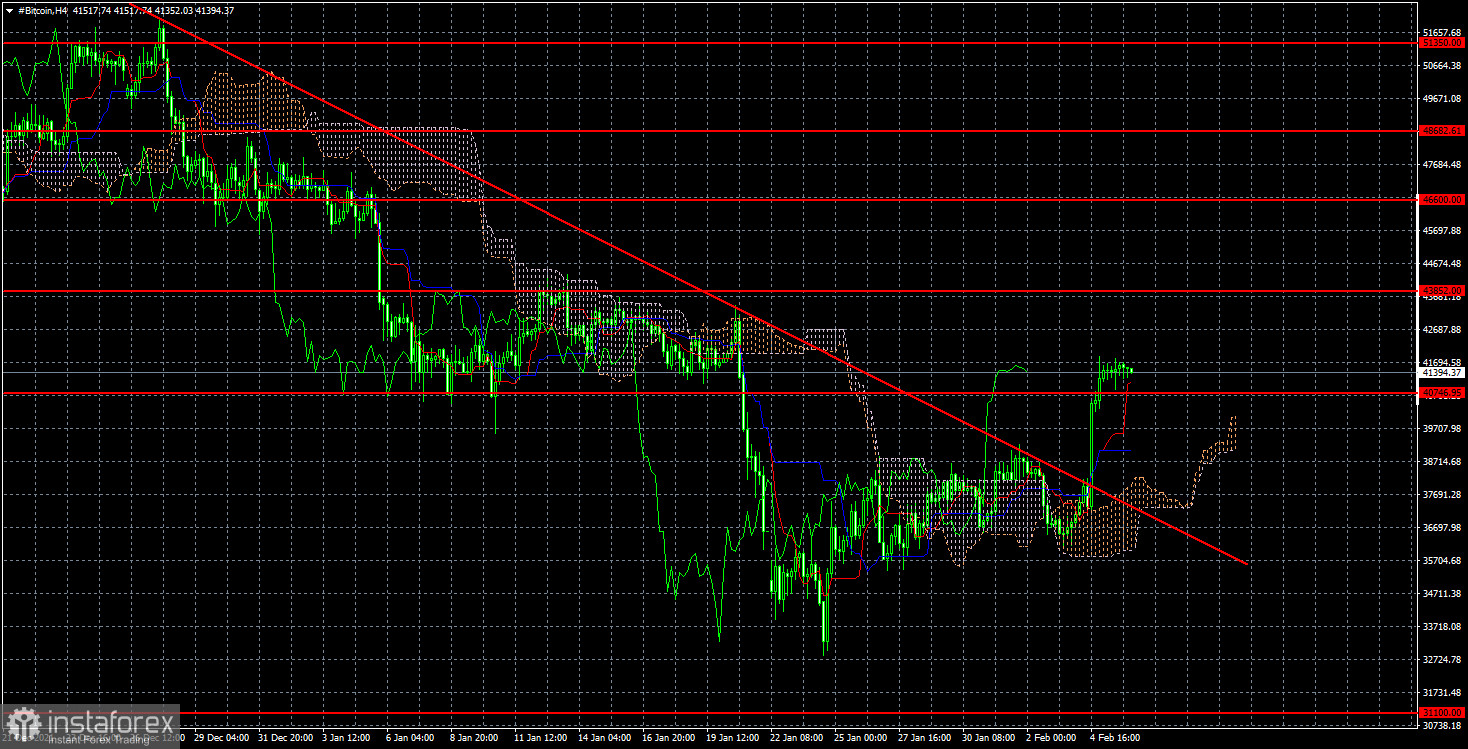

An important technical event happened last week. The 3-month trend line has been overcome, so at this time the trend for bitcoin has changed to an upward one. The price also consolidated above the level of $ 40,746, which opens up certain prospects for it. However, the $ 8,000 increase in recent weeks has not been associated with an improvement in the fundamental background. That is, roughly speaking, we have seen technical growth, which may be a banal correction. Just a deeper correction than the trend line on the 4-hour TF allowed. Therefore, from our point of view, the decline of bitcoin may resume in the coming weeks. The following factors speak in favor of this. First, the cryptocurrency did not reach the level of $ 31,100, which was the target for the entire "bearish" trend of recent months. Second, the fundamental background has not improved in any way in recent weeks. Many crypto experts and crypto enthusiasts continue to insist that bitcoin is the currency of the future and in a few years, it will become the main financial instrument in the world. In favor of this, many argue that cryptocurrencies are not subject to central banks, and also have a limited issue, so inflation will not affect them. However, at this time, bitcoin remains only an investment tool, but not a currency for conducting trading or exchange operations.

Tightening monetary policy does not contribute to the growth of bitcoin.

And, of course, now a lot depends on the central banks of the world. Everyone knows that in 2022 many central banks will raise rates. Of course, bitcoin is hardly interested in whether the central bank of Malaysia will raise rates, but at the same time, it cannot ignore the actions of the Fed. Also, the Bank of England has already started raising rates, and I want to believe that sooner or later the ECB will also start. Thus, the attractiveness of risky investment instruments and assets will decrease. The profitability of bank deposits and bonds will grow, so a certain flow of capital from risky to safe assets will occur. Moreover, it should be remembered that actions to tighten monetary policy will be carried out to curb inflation. And bitcoin has been actively used by investors in the last year to diversify inflation. Consequently, the demand for it will fall for this reason. In addition, do not forget that in 2022 the ECB, the Fed, and the Bank of England will complete their monetary stimulus programs. Consequently, the flow of money into the economy from nowhere will stop. Consequently, investments will cease to increase in volume. All this should, at a minimum, lead to a global correction and long-term consolidation. Bitcoin may not fall to $ 10,000, but it will also be very difficult for it to return to its absolute highs. We also remind you that quite a large number of regulators have already imposed restrictions on the turnover of digital assets, introduced taxation of cryptocurrency transactions, or completely banned mining and any operations with cryptocurrencies. Naturally, this will also not contribute to the growth of the main cryptocurrency.

The trend on the 4-hour timeframe has changed to an upward one. Since the price has been fixed above the level of $ 40,746, in the coming days, you can buy bitcoin with the goals of $ 43,852 and $ 46,600. At least until the moment when the price drops below $ 40,746 or bounces off any resistance level. So far, there is neither a trend line nor a channel that would support the further growth of the "bitcoin".