The ISM manufacturing index released on Tuesday (+57.6 against the expected +57.5) confirmed the assumption that the US economy continues to recover steadily, which, combined with high inflation, allows us to conclude that the Fed is doing the right thing by targeting the start of the rate hike cycle in March.

The demand for risk remained at a high level, due to which the US dollar is still under slight pressure. The New Zealand and Australian dollars are on the list of leaders. Today, we should pay attention to the ADP report on the level of employment in the private sector, which may slightly clarify the employment situation before the Nonfarm data on Friday.

USD/CAD

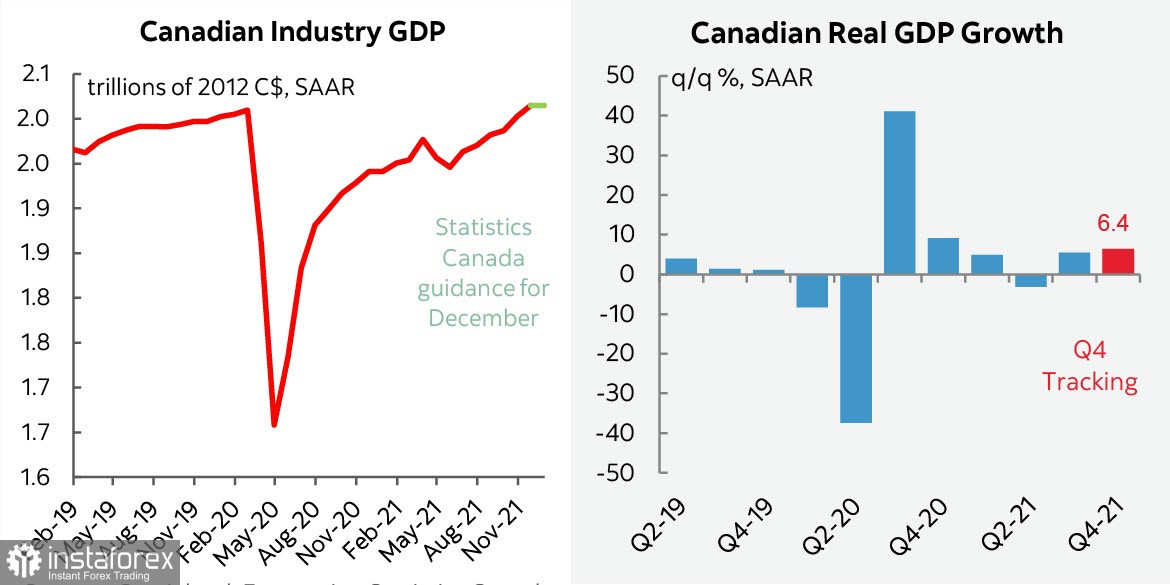

On Monday, Statistics Canada published its estimate of GDP growth in November 2021, and it turned out that the pandemic decline in GDP was fully offset. The growth was 0.6% last Novemeber. The estimate was raised to +6.33% y/y for the 4th quarter, which is very high indicator.

Scotiabank believes that the Bank of Canada made a mistake last week, as strong GDP growth, high inflation, a sharp rise in house prices and a reduced threat from Omicron are the ideal backdrop to start a rate hike cycle. But what's done is done, and now the Canadian dollar will be subject to additional pressure instead of starting to strengthen.

The weekly change in CAD futures was +377 million. The total bullish margin of 975 million in favor of the Canadian dollar is unchanged here, but it must be assumed that this data was collected before the Bank of Canada held a meeting and does not reflect investor disappointment too soft solution. Accordingly, the settlement price is directed downwards, but the next report on Friday may show a strong bearish correction for this currency.

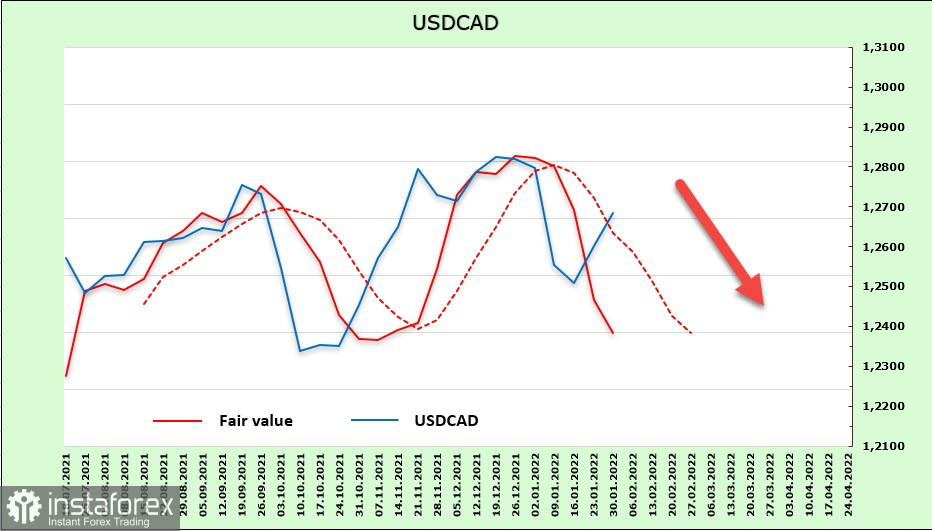

So far, it can be assumed that trading continues in a converging triangle with signs of symmetry, which makes it difficult to find the direction of the breakdown. If we follow the estimated price, we can expect a downward breakdown with consolidation below the support of 1.2450. Given that the US dollar gains a fundamental advantage due to the Fed's more aggressive policy, then an upward breakdown with the nearest target of 1.2960 is possible. It is possible that some clarity will come today after the comments of the BoC head Macklem.

USD/JPY

A January study by the Cabinet of Ministers showed that the industry break-even rate is $99.8 per yen, which is even slightly better than a year ago. And with the yen now much weaker, the improved break-even point gives Japanese corporations more room to maneuver.

At the same time, the Japanese economy is in quite a difficult position due to a structural decline in domestic demand caused by a declining population, low birth rates and an aging society. Mizuho Bank believes that Japan's financial situation is the worst among industrialized countries, which excludes tightening of monetary policy in the near future. On the contrary, stimulus measures continues to expand. Since November, the government has launched a new support program for 55.7 trillion yen, and taking into account the attraction of private sector funds – 78.9 trillion.

There are no monetary reasons for the yen's strengthening. The main threat to its possible growth is a sharp increase in demand for protective assets. Accordingly, if the global economy is preparing for the end of the pandemic and the growth of industrial and trade activity, then this is a factor to further weaken the currency.

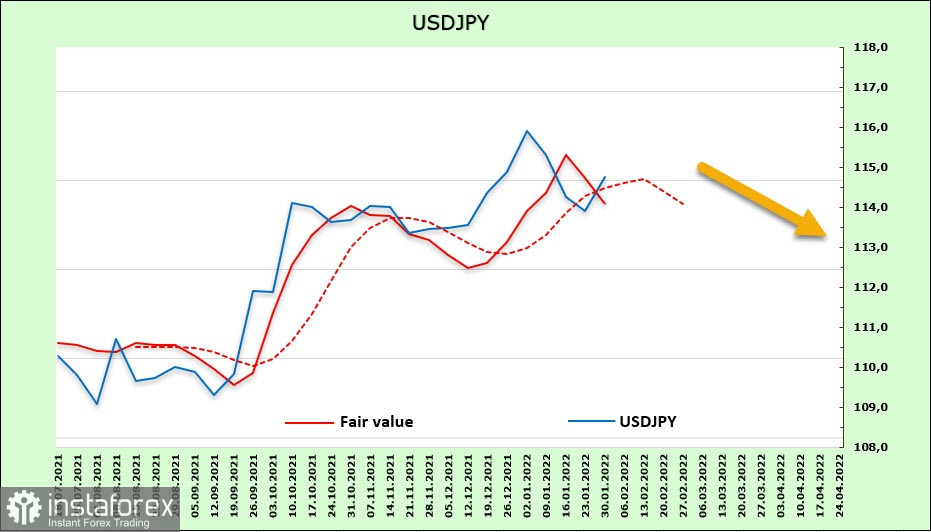

The net short position on the yen adjusted for the week to -7.494 billion (+1.327 billion), which is quite a lot. This allowed the estimated price to turn down, but at the same time the bearish advantage remains significant.

The Japanese yen is trading within the ascending channel. There are no reasons to change the trend yet. The emerging reversal of the settlement price gives reason to believe that the local high of 116.37 will not be broken in the near future. The downward correction may find support near 113.10 or 112.50 with a subsequent transition to the side range since there are no grounds for a stronger decline.