Over the past three months, the first cryptocurrency has taken a significant step towards assimilation with the traditional financial system. The cryptocurrency cemented its position on the world stage in the wake of growing institutionalization and extensive functionality amid rising inflation. JPMorgan even suggested that the coin's volatility would fall twofold by early 2022.

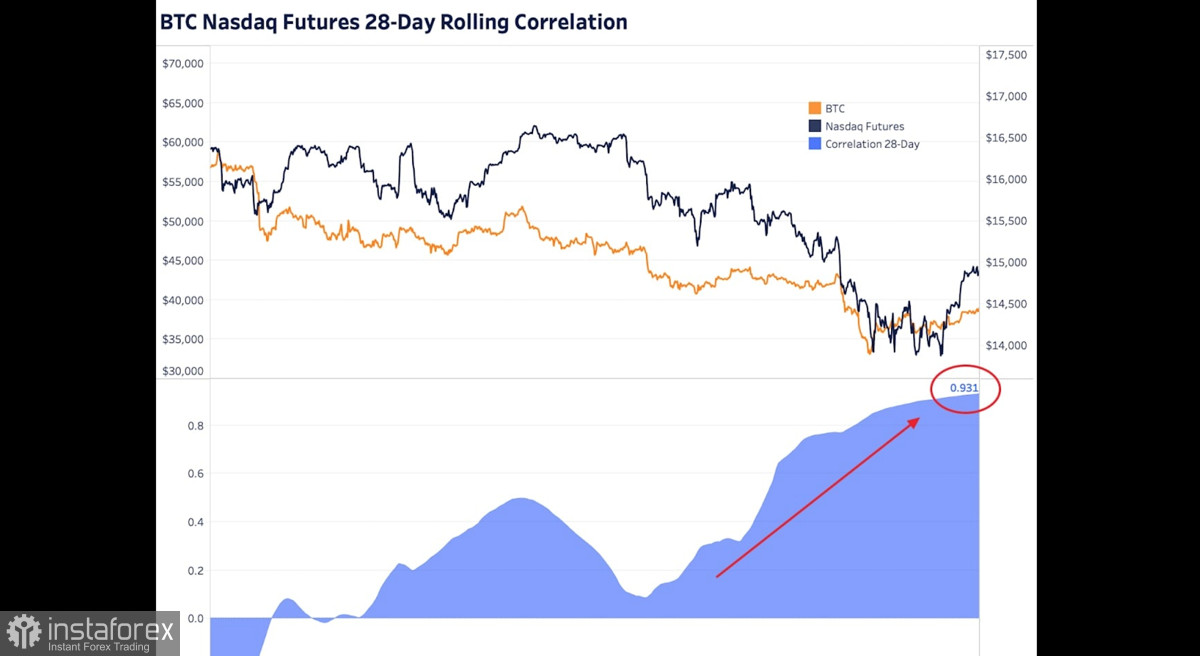

Consequently, the main cryptocurrency updated the 6-month low and recovered above $36K afterward. During the 3-month downtrend, the positive correlation of BTC with the equity indices increased. In January 2022, investors turned to the S&P 500 before putting money in bitcoin. Last month, the correlation between Bitcoin and the NASDAQ rose to 1 from 0, and correlation with the S&P 500 reached an all-time high.

So, investors monitored the stock market and accumulated BTC. The accumulation process coincided with the formation of swing support for the S&P 500 at $4.3K. The index rebounded afterward and hit the swing high of 4.6k. Following the movement of the S&P 500, bitcoin investors pushed the price to the descending trendline where they encountered bearish resisrance and were forced to retreat.

The correlation between bitcoin and equity indices has a negative effect on the cryptocurrency. Perhaps it is due to the current market cycle and the paths of financial instruments will diverge soon. The fact that the first crypto asset depends on stock indices cannot be denied.

With the S&P 500 hitting the 5-year high in percentage gains, this indicates that the instrument is about to enter a corrective stage. It usually follows the bullish cycle with the updated all-time high. Similar events unfolded in 2020 when the asset lost $35% after reaching the $3.38K mark. If the cycle repeats, bitcoin will not see a bullish rally in the coming months.

At the same time, the coin may touch the bottom after a failed retest of the $40K barrier, according to Bloomberg. Mark L. Newton, the managing director and head of technical strategy at Fundstrat Global Advisors, pinpoints that the temporary stabilization of bitcoin quotes does not indicate a recovery rally. The key target for bulls is seen at $40K. However, the asset is expected to fall in the near future. In the event of a breakout at $35.1K, BTC risks heading towards $32K.

The support zone is seen in the $36.2K-$36.5K range. If the coin leaves the range, the level of $31.5 will stand as the next target. This is the final support level on the way to the swing low.