Treasury bonds tumbled on Friday after the strong US employment report upped the ante on monetary tightening. US stocks, on the other hand, edged higher on bullish sentiment from Amazon's earnings.

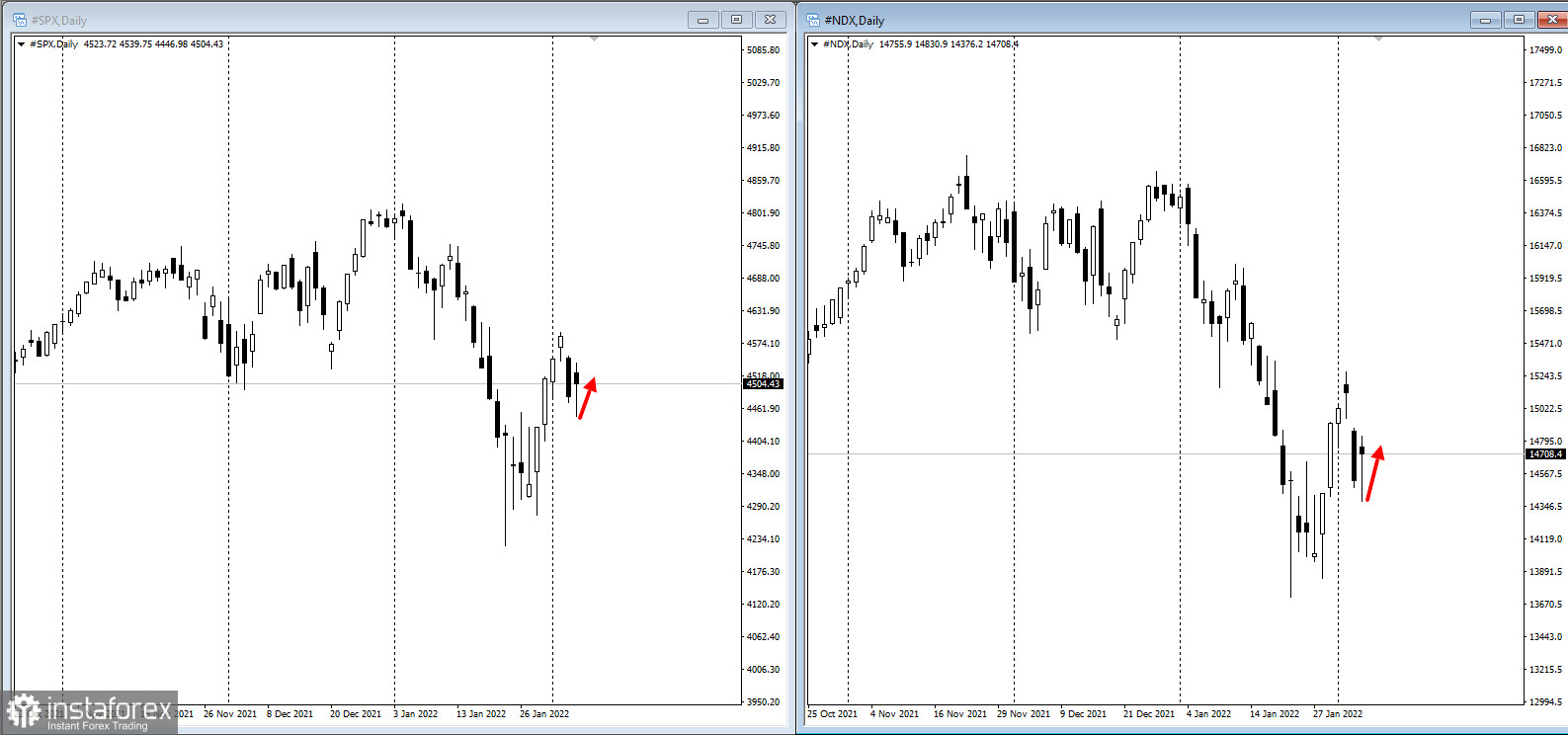

Reportedly, the yield on 10-year US bonds rose to 1.92% because investors deem that the Fed may start raising interest rates by 50 basis points in March instead of the typical quarter-point hike. As for the S&P 500, it rallied and offset previous losses. The Nasdaq 100 also gained 1.6%, while the dollar climbed slightly, but failed to overcome its worst weekly drop since 2020.

Latest data showed that jobs in the US rose more than expected in January despite a surge in Covid-19 cases and related business closures. It was up 0.7% than the previous month, amounting to 467,000. Average hourly wages also increased by 0.7%.

"The jobs report blew away expectations across the board," said Cliff Hodge, CIO of Cornerstone Wealth. "The report is unequivocally good for the economy, but not for markets as the strength in the numbers presents another data point which supports more aggressively hawkish Fed action," he added.

The market has been volatile in the past week, primarily due to investors being shaken by the weak performance of US tech giants. Meta Platforms reported a loss of more than $250 billion, but thanks to the positive earnings of Amazon, indices stayed afloat.

"It seems like each day we wake up to, 'Thank you sir, may I have another?' as a few tech blowups drag down the overall market," said Mike Bailey, director of research at FBB Capital Partners. "There is an interesting behavioral metric where one bad thing requires four to five good things to make up for it," he added.

Mike Lowengart of E*Trade also commented that the recent US employment report fuels "the Fed's fire to raise rates and act quickly". "While they've already signaled that the labor market is in a good place, there was potential for omicron to derail that progress -- and that just doesn't seem to be the case. So with the market typically unwelcoming of news that could accelerate the pace of action from the Fed, we could see some volatility," he said.

Most buyers are hoping that a stronger reporting season would keep stocks attractive and counter fears over rate hikes in the face of higher inflation. Of the 272 companies in the S&P 500 that reported results, 82% met or beat estimates, with earnings 8.8% above forecast.

Even so, signs of persistent price pressure remain as the latest data showed US gasoline prices at their highest in more than seven years. Crude oil hit a new seven-year high and banks, including Goldman Sachs, are forecasting Brent to hit $100 a barrel.

Hawkish comments from ECB President Christine Lagarde and an interest rate hike by the Bank of England highlighted the risks associated with inflation. While the regional bond sell-off eased on Friday, stock market sentiment was unfavorable, with Europe's Stoxx 600 falling 1.4%.