The GBP/USD currency pair continued its upward movement on Tuesday, which began on Monday and was also completely groundless. On the first trading day of the week, there were no important publications either in the UK or in the USA. Therefore, based on what did the British pound grow? Although in the case of the pound/dollar pair, we can still say that technical factors worked. First, the growth of the British currency was not so strong. Second, on Monday, there were no statistics that would support the dollar (and in the case of the euro/dollar pair it was). Thus, there are fewer claims to the pound sterling now. The price has also consolidated above the moving average line, so the movement to the north may continue. But everything also depends on the results of the Bank of England meeting on Thursday. If BA raises the key rate (and so far everything is going to this), then the pound will not be able to ignore this and, most likely, will continue to grow. Therefore, now it would be much more logical to see a calm, semi-lateral movement. But instead, both the pound and the euro are showing impressive growth. It makes no sense to build longer-term forecasts now. No one knows for sure what the central banks of the European Union and the UK will announce on Thursday. No one knows what the market reaction will be, especially given the growth of the euro and the pound on Monday and Tuesday. Thus, it will be better to make conclusions on Friday. Recall that after such important events as the meetings of the central bank, it is necessary to allow the market to calm down and wait at least a day. The reaction to the event can persist for 20-24 hours.

There are still few macroeconomic statistics.

This means that the euro and the pound can continue to trade on technical factors today. Of course, the ISM report on the business activity was published yesterday. Today, a report on the number of people employed in the private sector ADP will be released in the States. Therefore, the data is formally available, but they are not too strong and traders do not pay much attention to them. In the UK, the news flow has weakened significantly over the past few days. Boris Johnson decided to organize an alliance with Poland and Ukraine and flew to Kyiv for negotiations. Britain is also going to allocate money and weapons to resolve the conflict in Eastern Ukraine and stabilize the country's economy. However, all these topics do not interest traders too much. Market participants are waiting for important macroeconomic data, and not messages about a new "coronavirus" party at 10 Downing Street or military assistance to Ukraine. And there are simply no such now. So it turns out that traders should trade on the first three trading days of the week with an eye to Thursday.

And on Thursday, the Bank of England will announce the results of its meeting. According to the absolute majority of experts, the key rate will be raised, but it is interesting not even that, but what Chairman Andrew Bailey will tell the markets. Recently, information has been increasingly appearing that the Bank of England is going to raise the rate at least 4 times. Moreover, all four increases will take place in a row, and the rate will rise to 1% in May. If so, then the pound sterling has an excellent opportunity to resume growth and resist the US currency on an equal footing in the coming months. However, the situation, as usual, is contradictory. You need to understand how this week will end, how the euro currency, which unexpectedly and unreasonably rose on Monday and Tuesday, will behave, and what will be the correlation between the euro and the pound in the next few days. So far, we can say that the further growth of the British currency looks much more promising than the growth of the euro currency. Nevertheless, at this time, it is the euro currency that is showing strong growth. Thus, we recommend that you continue to trade on technical analysis and wait for two meetings of central banks with caution. The markets are not just waiting for these events now, they are already actively trading on the eve of them.

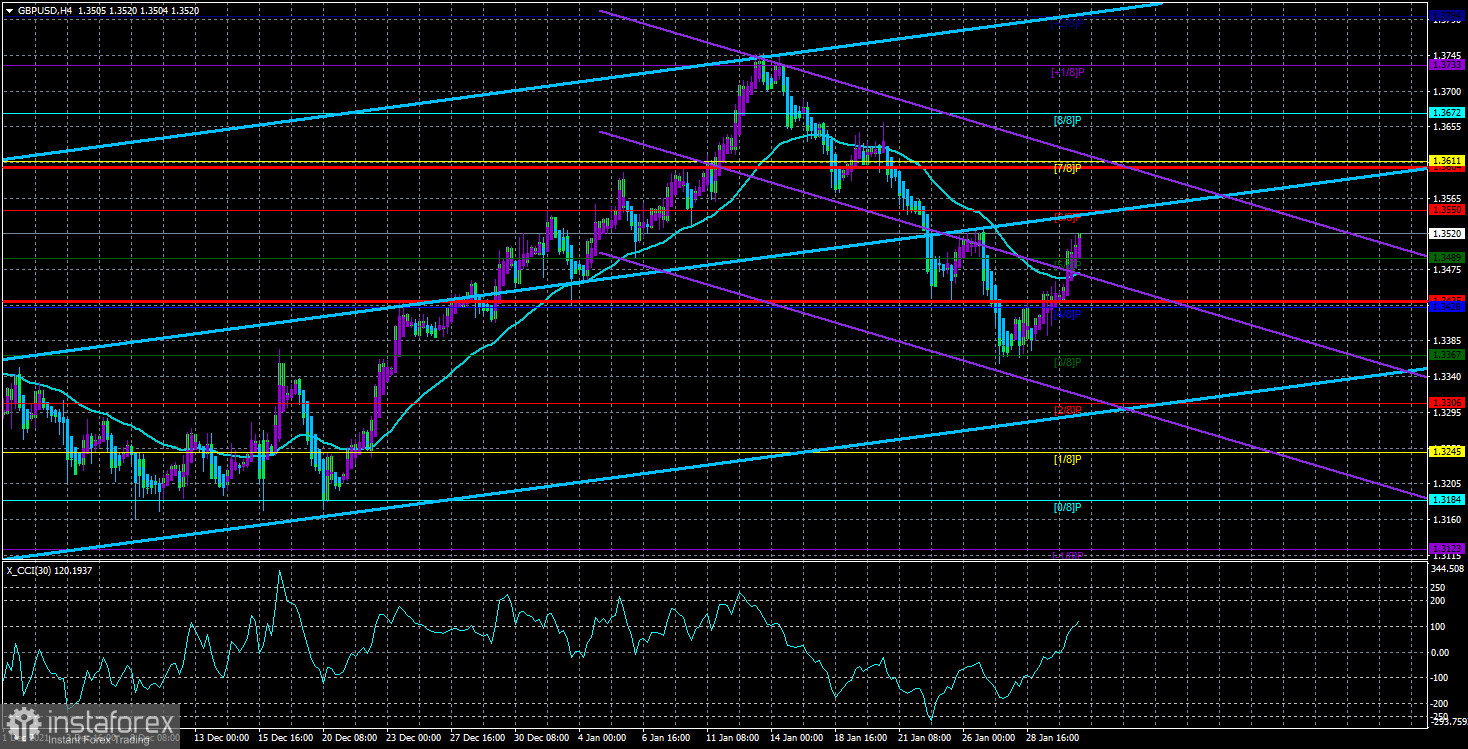

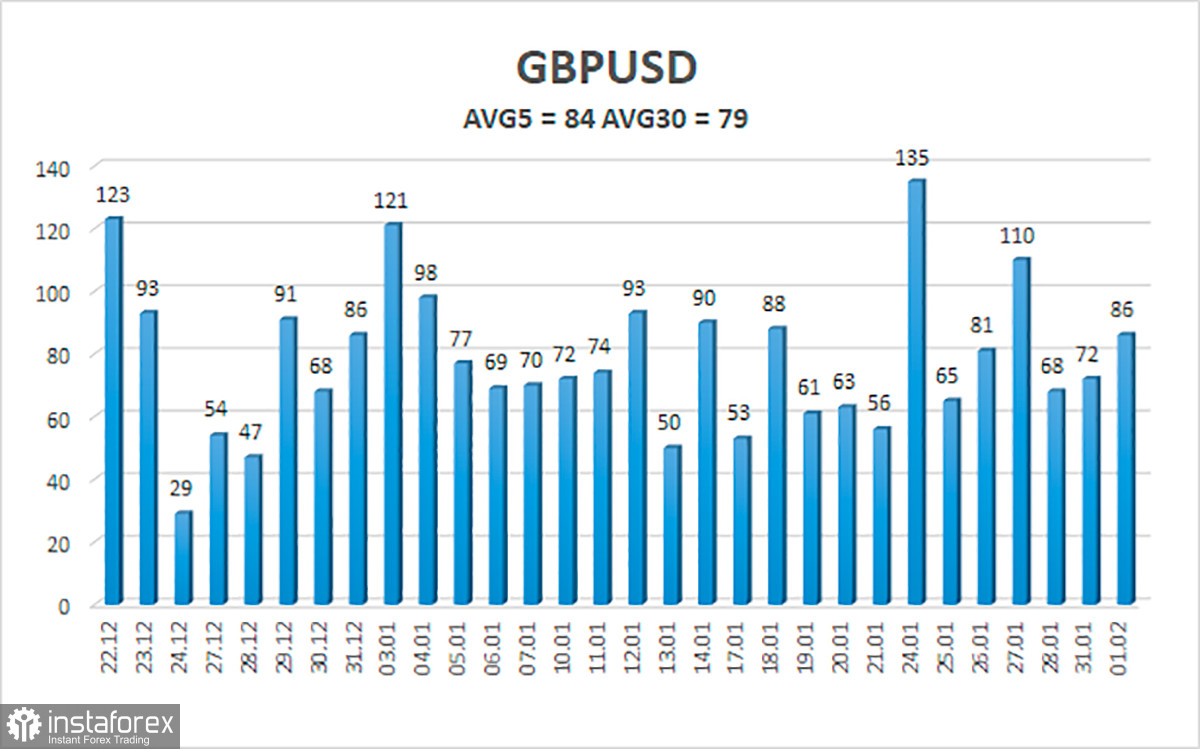

The average volatility of the GBP/USD pair is currently 84 points per day. For the pound/dollar pair, this value is "average". On Wednesday, February 2, thus, we expect movement inside the channel, limited by the levels of 1.3435 and 1.3604. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downtrend.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, at this time, it is recommended to stay in long positions with targets of 1.3550 and 1.3604 until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3425 and 1.3367, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.