The Bank of England has once again raised the refinancing rate, which now stands at 0.50%. And this is despite the fact that the previous increase took place just a month and a half ago. That is, the British central bank did not even wait for the results of the impact of the previous decision on the economy as a whole. So it is not surprising that the pound immediately began to grow. Nevertheless, the scale of growth is noticeably more modest than after the December increase. It just came as a complete surprise then, and this time the market as a whole was ready for such a development. Based on this, we can conclude that the overall growth of the pound will be much more modest. However, most likely, the pound will strengthen its position for a whole month. Judging by the previously published plans of the BoE, by the end of this year the refinancing rate was supposed to rise to just 0.50%. However, many members of the board of the British central bank spoke in favor of a larger increase in the interest rate. In other words, the BoE may raise the refinancing rate more than once before the end of the year. This prospect will contribute to the further growth of the British currency.

Moreover, the content of the report published today by the United States Department of Labor will only strengthen this trend. It's all about the number of new jobs created outside agriculture, of which there should be only 30,000. This is incredibly small, and clearly indicates a high probability of unemployment growth. In other words, the situation on the labor market in the United States is beginning to deteriorate, which of course reduces the US dollar's appeal.

Number of new jobs created outside agriculture (United States):

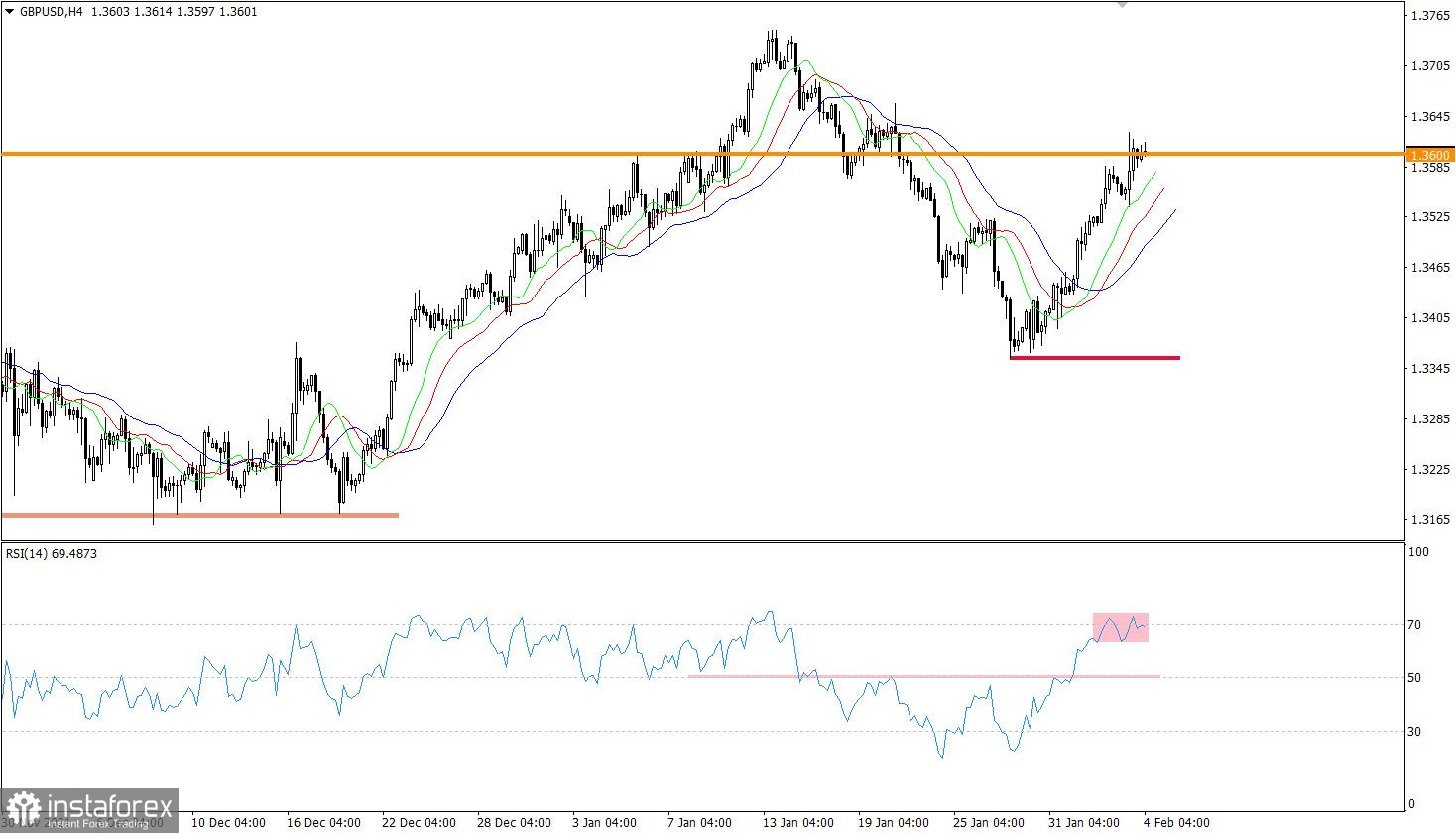

The GBPUSD currency pair during an intensive upward move reached the resistance level of 1.3600 in the short area, there was a reduction in the volume of long positions. This led to price stagnation along the reference level.

The RSI technical instrument is moving within the 70 line in the four-hour period, which indicates a signal about the overbought pound. The RSI D1 crossed the 50 line from the bottom up, this signals the superiority of long positions in the market.

The Alligator indicator in a four-hour period indicates an upward move. Alligator D1 has an intersection between the MA lines, which indicates a change of trading interests.

Expectations and prospects.

In this situation, special attention is paid to the price movement along the 1.3600 level, since a stable price hold above it in the daily period will cause a subsequent upward move. This step may well trigger the process of changing trading interests, which will lead to an initial move towards the local high of 1.3747.

At the same time, the initial stagnation along the control level leaves a chance of a reverse move, but this signal will be confirmed in the market only after the price is kept below 1.3565.

A comprehensive indicator analysis gives a signal to buy based on short-term, intraday and medium-term periods due to inertia.