For the last few days, Bitcoin has continued to rise very weakly after rebounding from the 50.0% Fibonacci level. The activity of the crypto market has fallen noticeably after Bitcoin dropped to $34,238. Apparently, the market itself does not quite understand what to do next with cryptocurrency. In most cases, a new upward trend or its separate wave begins quite abruptly and quickly. But for nine days, Bitcoin's price has only increased by $3,000. We believe that the weak news background remains a factor. There are no good reasons for Bitcoin to strongly rise at the moment as markets are frankly worried that many of the world's central banks will tighten monetary policy in 2022. In turn, this will increase the demand for safe assets and reduce risky ones.

- Goldman Sachs believes that Bitcoin is dependent on Fed rates

Investment company giant, Goldman Sachs, regularly releases reports on various topics related to the economy. This time, the focus of the report was cryptocurrencies. According to it, Bitcoin is dependent on the Fed rates and on the value of the US dollar. Analysts from this investment bank said that the world's first cryptocurrency is not protected from the influence of macroeconomic factors. The bank also noted that the massive introduction and popularization of Bitcoin has pros and cons. Many analysts have concluded that it will grow due to this factor, but in reality, it may also decline. The report explains that the shares of many low-yield technology companies have fallen due to the upcoming Fed rate hike, which resulted in the fall of Bitcoin's value, as well as other cryptocurrencies. The bank also believes that the mass introduction of Bitcoin into the financial system will reduce its attractiveness as a tool for diversification.

- Bitcoin could collapse like a house of cards

It is widely assumed in the market that Bitcoin can collapse to $20,000. Previously, this opinion was expressed by Robert Kiyosaki, Arthur Hayes, and some well-known traders and analysts. In their opinion, Bitcoin's further decline will provoke a "domino effect", where each fall causes a new fall. No matter how paradoxical it may sound, the more Bitcoin falls, the less confidence the market will have in its growth. If so, more market participants will try to get rid of it; but, this will not mean that the main digital asset will disappear or collapse to zero. In a year or two or three, a new upward trend may begin. However, this cryptocurrency will be in a depression in the near future.

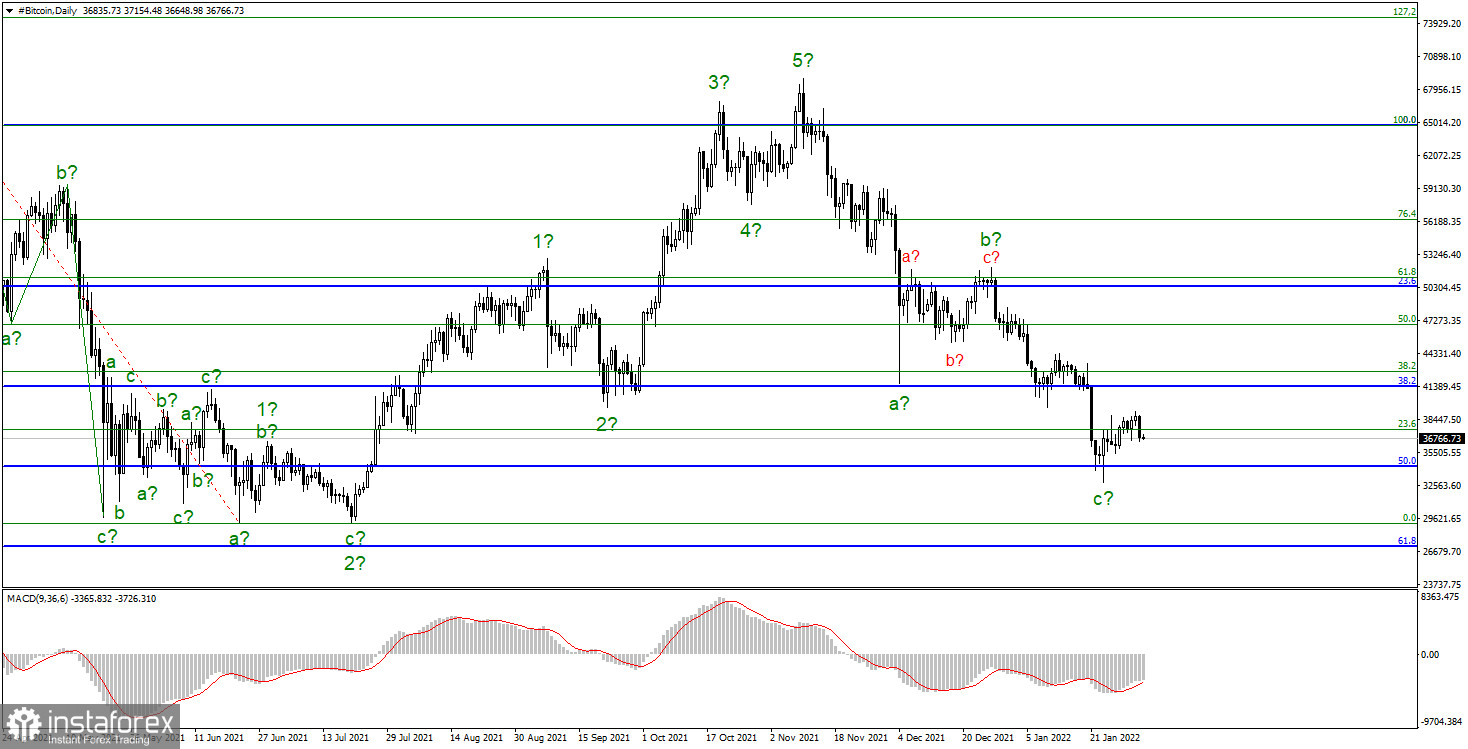

The downward trend section continues to form. An unsuccessful attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward section of the trend. This wave could continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e or waves 5 in c. So far, the internal wave counting of the expected wave c looks too holistic, the corrective waves are very small and difficult to distinguish. However, the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. To sell Bitcoin, new downward signals are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator. In general, any signs that the upward wave that is currently being built is already completed.