downtrend. It would be good to know that the downtrend is actually canceled and the pair can now move up. However, there is reason to doubt. On Thursday, the ECB will announce the outcome of its monetary policy meeting, which may exert pressure on the euro. On Wednesday, the eurozone inflation report will be published. If it is in line with the forecast, the euro may go down. In other words, the single European currency is highly likely to be bearish on Wednesday. This scenario will play out if the quote consolidates below 1.1234.

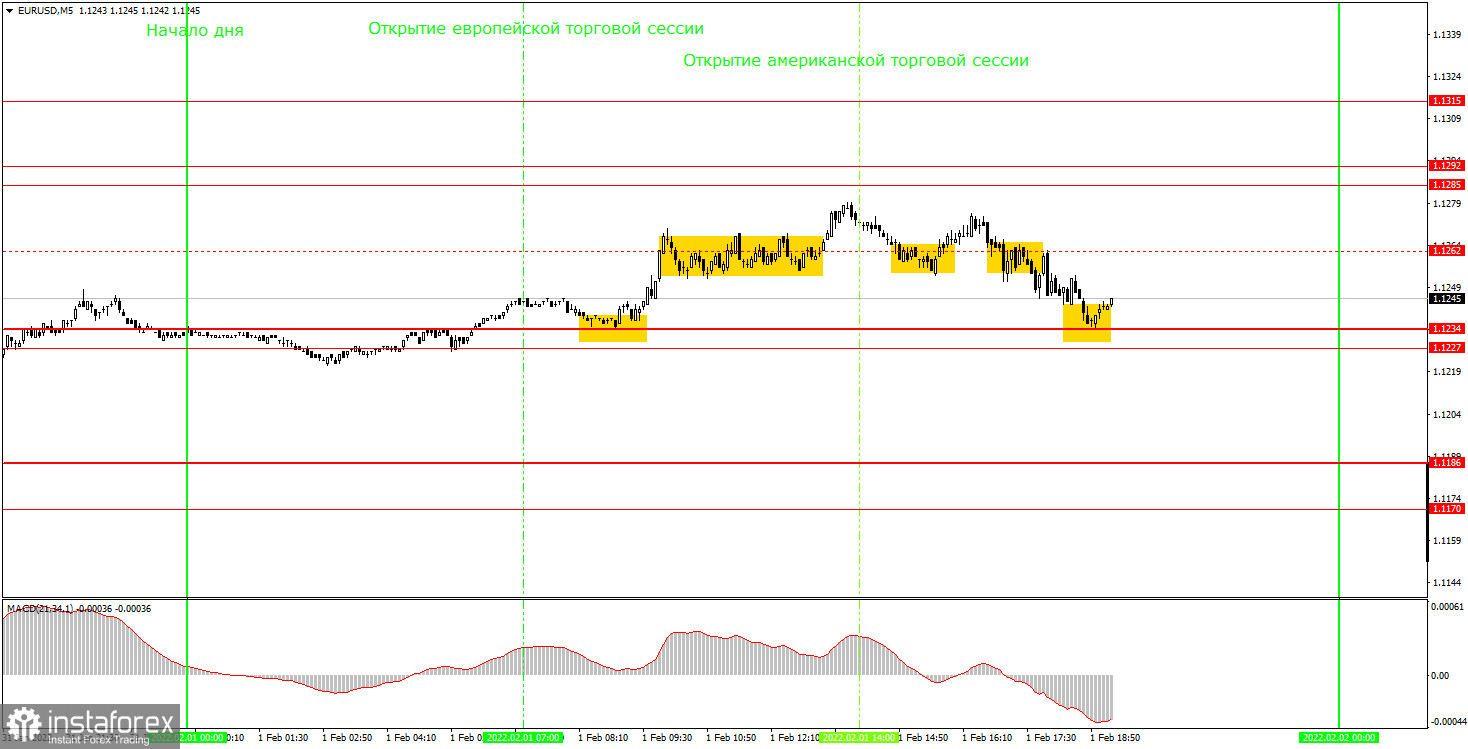

M5 chart of EUR/USD

On the M5 chart, the level of 1.1262 turned out to be exactly in the middle of the range in which the pair was trading all day. As a result, most of the trading signals produced near this mark were false. Let's analyze all the trading signals more thoroughly. Firstly, the pair rebounded from the level of 1.1234, signaling to go long. Then, it broke through the level of 1.1262 but failed to reach the 1.1285 mark. So, it was time to close trades either manually or after the quote had settled below the level of 1.1262. The maximum profit yielded was 10 pips. As soon as the price consolidated below 1.1262, short positions could be opened. The quote then rebounded from 1.1234, and it was the time to close short trades. The maximum profit yielded was again 10 pips. The last buy signal was weak enough to enter the market because the movement was sluggish during the day and the signals produced were inaccurate. As a result, Tuesday trading brought beginners no more than 20 pips in profit, which was also not bad.

Trading plan for Wednesday:

In the 30M time frame, the downtrend is canceled. The price consolidated above 1.1234, indicating bullish market sentiment. If the quote falls below the mark in the next couple of days, the downtrend may resume. The target levels in the 5M time frame are seen at 1.1170-1.1186, 1.1227-1.1234, 1.1285-1.1292, and 1.1315. There are no other levels below 1.1121 because the price has not been there for more than a year. Therefore, it will be more difficult to trade there. The European economic calendar contains a single report on inflation. The data are very important and may trigger turbulence in the market. Therefore, traders should pay close attention to the release. The ADP jobs statistics will come out in the United States. It has less influence on the market than Nonfarm Payrolls. Therefore, market participants are unlikely to show any reaction to the results.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance price levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading in the long term.