Hi, dear traders!

Hi, dear traders!

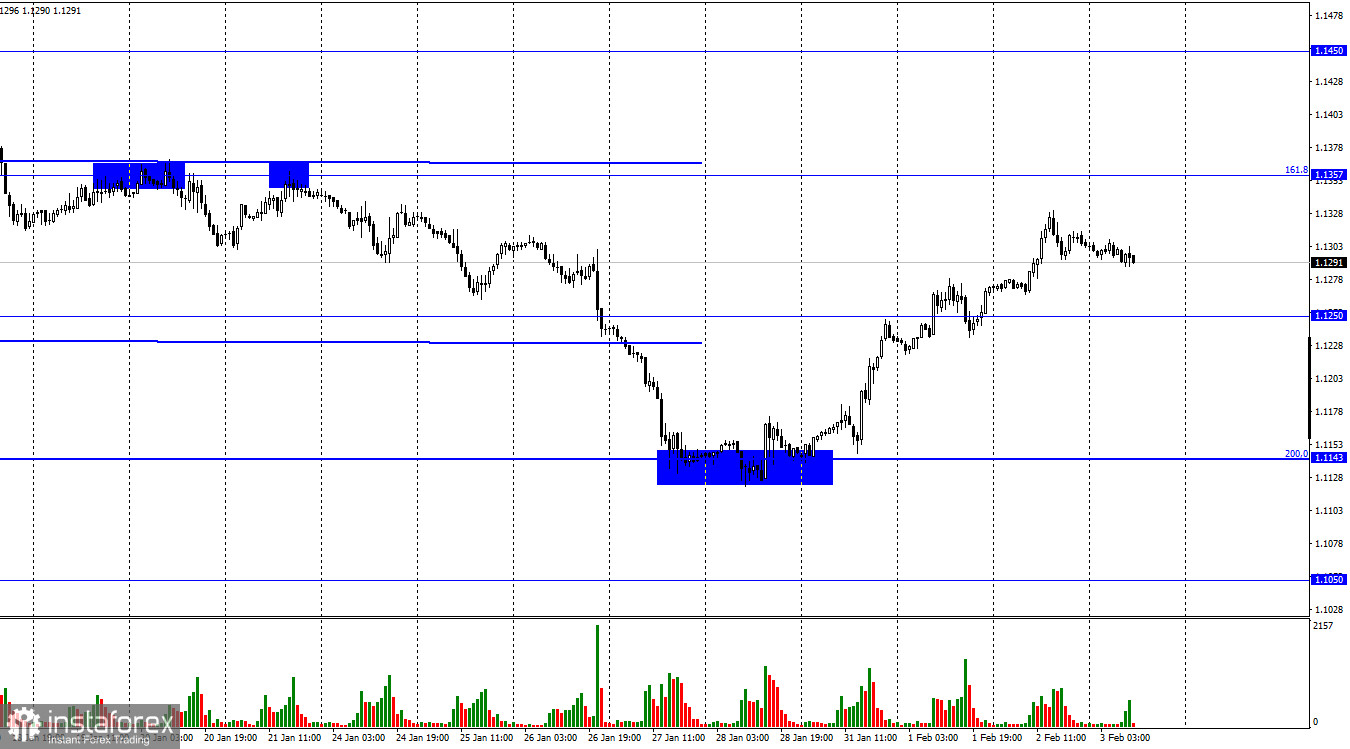

On Wednesday, EUR/USD bounced upwards from the retracement level of 200.0% (1.1143) and continued to climb towards the retracement level of 161.8% (1.1357), closing above 1.1250. Today, the European Central Bank is conducting a monetary policy meeting, followed by a press conference with Christine Lagarde. EUR could likely go down afterwards - the European currency went up without anything to boost it upwards except the bounce off the Fibo level of 200.0%, and a hawkish shift by the ECB and Lagarde is highly unlikely.

These factors should push the euro down, but the reaction of traders is often unpredictable. Today, the EU services PMI data was released - the index fell to 51.1. Traders ignored the data and focused solely on the ECB meeting. The euro's trajectory would entirely depend on Lagarde's statements, the outlook for 2022 and any information on the economic stimulus program.

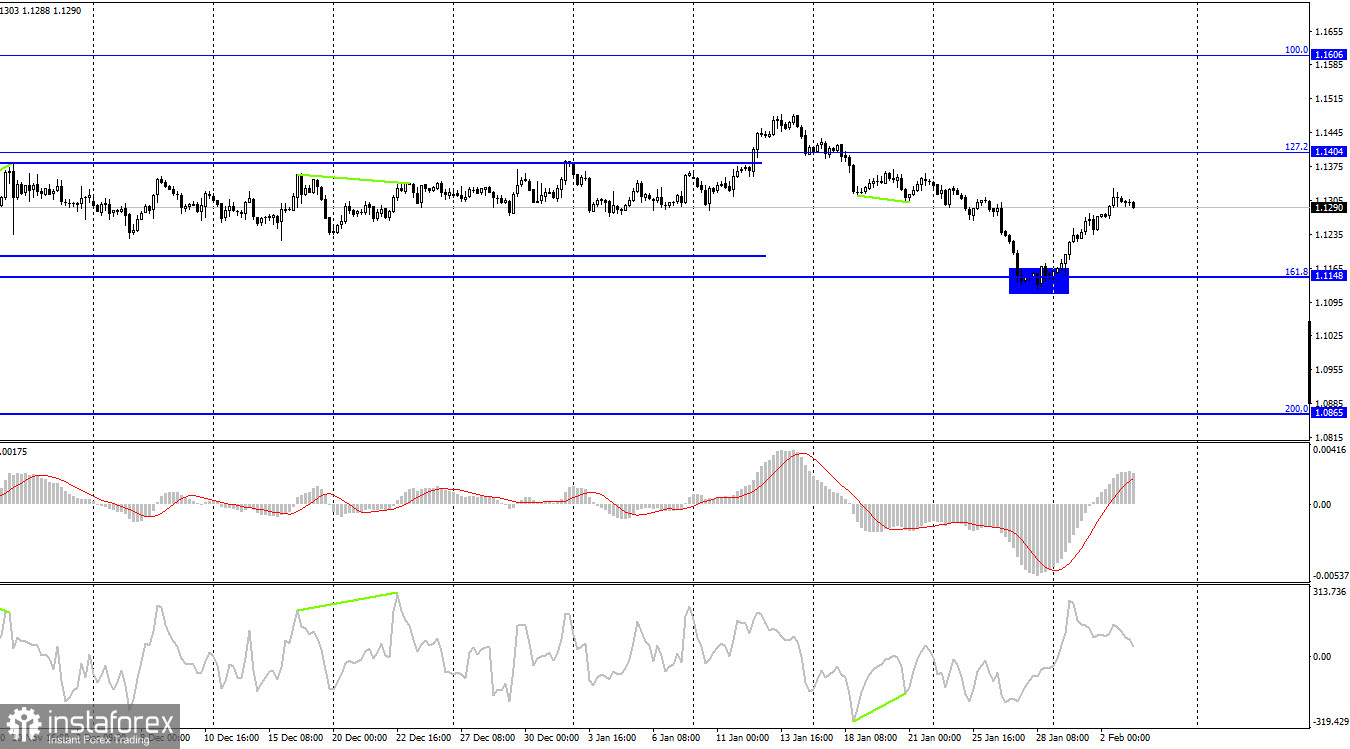

According to the H4 chart, the quote bounced off the Fibonacci level of 161.8% (1.1148). EUR/USD continues to climb towards the retracement level of 127.2% (1.1404). Technical indicators show no signs of emerging divergences today. If the pair bounces off the retracement level of 127.2% downward, it would resume its fall towards the Fibonacci level of 161.8%.

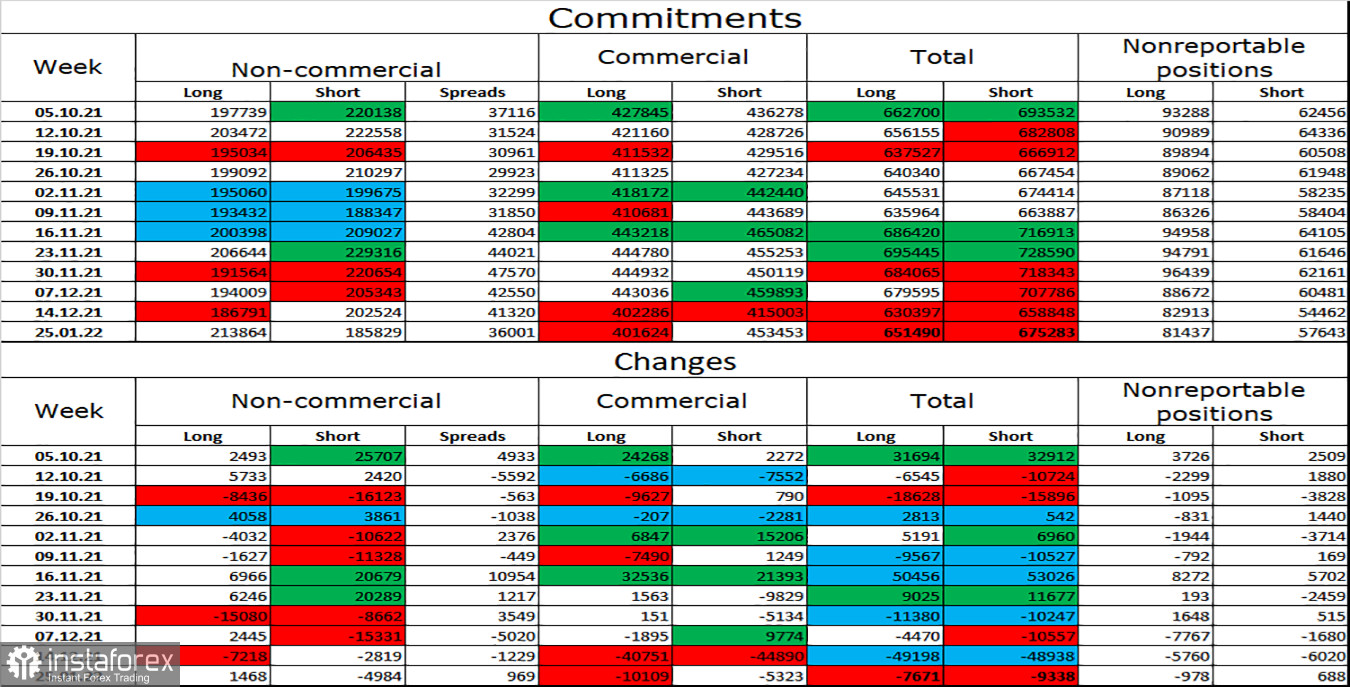

Commitments of Traders (COT) report:

Last week, traders opened 1,468 Long positions and closed 4,984 Short positions, indicating an increasingly bullish market sentiment. The total number of open Long positions is now 214,000, while the amount of open Short positions is 185,000. Non-commercial traders are now bullish on EUR/USD, and the pair could advance. However, the COT report does not include the trades made after the meetings of the Fed and the ECB. The statistics on Non-commercial traders can change substantially.

US and EU economic calendar:

EU - Services PMI (09-00 UTC)

EU - ECB interest rate decision (12-45 UTC)

EU - Monetary policy statement (12-45 UTC)

EU - ECB press conference (13-30 UTC)

US - Initial jobless claims data (13-30 UTC)

US - ISM services PMI (15-00 UTC)

The ECB meeting is the most important event today, but US data releases could also influence traders.

Outlook for EUR/USD:

New short positions could be opened if the pair closes below 1.1250 on the H1 chart or bounces off 1.1357, with 1.1143 being the target. Earlier, traders were recommended to open long positions if the pair bounced off 1.1148 on the H4 chart. The pair has reached the target of 1.1250 on the H1 chart, and long positions targeting 1.1357 could be kept open. However, the ECB meeting could change the market sentiment to bearish.