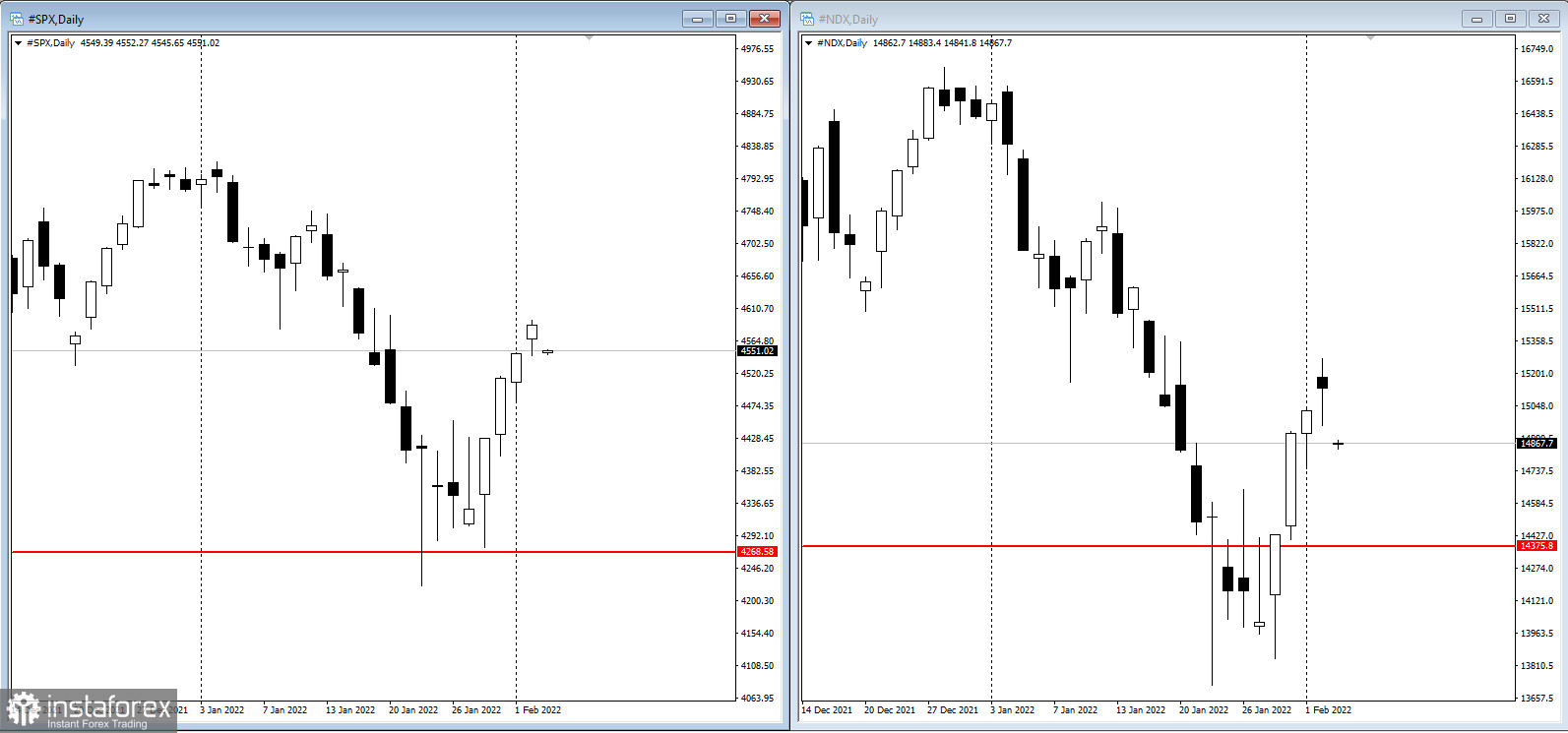

US stocks posted their largest four-day rally since 2020, thanks to investors resuming deals on tech stocks. The S&P 500 rose 0.6%, while the tech-heavy Nasdaq 100 increased by 0.3% amid gains from Alphabet and Advanced Micro Devices.

Dollar and Treasury yields, on the other hand, declined.

The market was unstable at the beginning of this year because investors were torned between potential Fed rate hikes and strong economic recovery. Fortunately, robust earnings data helped ease uncertainty, at least for now. But many of the dangers, including persistent inflation, geopolitical risks and pandemic outbreaks, are still behind.

Latest comments from the Fed hints at a measured approach to raising interest rates, assuaging some fears that the economy could suffer from a tighter monetary policy None of the six Fed officials who spoke this week supported the idea of raising rates by half a point in March, and the most aggressive one was James Bullard, who announced five rate hikes.

Dennis DeBusschere, founder of 22V Research, said: "Fed officials backing away from a 50bp hike is important because it suggests the Fed will not aggressively offset a near-term economic rebound. If true, that would favor a significant reversal in cyclicals, higher real yields, and reopening stock performance."

On a different note, a recent report from the ADP indicated that employment in US companies declined in January due to a surge in omicron cases. This figure may force the Fed to reconsider aggressive rate hikes, even though the dip was already expected.

"It was a weak number versus surveys, but not a cause for concern for the Fed in their hiking plans," said Adam Shakoor, portfolio manager at Columbia Threadneedle Investments. "The Fed has already telegraphed the labor market as tight and near maximum employment at the end of 2021, so we should expect to see some deceleration in these figures play out in 2022."

Other key events for this week are:

- earnings reports from Amazon, Ford Motor, Meta Platforms, Qualcomm, Sony and Spotify;

- policy decision of the Bank of England and the European Central Bank (Thursday);

- Fed Board of Governors confirmation hearing (Thursday);

- US factory orders, initial jobless claims and orders for durable goods (Thursday);

- US payrolls report for January (Friday);

- start of Winter Olympic Games in China (Friday).