Review :

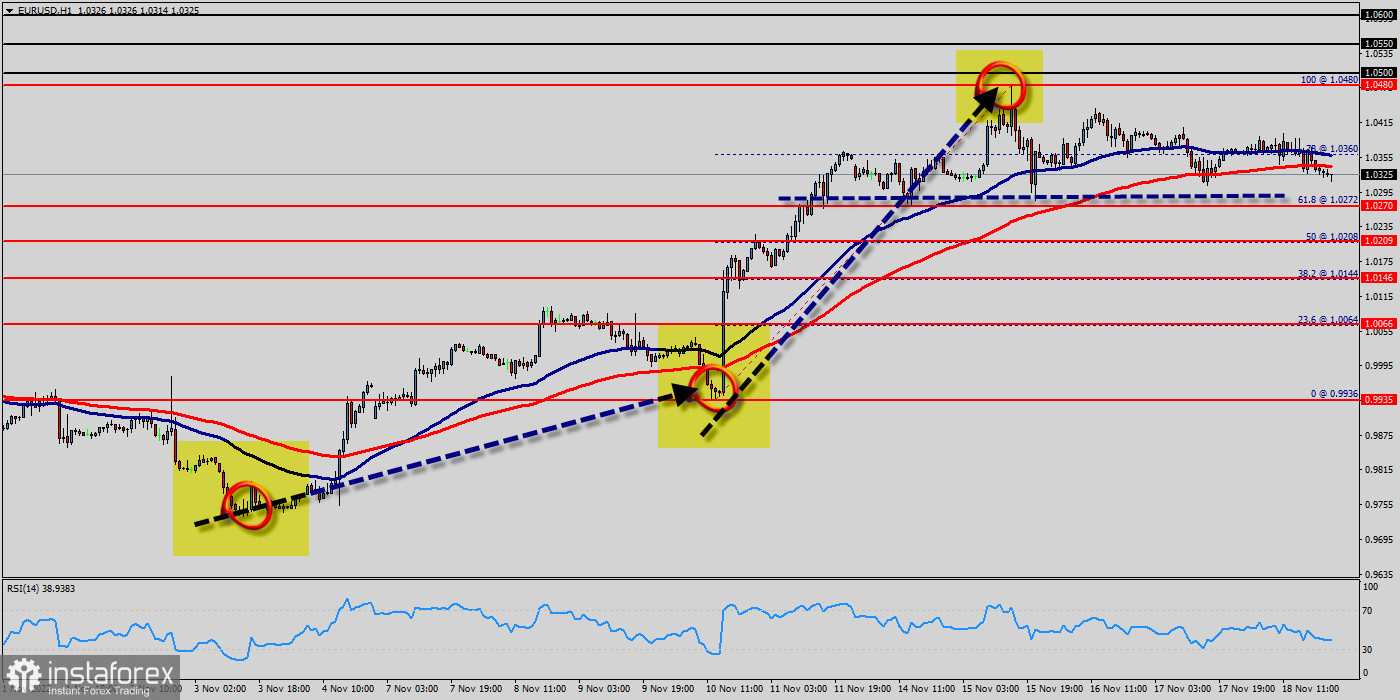

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0480 and 1.0208, so it is recommended to be careful while making deals in these levels because the prices of 1.0480 and 1.0208 are representing the resistance and support respectively. Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market. It should be noted that the volatility is very high for that the price of the EUR/USD pair is still trading between the prices of 1.0480 and 1.0208 in the coming hours. Furthermore, the price has been set below the strong resistance at the levels of 1.0480 and 1.0360 which coincide with the 100% and 78% Fibonacci retracement levels respectively. In other words, sell deals are recommended below the price of 1.0360 with the first target at the level of 1.0272. From this point, the pair is likely to begin an descending movement to the price of 1.0208 with a view to test the daily bottom at 1.0208. Additionally, currently the price is in a bearish channel. According to the previous events, the pair is still in a downtrend. From this point, the EUR/USD pair is continuing in a bearish trend from the new resistance of 1.0360. Thereupon, the price spot of 1.0360 and 1.0480 remains a significant resistance zone. Therefore, the possibility that the Pound will have a downside momentum is rather convincing and the structure of the fall does not look corrective. The market indicates a bearish opportunity below 1.0480 and 1.0360 it will be a good signal to sell below 1.0480 and/or 1.0360 with the first target of 1.0272. It is equally important that it will call for downtrend in order to continue bearish trend towards 1.0206. Besides, the weekly support 2 is seen at the level of 1.0206. However, traders should watch for any sign of a bullish rejection that occurs around 1.0206. The level of 1.0206 coincides with 50% of Fibonacci, which is expected to act as a major support today. Since the trend is above the 50% Fibonacci level, the market is still in an uptrend. Overall, we still prefer the bearish scenario.

he EUR/USD pair has faced strong resistances at the levels of 1.0480 because support had become resistance last week. So, the strong resistance has been already formed at the level of 1.0480 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 1.0480, the market will indicate a bearish opportunity below the new strong resistance level of 1.0480 (the level of 1.0075 coincides with a ratio of 100% Fibonacci - last bullish wave - double top). Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0480 and 1.0272, so it is recommended to be careful while making deals in these levels because the prices of 1.0480 and 1.0272 are representing the resistance and support respectively. Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market. It should be noted that the volatility is very high for that the price of the EUR/USD pair is still trading between the prices of 1.0480 and 1.0272 in the coming hours. Furthermore, the price has been set below the strong resistance at the levels of 1.0480 and 1.0272 which coincide with the 100% and 50% Fibonacci retracement levels respectively. Thus, the market is indicating a bearish opportunity below 1.0480 so it will be good to sell at 1.0480 with the first target of 1.0272. It will also call for a downtrend in order to continue towards 1.0208. The daily strong support is seen at 1.0208. However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.0503. Moving averages, in the meantime, maintain their bearish slope way above the current level. Furthermore, although the news is bearish for the EUR/USD pair, professional may not want to sell weakness, but rather following a rebound rally. Additionally, some aggressive counter-trend buyers may be defending parity. In case a continuousion takes place and the EUR/USD pair breaks through the support level of 1.0208, a further decline to 1.0144 can occur which would indicate a bearish market.

Coming days :

The EUR/USD pair's rise from 1.0272 is still in progress and intraday bias stays on the upside for 1.0272 resistance first on the one-hour chart. All elements being clearly bullish market, it would be possible for traders to trade only long positions on the EUR/USD pair as long as the price remains well above the price of 1.0272. The EUR/USD pair will continue rising from the level of 1.0272 in the long term. It should be noted that the support is established at the level of 1.0272 which represents the daily pivot point. The price is likely to form a double bottom in the same time frame. Accordingly, the EUR/USD pair is showing signs of strength following a breakout of the highest level of 1.0340. This suggests that the pair will probably go up in coming hours. If the trend is able to break the level of 1.0340, then the market will call for a strong bullish market towards the objectives between 1.0272 ans 1.0480 this week. Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. As the price is still above the moving average (100), immediate support is seen at 1.0272, which coincides with a key ratio (61.8% of Fibonacci). The EUR/USD pair swing around the breached resistance of the bullish channel and keeps its stability above it until now, noticing that the EMA50 continues to resistance the price from above, while RSI begins to overlap positively. Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. So, buy above the level of 1.0340 with the first target at 1.0360 in order to test the daily resistance 1. The buyers' bullish objective is set at the level of 1.0480. A bullish break in this resistance would boost the bullish momentum. The buyers could then target the resistance located at 1.0480. If there is any crossing, the next objective would be the resistance located at 1.0480. The level of 1.0550 is a good place to take profits. Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). However, beware of bullish excesses that could lead to a possible short-term correction; but this possible correction would not be tradeable. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.0272, a further decline to 1.0208 and 1.0144 can occur. It would indicate a bearish market.