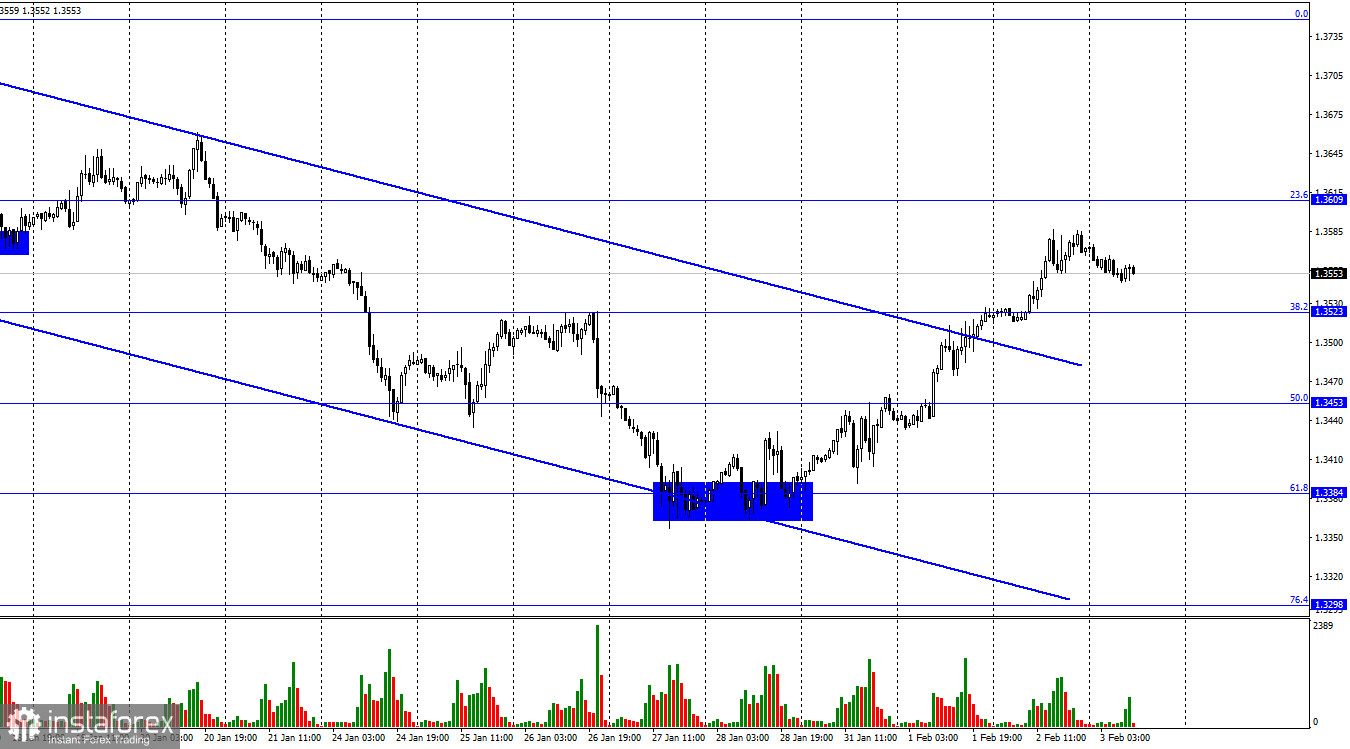

On the hourly chart, the GBP/USD pair performed a reversal in favor of the American currency and started a weak fall towards the retracement level of 38.2% (1.3523). Yesterday, the upward movement towards the Fibonacci level of 23.6%, 1.3609, lasted the whole day. However, the movements yesterday and today are irrelevant. The Bank of England will announce the results of its meeting in an hour, and most traders are waiting for the information on the interest rate hike. Thus, I believe that the Euro will fall and the Pound Sterling could continue its rally. Of course, if the Bank of England does not raise the rate, it will come as a surprise, in which case traders might start to sell the pound.

On the hourly chart, the GBP/USD pair performed a reversal in favor of the American currency and started a weak fall towards the retracement level of 38.2% (1.3523). Yesterday, the upward movement towards the Fibonacci level of 23.6%, 1.3609, lasted the whole day. However, the movements yesterday and today are irrelevant. The Bank of England will announce the results of its meeting in an hour, and most traders are waiting for the information on the interest rate hike. Thus, I believe that the Euro will fall and the Pound Sterling could continue its rally. Of course, if the Bank of England does not raise the rate, it will come as a surprise, in which case traders might start to sell the pound.

As can be seen, there are several possible scenarios. I believe it is likely to be a rate hike, hawkish rhetoric from Andrew Bailey and a rise of the pound. The UK service sector business activity index has already been published this morning. It was 54.1 points in January, slightly better than traders' expectations. However, the pound is moving very weakly today as traders are waiting for the Bank of England meeting. Thus, now we can only wait. It is important to monitor as closely as possible those decisions made by the British central bank and react to them promptly. Or you can simply wait out a potentially dangerous period of time. It's up to you!

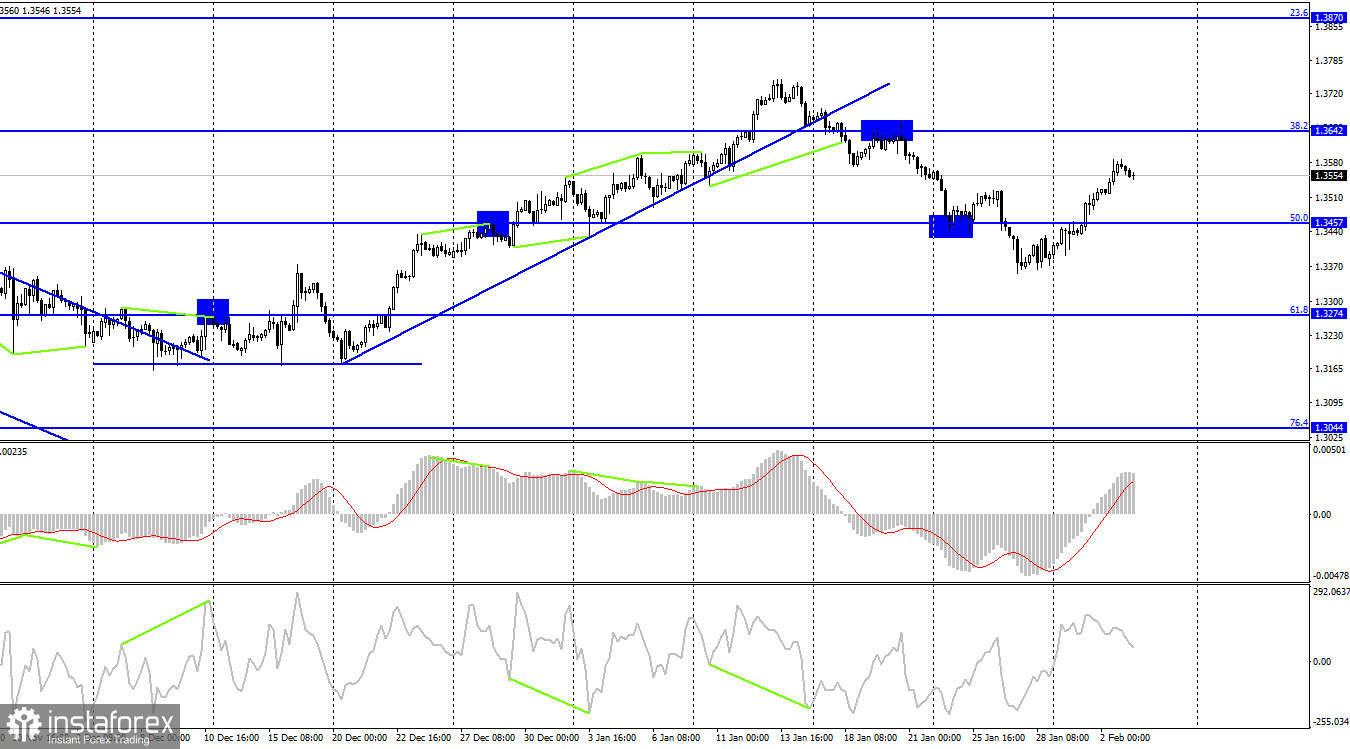

According to the H4 chart, the pair closed above the retracement level of 50.0% (1.3457). From there, GBP/USD could climb towards the next Fibonacci level of 38.2% (1.3642). If the quote closes below the retracement level of 50.0%, it could resume its fall towards the Fibonacci level of 61.8% (1.3274).

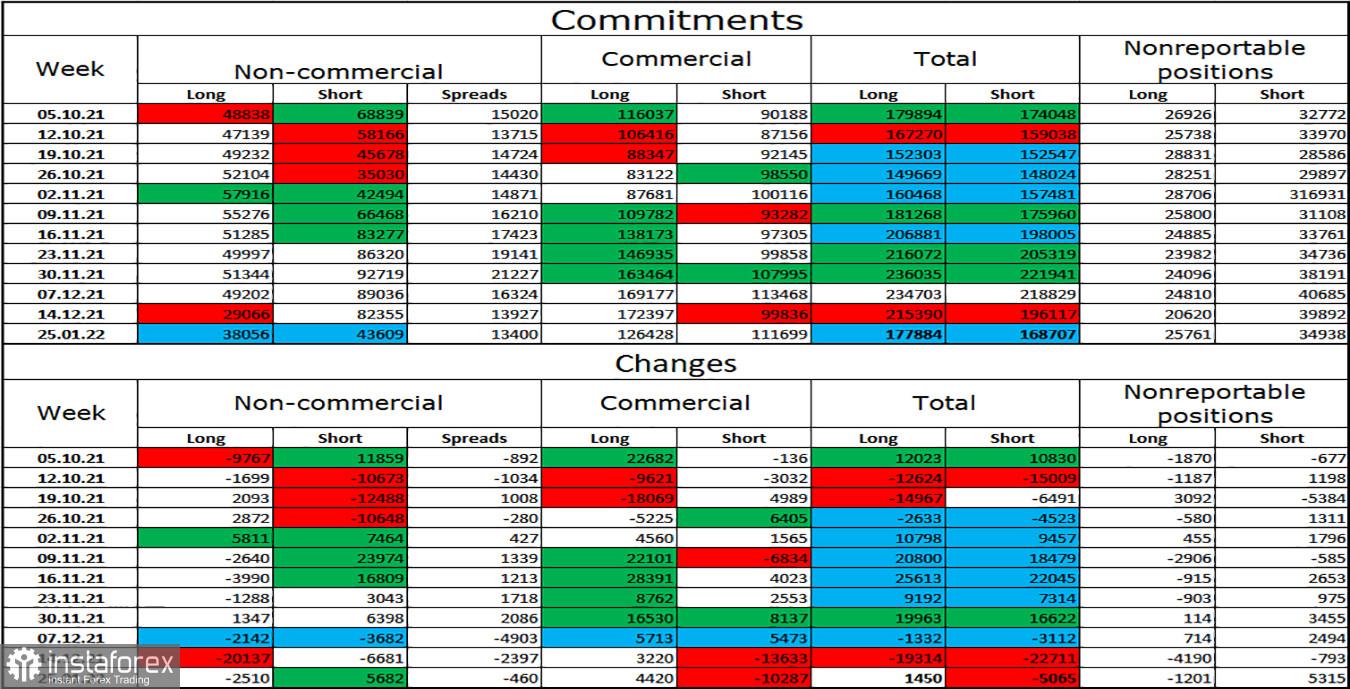

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders is largely neutral at the moment. The number of opened Short positions slightly exceeds the number of Long positions, suggesting the pound sterling could go down. However, the COT report does not include trades made after the meeting of the Federal Reserve. The Bank of England's meeting this week could also strongly affect traders.

US and UK economic calendar

UK - Services PMI (09-30 UTC).

UK - Bank of England key interest rate decision (12-00 UTC).

UK - Bank of England Monetary Policy Report (12-00 UTC).

UK - Bank of England Governor Andrew Bailey will give a speech (12-30 UTC).

US - Initial Jobless Claims (13-30 UTC).

US - ISM Services Business Activity Index (15-00 UTC).

The UK and US economic calendars are full of important events on Thursday. The most interesting will be the Bank of England governor's speech. Today, I think the information backdrop will be extremely strong.

Outlook for GBP/USD:

Short positions could be opened if the pair closes below 1.3523 on the H1 chart, with 1.3454 and 1.3384 being the targets. Previously, traders were recommended to open long positions if the pair closes above the descending channel on the H1 chart targeting 1.3609 - these positions can be kept open. It should be noted that, due to the strong information background, the sentiment of traders could change drastically in the next few hours.