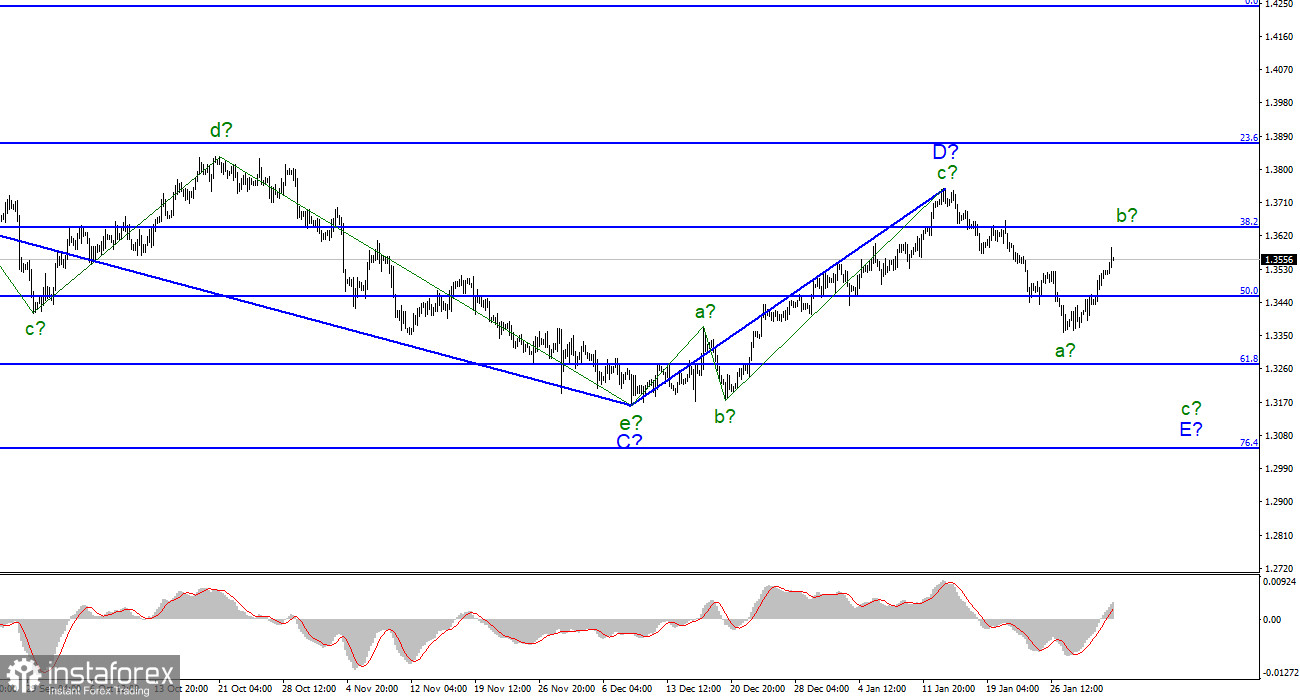

The wave picture in the GBP/USD pair looks rather convincing. In the past few weeks, the cable was forming a new downward wave that is currently seen as the wave E of the downside trend segment. However, in the few recent days, we've been witnessing an increase which can be interpreted as the wave b within E. If so, we can expect the resumption of the downtrend in the coming days. Some inner waves can be seen in the wave a within E. So, it is also possible to find three waves in the wave b within E. In this case, an upward trend is likely to remain in place until Friday, as the completion of a complex wave b can take some time. As soon as this wave is completed, the downward trend may resume as part of the wave c within E with targets near the 1.30 level. It is hard to predict the depth of the wave b. That is a drawback of correctional figures and waves as they poorly define the targets.

Bank of America doubts that the pound sterling will grow further

On February 2, the pound/dollar pair rose another 40 pips, thus demonstrating a 190-pips increase in three days. Remarkably, the rise was not backed by any fundamental factors. The United Kingdom did not release any significant economic reports today. At the same time, the ADP Payrolls data from the United States turned out to be negative which is a rare occasion. However, this report was published in late trades, whereas the American currency had been falling from today's morning. Therefore, we can conclude that markets barely noticed the ADP figures. Meanwhile, the Bank of England will unveil the results of its monetary policy meeting tomorrow. As widely expected, the regulator will hike the rate. Moreover, most experts anticipate that the rate will be further increased in May and August. However, Bank of America doubts these measures will help the pound sterling continue its upward trend in February. The bank's analysts believe that the British currency will traditionally demonstrate a downtrend in February. A rate hike, the QE program tapering, and the announcement of the balance securities sale starting from November are unlikely to provide support to the pound sterling according to experts. They also believe that these decisions may already have been factored in the current GBP quote. It is seen as the only reason behind the recent three-day run of 200 pips. It was happening right before the BOE announcement. I think there is a high chance of forming a new downward wave on the condition that the demand for the British currency declines in the near future.

General conclusions

The wave picture of the GBP/USD pair implies the completion of the suggested wave E. So far, we have noticed that the inner correctional wave started to appear, and may be completed in a few days. But I still expect the resumption of the downtrend that is likely to start on Thursday or Friday. GBP sell trades seem to be more promising but we should wait for the BOE meeting results. A false break of 1.3641, 38.2% Fibo, will signal the market's readiness to sell.

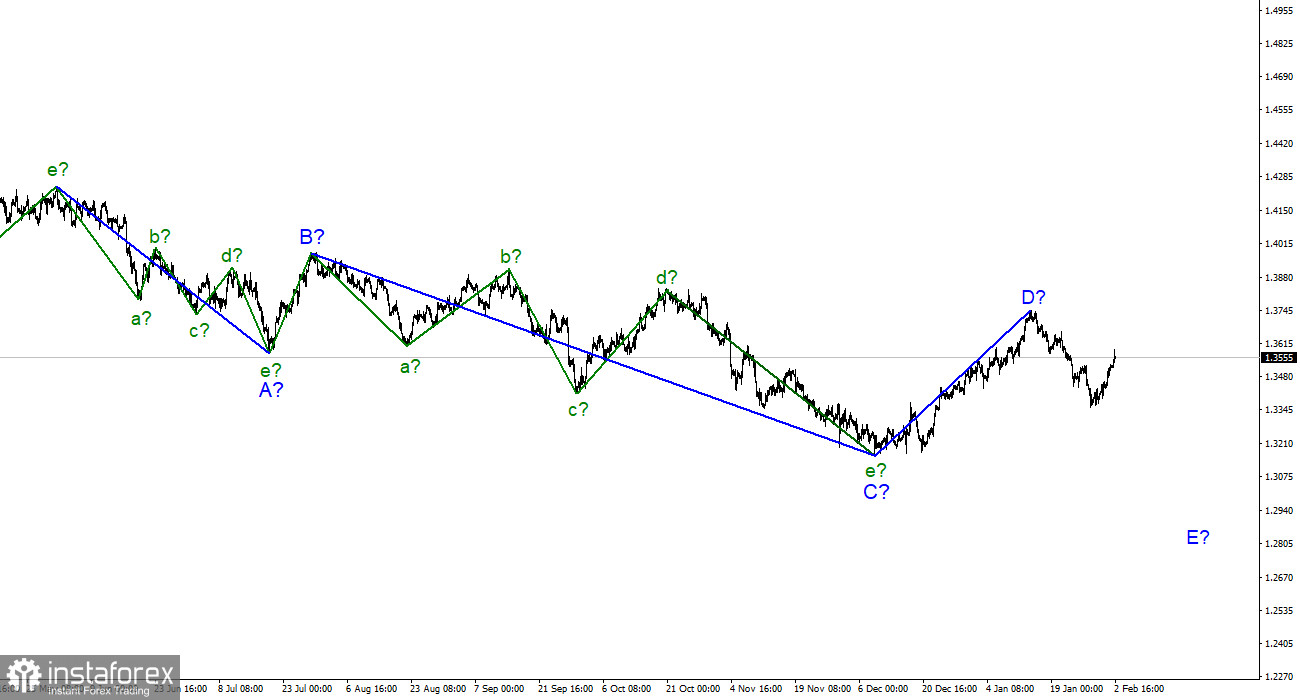

In the bigger time frame, the wave D looks completed, unlike the whole downward loop. So, in the coming weeks, I expect the pair to resume sliding towards the targets below the wave C low. The wave D consists of three waves so I don't interpret it as wave 1 of the new upward loop.