Here are the details of the economic calendar for February 1:

The final data on the index of Eurozone's business activity in the manufacturing sector turned out to be worse than the preliminary estimate, which rose from 58.0 to 59.0 points. The final data came out with an increase to 58.7 points, but in their defense, the adjustment is insignificant. Thus, they did not put pressure on the euro.

In Britain, the final data on the index of business activity in the manufacturing sector also came out with a slight adjustment, but in this case, the index came out even better than the preliminary estimate.

One of the most significant events is Europe's data on the unemployment rate, where the previous indicator was revised in favor of a decrease from 7.2% to 7.1%, and the current one came out better than the forecast of 7.0%. It was this recovery in the labor market section that supported the Euro currency.

During the American trading session, the final data on the index of business activity in the US manufacturing sector were published, where the data coincided with the preliminary assessment. Therefore, they were ignored.

Meanwhile, JOLTS data on open vacancies in the US came out better than expected. Their total number increased from 10,775 thousand to 10,925 thousand.

Analysis of trading charts from February 1:

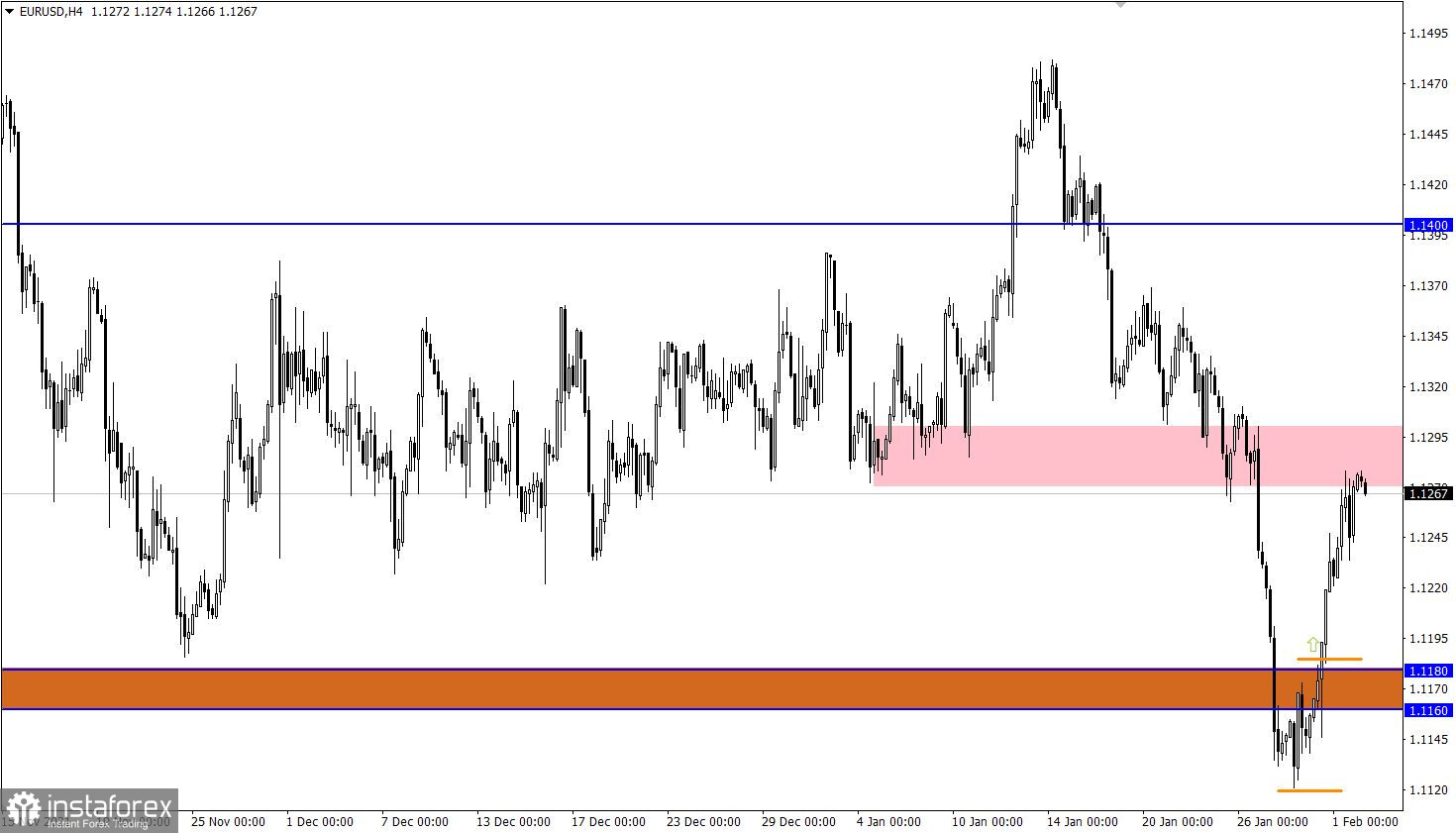

The EUR/USD pair reached the resistance area of 1.1270/1.1300 due to the correction, where a local reduction in the volume of long positions occurred. This led to a slowdown in the upward cycle, but not to the end of correction.

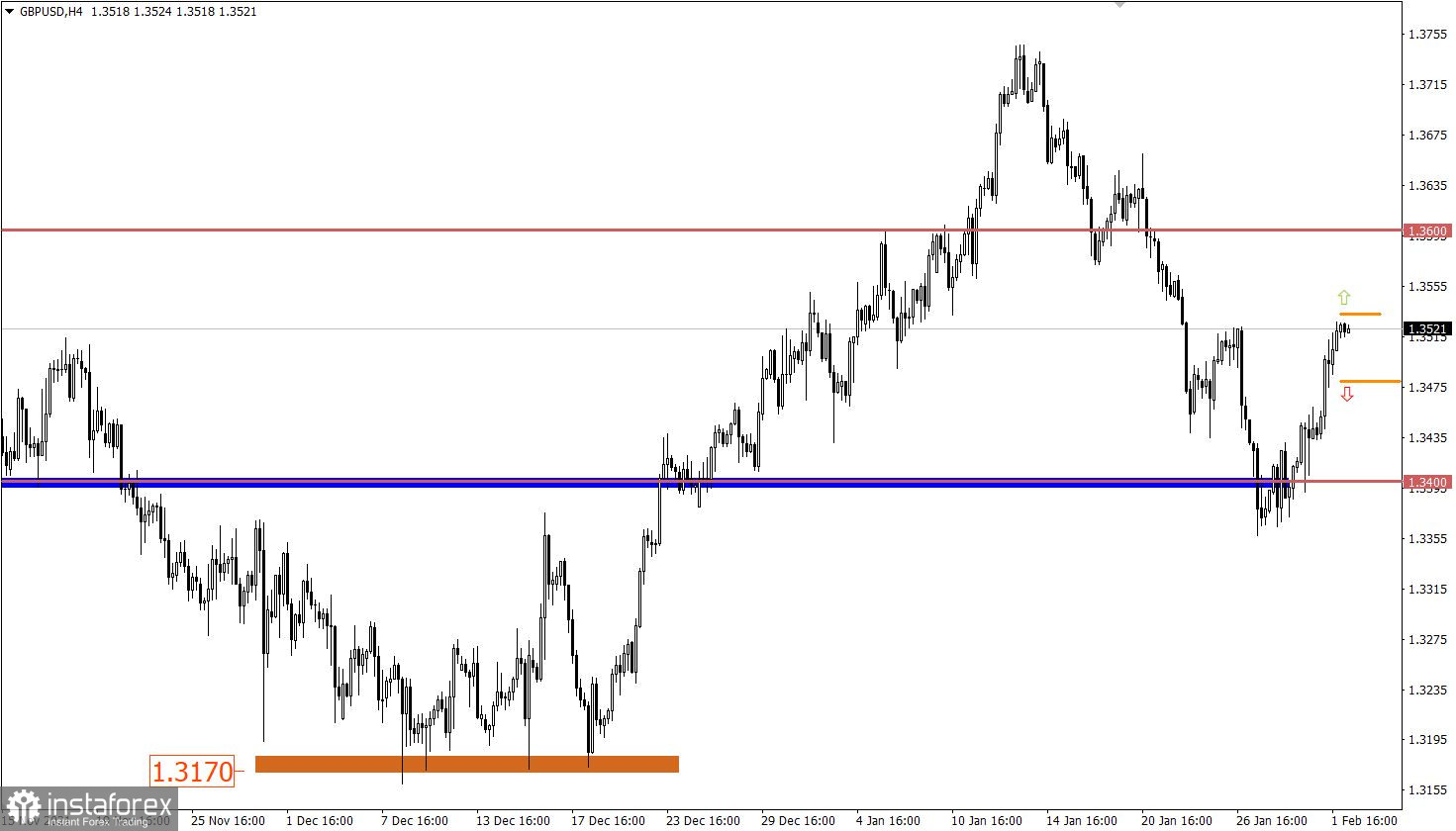

The GBP/USD pair moved from the pullback stage to a full correction cycle after the quote broke the level of 1.3500. This move led to a subsequent increase in long positions, which calls into question the process of restoring the US dollar from January 14.

February 2 economic calendar:

Europe will release its inflation data today, which may slow down from 5.0% to 4.5%. Given the ECB's vague position, the decline in inflation is in no way a bad factor, but in this case, tomorrow's meeting may remain unchanged since the European regulator sees a decline in consumer prices.

ADP's employment report in the US will be published during the US trading session, which may increase by 207 thousand. On the one hand, the figure is not small, but compared to the previous month, where there was an increase of 807 thousand, speculators may be afraid. This will negatively affect the US dollar.

Time targeting:

EU inflation - 10:00 Universal time

US ADP report - 13:15 Universal time

Trading plan for EUR/USD on Feb 2:

The correction is still relevant in the market, despite the resistance area. Therefore, the quote may continue to move within 1.1270 /1.1320, locally leaving the resistance zone.

The signal for the prolongation of the upward cycle will be received if the price holds above the level of 1.1330 in a four-hour period.

The signal about the completion of the correction will be considered by traders if the price holds below the level of 1.1230 in a four-hour period.

Trading plan for GBP/USD on Feb 2:

The corrective course remains in the market, where traders do not exclude a subsequent increase in the value of the pound if the price holds above the level of 1.3530. In this case, it will likely move in the direction of 1.3600.

Traders will consider an alternative scenario of market development in case the price returns below the level of 1.3480. This step may indicate the primary signal to the end of the correction.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.