Hi, dear traders!

Yesterday, EUR/USD closed in positive territory, confirming the Morning Star candlestick reversal pattern. The pair's further trajectory remains uncertain - on Thursday, the European Central Bank will decide on the interest rate, followed by a press conference with the ECB's president Christine Lagarde. The ECB is unlikely to change the rate from its current level of 0.00%. Market players are currently focusing on the tone of Lagarde's statements. It is likely that the ECB's president will not take a clearly hawkish position and would rather address market concerns over high inflation. Lagarde could ensure the market that the European regulator would tackle inflation with all means possible within its mandate. However, a hawkish shift cannot be ruled out.

Yesterday's EU and German employment data were quite positive and pushed the euro up against the US dollar. Today's data releases that could seriously influence EUR/USD are the eurozone's CPI data and the US ADP national employment report.

Daily

EUR/USD closed in positive territory yesterday, breaking through the red Tenkan-Sen line of the Ichimoku cloud and confirming the Morning Star reversal pattern. If the pair continues to rise today, it would test the key technical area of 1.1291-1.1309. The lower boundary of the Ichimoku cloud, the blue Kijun-Sen line and the 50-day SMA line are all located in this area. A successful breakout above this area would determine the pair's upside potential. Investors could also take a wait-and-see approach in the run-up to the ECB meeting and Lagarde's statements.

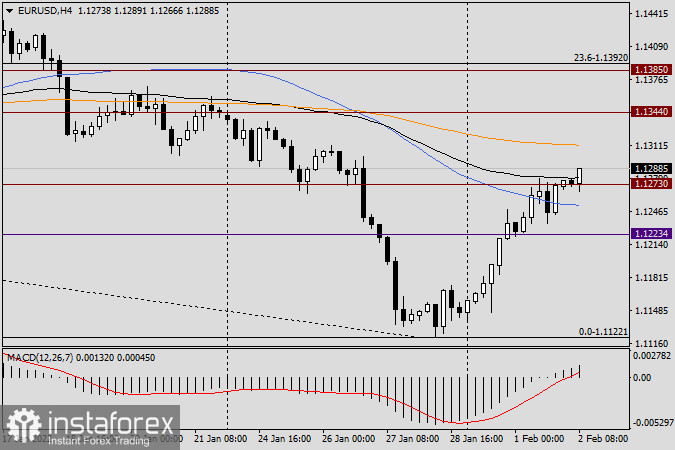

H4

According to the H4 chart, the quote is trying to break through the black 89-day EMA line, which is followed by the 200-day EMA at 1.1311. Despite the Morning Star reversal pattern being clearly visible on the daily chart, the upward movement of the pair seems to be merely an upward correction right now. Right now, opening short positions is the main trading idea - they can be opened once EUR/USD tests the strong technical level of 1.1300. The 50 MA on the daily chart and the 200 EMA on the H4 chart lie above this level. This is a very strong obstacle for the pair, so traders are advised against opening long positions.

Good luck!