The GBP/USD currency pair continued its upward movement on Thursday, but paradoxical movements were shown on this day by both major currency pairs. If the European currency showed the strongest growth almost out of the blue, then the pound showed restrained growth while the Bank of England raised the key rate, made this at the second consecutive meeting, and overtook the size of the Fed's key rate. Of course, we can say that the pound sterling has been getting more expensive since the beginning of the week, so to some extent, the market has already taken into account the rate increase. Moreover, they have been talking about it in the last two weeks and all forecasts gave a high probability of its increase. But why then did the euro currency show even stronger growth if the ECB had no prerequisites to tighten monetary policy, and no "hawkish" decisions were made? A paradox. Yesterday, we warned traders that the reaction could be anything. "Whatever", but not a logical reaction, we got in the end. Now the technical picture for the British currency also indicates an upward trend, but, from our point of view, this conclusion cannot be considered confident now. The pound sterling has grounds for continued growth, but now it is unclear how the market will react to reports on Nonfarm and unemployment in the United States today. If the reaction is illogical again, then where will we see the pair on Friday evening? So far, everything is going to ensure that the upward movement will continue, but at the same time, very weak growth of the pound on Thursday may indicate that traders have already won back information from the Bank of England and now it's time to go down. The same can happen for the euro/dollar pair. In general, if we omit the absolute illogicality of what is happening this week, we would say that the euro and the pound should start falling in the near future.

The bid has been raised unanimously.

As for the results of the meeting of the Bank of England, it should be said here, first of all, that the key rate was raised unanimously. All nine members of the monetary committee voted "for" its increase. However, it should also be noted that four out of nine members of the committee voted for an increase not by 0.25%, but by 0.5%. And, from our point of view, this is another "bullish" factor for the pound, which traders simply ignored yesterday. The quantitative stimulus program remained unchanged in volume and still amounts to 895 billion pounds. Forecasts for GDP have been lowered to 3.75% in 2022, and for inflation - increased. Now BA expects average inflation this year at the level of 5.75%. However, forecasts are just forecasts. They can change and the market practically does not react to them. And here are two rate increases in a row. This has not happened in the UK since 2004. It is clear that the British regulator is aware of the danger of rising inflation and is not going to wait for it to reach 7%, as it is now in the United States. But this explanation does not negate the fact that the pound sterling has grown very weakly against such a strong fundamental background.

Now we can only hope that today's American statistics will not present surprises. Although it is better to pray that the market itself does not present surprises. We believe that today the movements of both pairs may also be illogical and do not correspond to the nature of macroeconomic statistics. This whole week is pretty strange and it's better to wait until it's over than to try to win back strong Non-farm in the US while watching the dollar fall for some reason. By the way, the pictures for the euro/dollar and pound/dollar pairs on the 24-hour timeframe are very much confused due to the movements this week. The euro is again trying to start a new upward trend and will again storm the Senkou Span B line, which lies at the level of 1.1438. The pound is now not paying attention to the Senkou Span B and Kijun-sen lines at all and is riding a roller coaster.

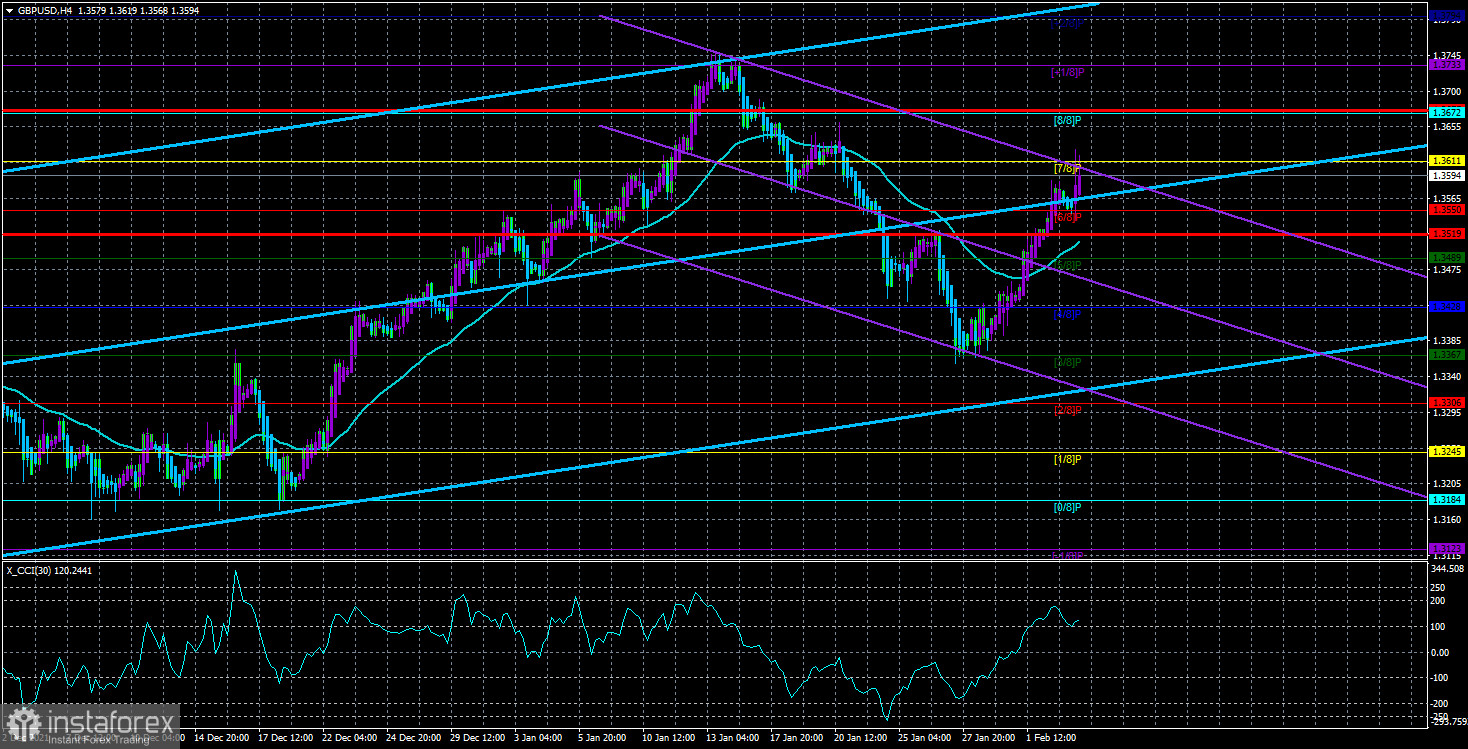

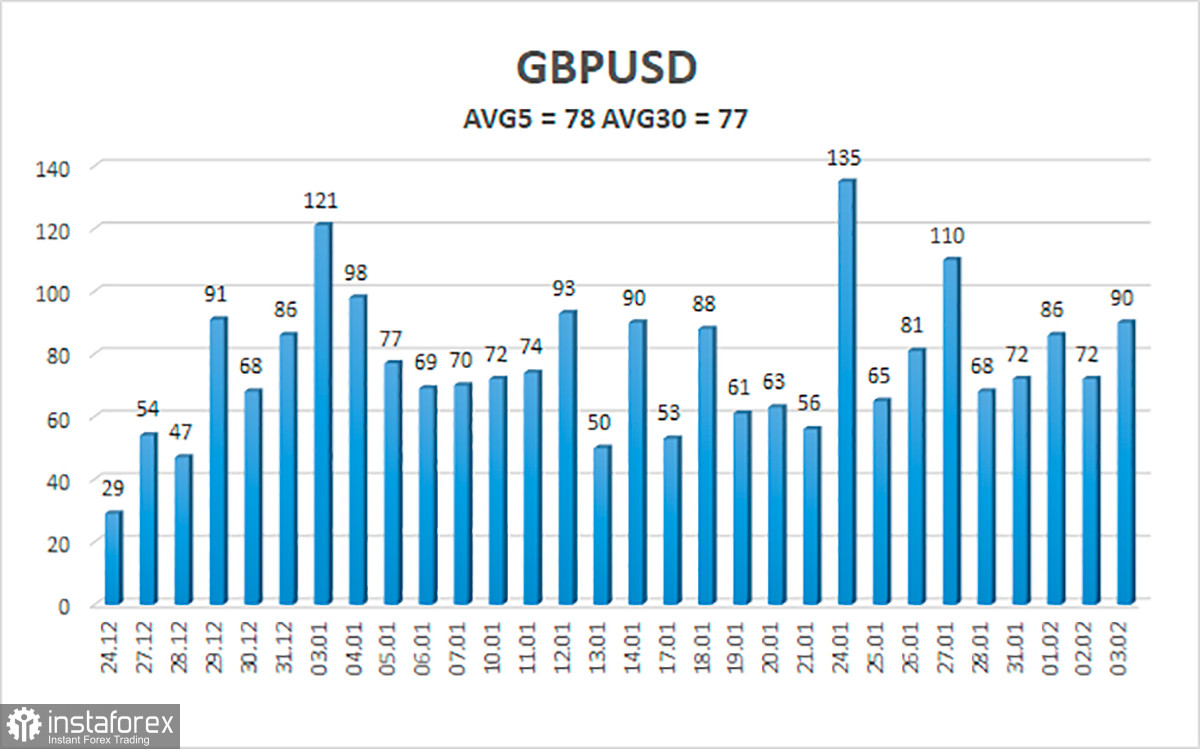

The average volatility of the GBP/USD pair is currently 78 points per day. For the pound/dollar pair, this value is "average". On Friday, February 4, thus, we expect movement inside the channel, limited by the levels of 1.3519 and 1.3675. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading recommendations:

The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, at this time it is recommended to stay in long positions with targets of 1.3611 and 1.3672 until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3428 and 1.3367, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.