S&P500

COVID-19 statistics as of early February 3

On Wednesday, the US stock market closed higher, extending its February rally and booking a fourth straight day of gains.

The Dow Jones added 0.6%, the NASDAQ gained 0.5%, and the S&P 500 advanced by 0.9%.

In Japan, the Nikkei 225 lost 1.2% early on Thursday.

The price of Brent crude oil edged up to $89 per barrel, but failed to shatter the $90 milestone. OPEC+ countries agreed to raise production quotas by 400,000 barrels in February. The increase is unlikely to fully cover the deficit in the market, which could potentially push oil prices higher. In the US, oil stockpiles declined by 1 million barrels over the week. Distillate inventories dropped by 2 million barrels, while gasoline stockpiles climbed by 2.1 million barrels.

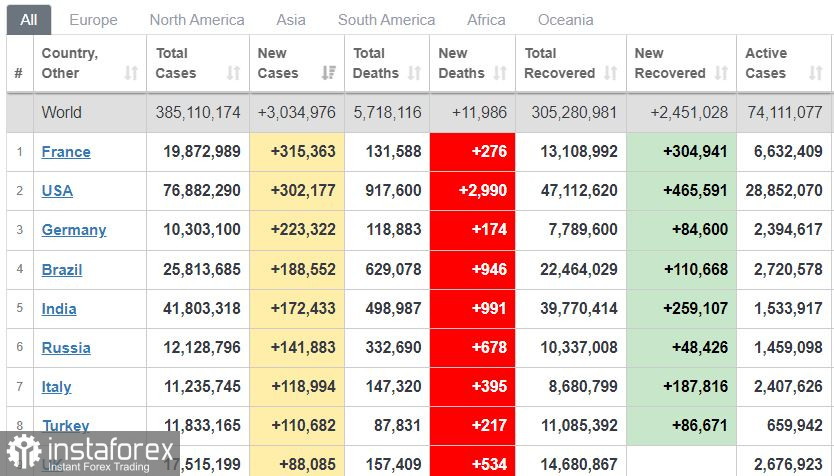

The number of Omicron infections has peaked, with 3 million cases reported worldwide on Wednesday. 300,000 infections were reported in the US and France, while 220,000 cases were registered in Germany. The current wave of the pandemic seems to be slowing down.

The S&P 500 is trading at 4,589 and is expected to be in the 4,560-4,610 range.

The US market made gains yesterday despite weak ADP payrolls data due to the spread of Omicron. The number of new jobs in the US economy fell by 300,000 in January, compared to a 776,000 increase in December. Investors remain highly bullish, despite disappointing data releases.

Shares of General Motors went up on the company's strong earnings report. GM's revenues have increased to $10 billion over the year.

Meta Platforms stock tumbled by 20% yesterday, limiting the NASDAQ's upside movement. The sell-off was triggered by a weak quarterly report indicating lower than expected revenues for Facebook's parent company.

The US national debt topped $30 trillion for the first time. An interest rate increase by the Federal Reserve would increase US interest payments. At some point, it could put pressure on the US dollar and send economic shockwaves worldwide. The US, being the world's strongest economy, could escape the full force of the resulting shock unlike other nations.

Today, US weekly employment report and the ISM services PMI are due, The index is expected to decline to 59.5% compared to 62% in December.

USDX is trading at 96.0 and is expected to be in the 95.70-96.30 range.

The US dollar has been losing ground for the past three days amid the US equities rally. EUR/USD closed in positive territory on Wednesday, boosted by EU inflation data. The eurozone's annual inflation rose by 5.1% in December. Economists expected inflation to rise by 4.4%. Germany's CPI increased by 4.9%. Today, the ECB is conducting its monetary policy meeting. The regulator is expected to address soaring inflation and comment on the potential interest rate increase, particularly taking into account the upcoming Fed rate hike. EUR could rise sharply today.

USD/CAD is trading at 1.2690 and is expected to be in the 1.2600-1.2800 range. If there are no significant changes in oil prices, the pair will likely remain within that range until March.

The US market is on the upswing. However, it is likely that the rally could be followed by a downward correction.