To open long positions on GBP/USD, you need:

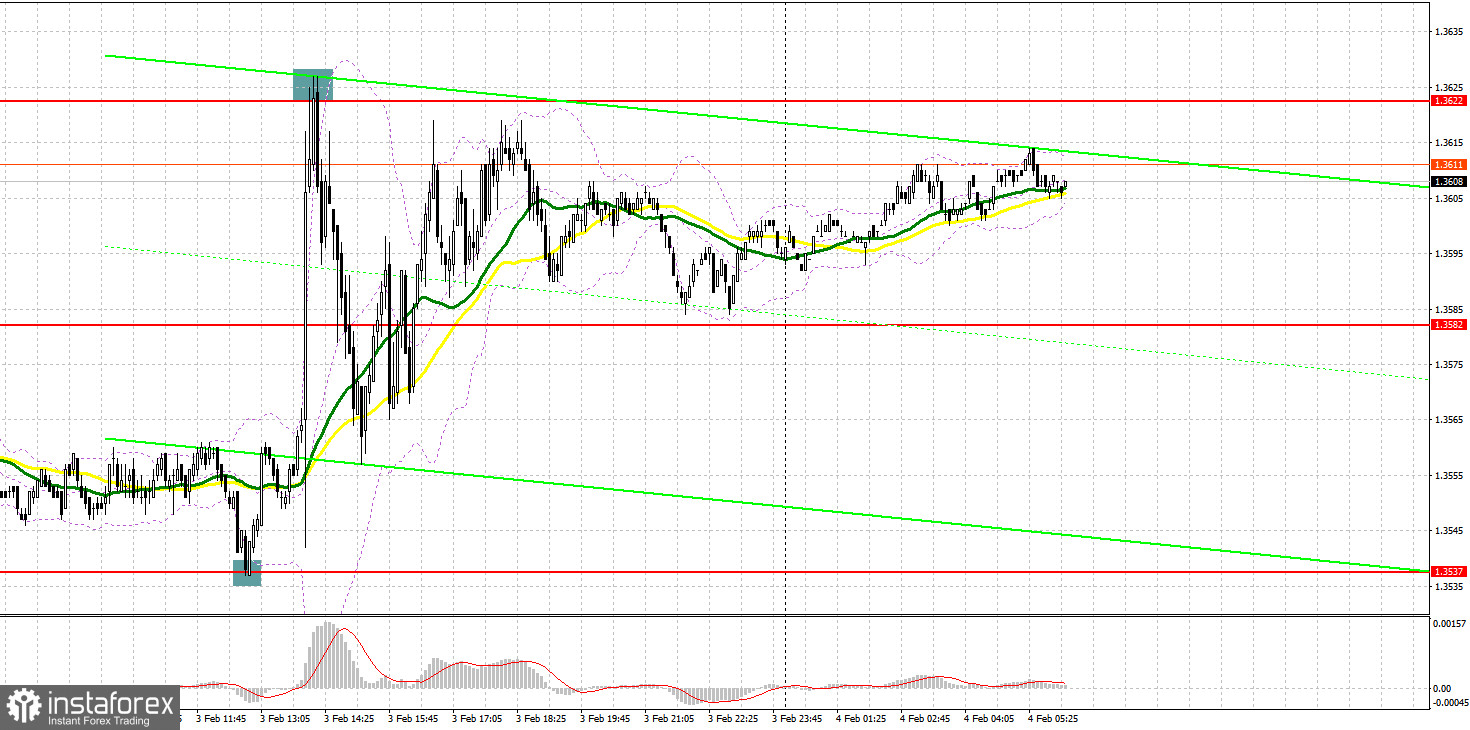

Yesterday, several excellent signals were formed to enter the market. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to several levels of support and resistance. Even despite the fact that the data on activity in the UK services sector turned out to be slightly better than economists' forecasts, traders ignored the report - preferring to take a wait-and-see position before the release of the results of the Bank of England meeting. As a result, intraday volatility in the first half of the day was about 15 points. Everything changed during the US session: the decline of the pound and the formation of a false breakout at 1.3357 resulted in creating the first entry point into long positions in continuation of the bull market. After the BoE meeting, the pair flew up by almost 90 points. A false breakout at 1.3622 resulted in creating a signal for short positions on GBP/USD, after which a downward correction of the pound by 70 points occurred.

The BoE has raised its key interest rate in an attempt to contain the fastest inflation in three decades. At the same time, some politicians have stated the need for a more aggressive reaction to rising prices. The Monetary Policy Committee voted to raise the key interest rate by 25 basis points to 0.5%. Four of the nine members of the committee insisted on a 50 basis point increase. This led to the pound's growth and to the preservation of the upward trend for the pair.

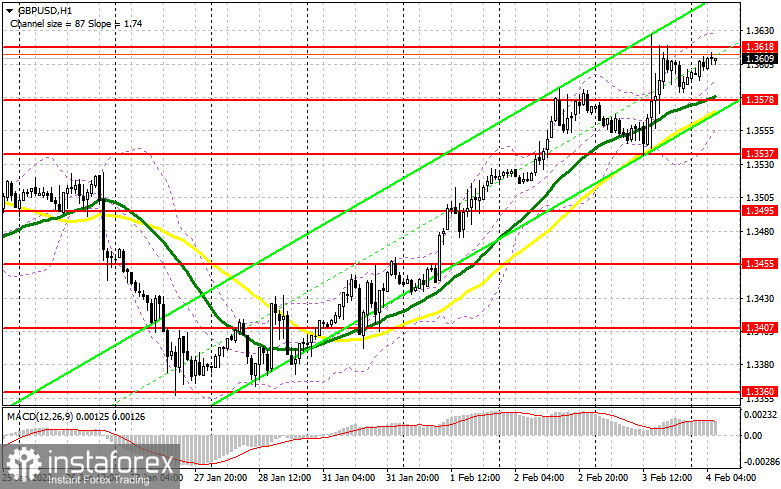

An important task for the bulls is to protect the support of 1.3578, where the moving averages are playing on their side. From this range, you can count on the continuation of the bull market, but it is very important to form a false breakout at this level, which will give the first entry point into long positions. Given that only the PMI index for the construction sector is published in the UK today, and the deputy governor of the Bank of England for monetary Policy Ben Broadbent and a member of the CMP of the Bank of England Hugh Pill are also speaking, most likely the focus will shift to the afternoon and to data on the US economy. An equally important task is a breakthrough and a top-down test of the 1.3618 level, which could not be broken above yesterday. This will give another buy signal with the goal of returning to 1.3656. A more difficult task is to update the 1.3697 area, but this will clearly happen only in case of very weak data on the US labor market and the unemployment rate in the US. I recommend taking profits there. In case GBP/USD falls during the European session and a lack of activity at 1.3578, it is better not to rush into buying risky assets. I advise you to wait for the test of the next major level 1.3537. Only the formation of a false breakout will provide an entry point into long positions. You can buy the pound immediately for a rebound from 1.3495, or even lower - from this month's low of 1.3455, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears are trying to offer something, but the fundamental background this week is clearly on the side of the bulls. The primary task is to protect the 1.3618 level, which has already been tested by bulls for strength several times, but the breakthrough has not taken place. Another unsuccessful consolidation above this range forms the first entry point into short positions in hopes of a downward correction of the pair after a weekly bull market to the intermediate support area of 1.3578, where the moving averages are playing on the bulls' side. A breakthrough and a test of 1.3578 from the bottom up will provide another entry point for short positions on the pound with the aim of falling to 1.3537 and 1.3495, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3618, and weak data on changes in the number of people employed in the US non-agricultural sector may lead to growth above this level, it is best to postpone short positions until the next major resistance at 1.3656. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3697, or even higher - from a high in the area of 1.3739, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for January 25 showed that short positions increased and a sharp reduction in long ones. All this has led to a return of the market to the bears' side, but this week the situation may change dramatically. As the bears did not try to continue the downward trend, it turned out quite badly. The bears were not helped by the Federal Reserve's statements after the monetary policy meeting that the central bank would start raising interest rates in the United States in March. Most likely, the demand for the pound will gradually recover, as a meeting of the Bank of England committee will be held this Thursday, at which it will be decided to raise interest rates. However, the pressure on the pound will remain due to the observed fundamental picture, which creates a number of more serious moments limiting the upward potential. However, if you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. In any case, the BoE's decision to raise interest rates further this year will push the pound to new highs. The COT report for January 25 indicated that long non-commercial positions decreased from the level of 39,760 to the level of 36,666, while short non-commercial positions increased from the level of 40,007 to the level of 44,429. This led to a drop in the negative non-commercial net position from -247 to -7,763. The weekly closing price dropped from the level of 1.3647 to the level of 1.3488.

Indicator signals:

Trading is above 30 and 50 moving averages, which indicates a continuation of the growth of the pound in the short term.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3618 will lead to the growth of the pound. Crossing the lower boundary in the area of 1.3578 will increase pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.