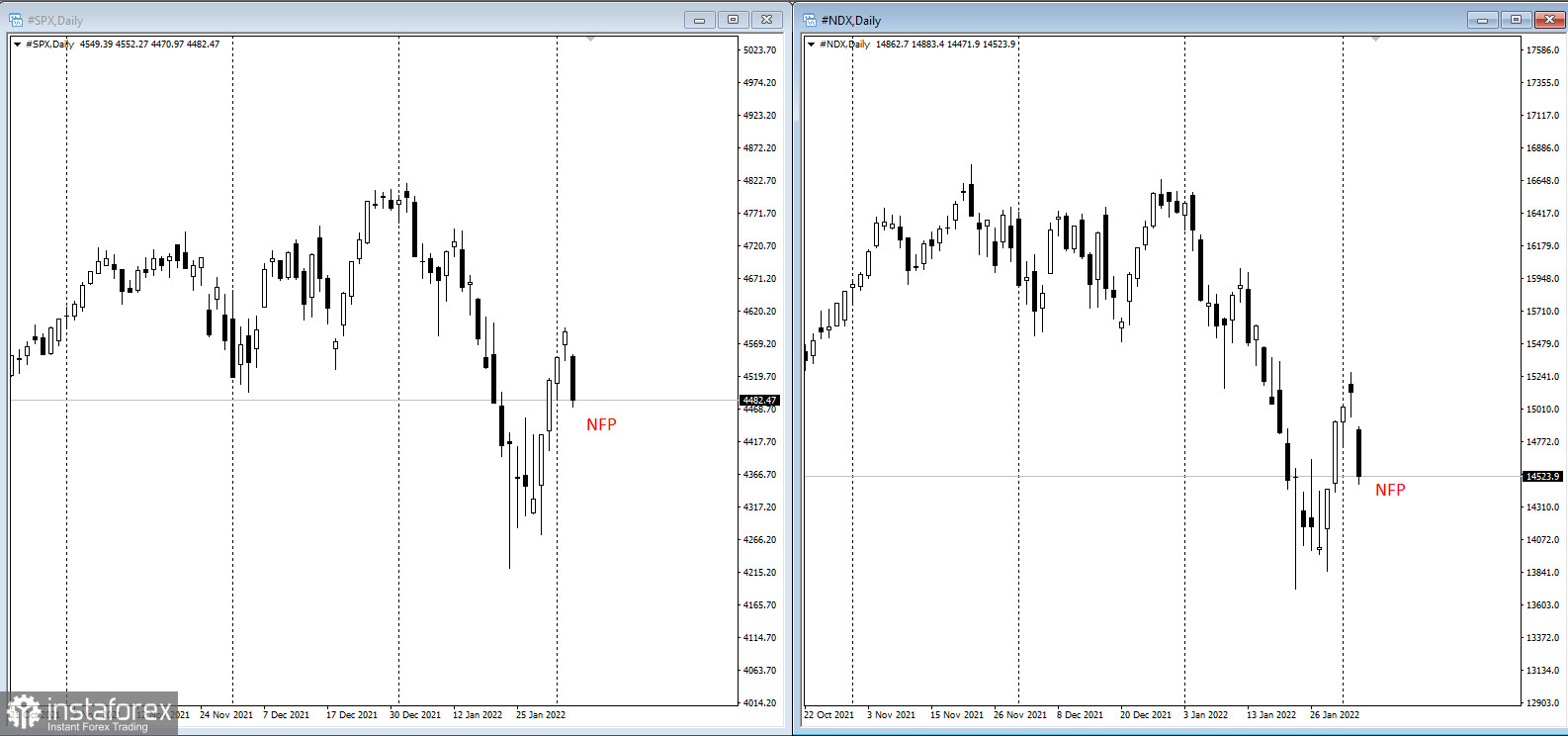

US stocks edged lower on Thursday because of disappointing results from Meta Platforms. ECB concerns on the persistently high inflation halted stock rally as well.

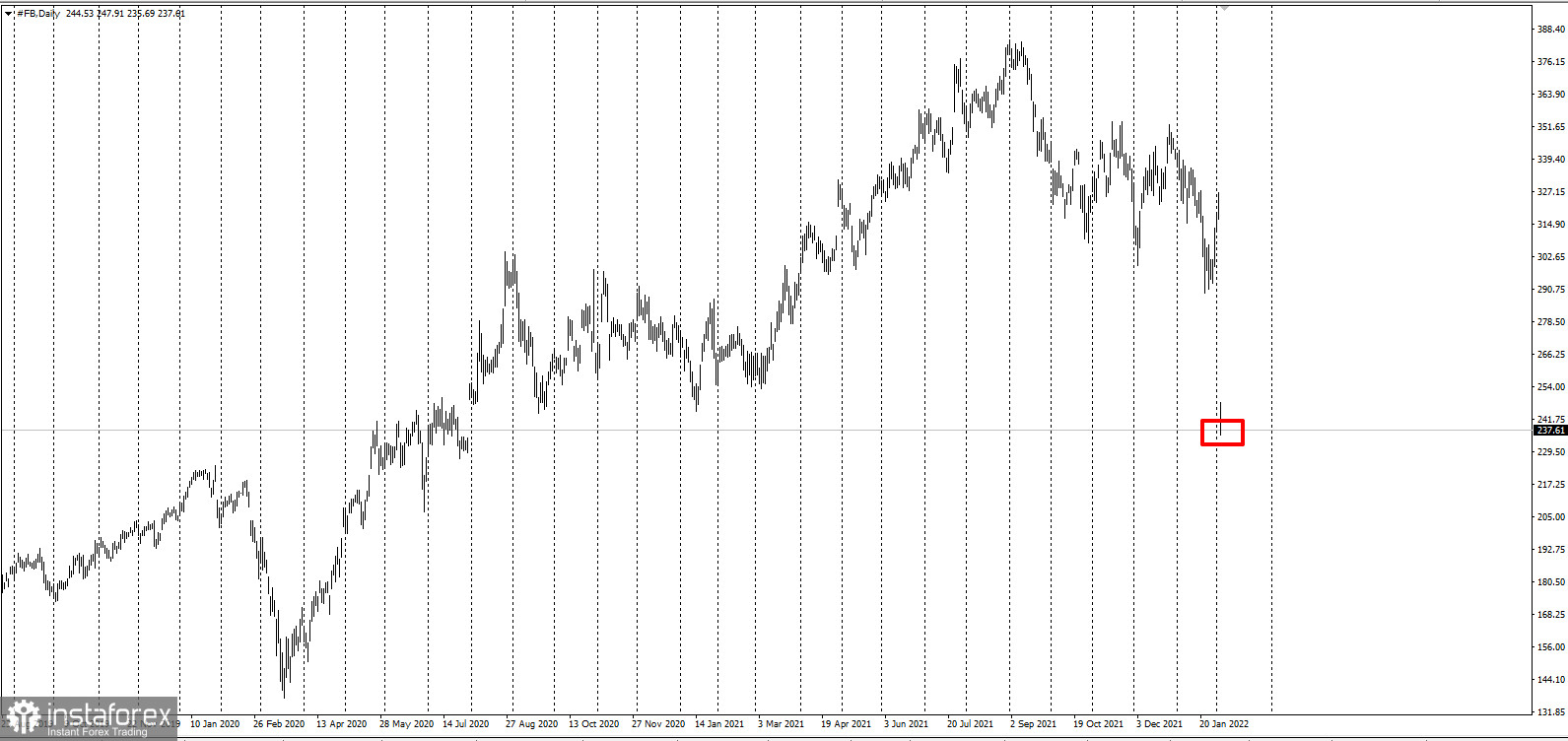

Both the S&P 500 and Nasdaq 100 posted declines after Meta reported more than $200 billion loss in its market value.

The weak performance from US tech giants surprised investors because most hoped for a strong reporting season that would keep stocks attractive. Supposedly, growth in earnings will allay some of their fears, especially in monetary tightening. After all, have swung sharply after markets officials cut stimulus to curb inflation.

"As focus on large-scale advanced-country monetary policy and investor sentiment around the world shifts, economic activity data releases will be the key," said Marilyn Watson, head of global fixed income fundamental strategy at BlackRock.

On a different note, growth in the US services sector slowed in January, while initial jobless claims fell more-than-expected last week to 238,000. Tom Essaye, a former Merrill Lynch trader who founded "The Sevens Report" newsletter, said the upcoming report on US payrolls will remind everyone that Fed policy expectations are a key influence on the markets because if data, especially inflation, exceed expectations, the Fed will be forced to tighten policy, which would return market volatility. "The bottom line is that Fed policy is still very important to this market," Essaye said.

Other key events for today are:

- earnings reports from Amazon and Ford Motor;

- US payrolls report for January (Friday);

- start of Winter Olympic Games in China (Friday)