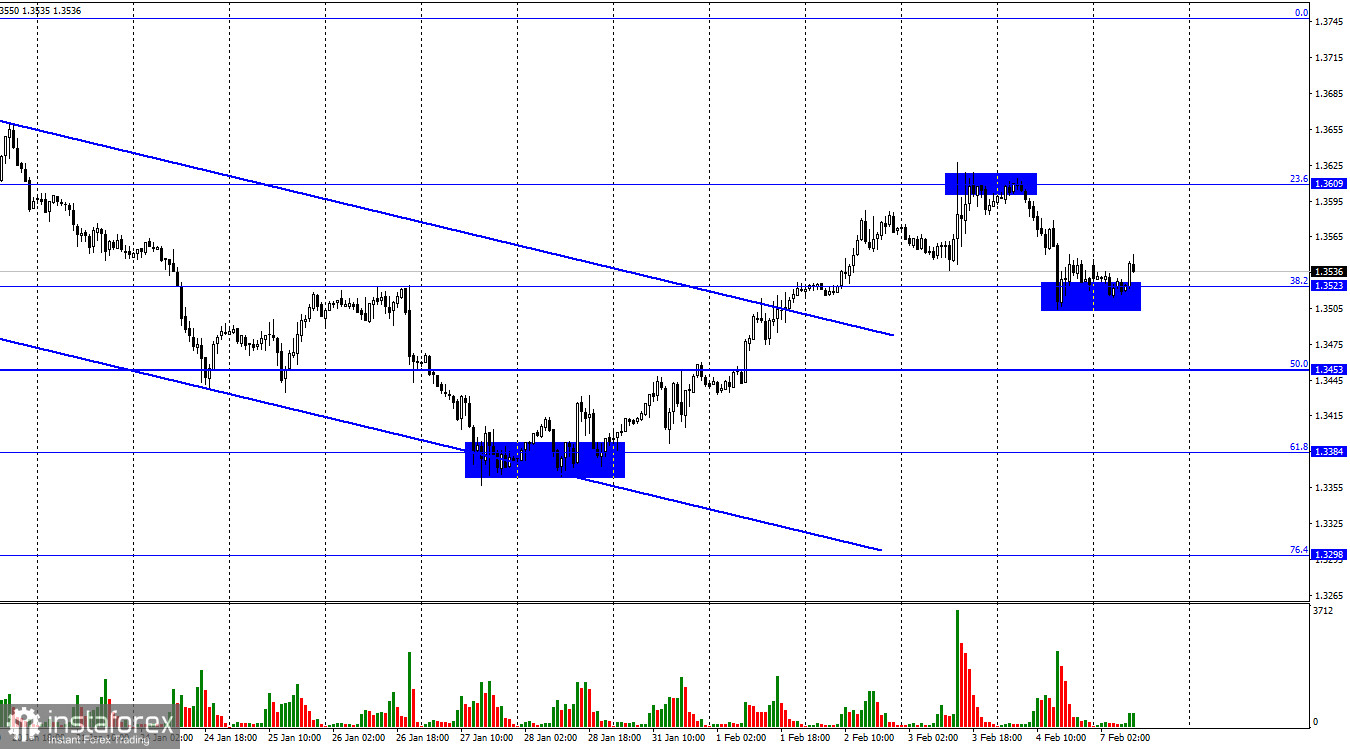

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US currency on Friday and fell to the corrective level of 38.2% (1.3523). The rebound of the pair's exchange rate from this level will work in favor of the UK currency and the resumption of growth in the direction of the Fibo level of 23.6% (1.3609). Closing quotes below the level of 38.2% will increase the chances of a further fall in the direction of the corrective level of 50.0% (1.3453). Last week, the pound received serious support from both traders and the Bank of England. Let me remind you that the British central bank decided to raise the interest rate to 0.5%, but bull traders reacted very modestly to this. The entire growth ended around the level of 1.3609. And on Friday, when the information background in the UK was already absent, American reports came out on top, among them Nonfarm Payrolls, which allowed the pair to perform a fall to 1.3523.

Thus, now it is the level of 1.3523 that acts as the most important benchmark for traders. There is no corridor or trend line now. An ascending trend line can be built only when two reference points are formed. Now there is no second point. Therefore, it is possible to focus only on the level of 1.3523. The information background is unlikely to help traders make decisions this week. Neither Monday, Tuesday nor Wednesday means any interesting entries in the UK calendar. The same picture is in America. Thus, it will be possible to pay attention only to the political sphere of Britain. The media again reported that the Conservatives are not happy with the fall in popularity of the prime minister and are ready to begin the procedure of changing their leader. The same sentiments are in Parliament itself, where Johnson has repeatedly been subjected to harsh criticism and calls to leave his post only over the past few months. However, this news is unlikely to greatly affect the mood of traders. Most likely, we will have to wait for economic information.

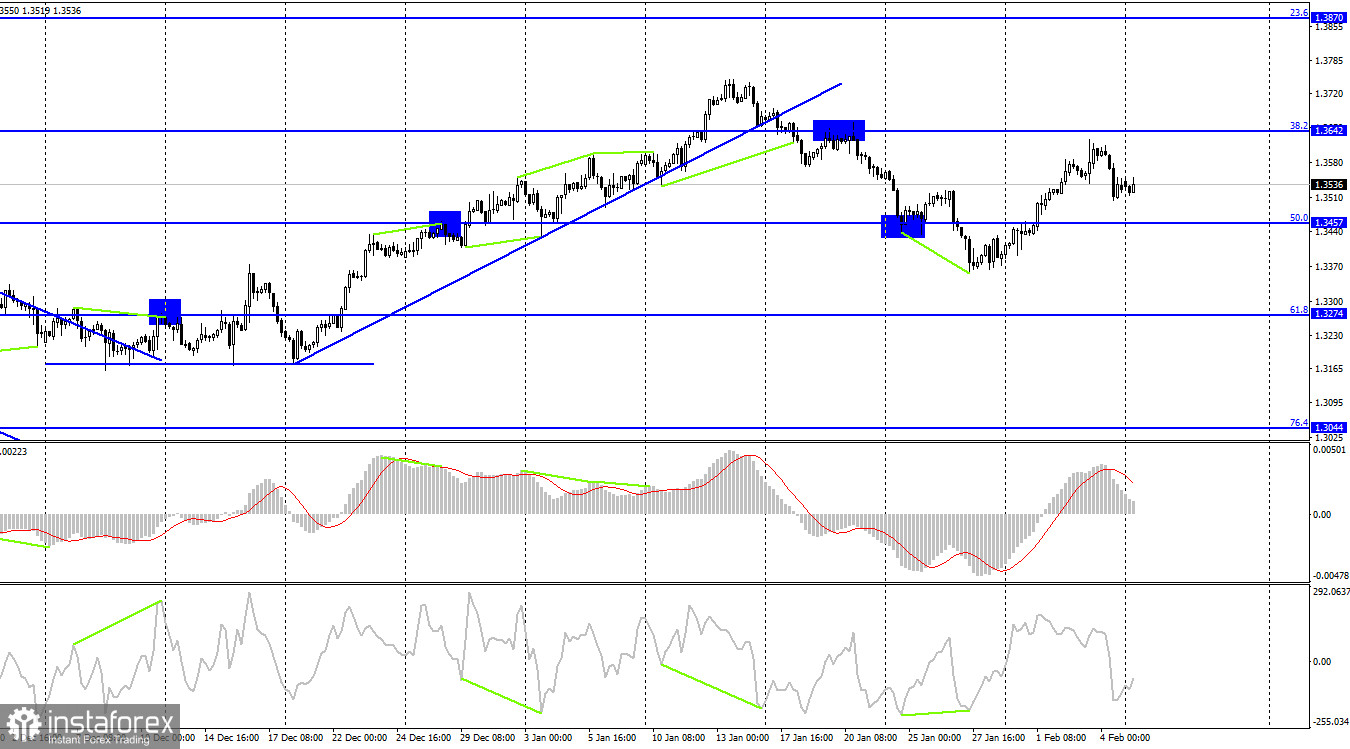

On the 4-hour chart, the pair secured above the corrective level of 50.0% (1.3457). Thus, the growth process is now continuing towards the next Fibo level of 38.2% (1.3642). But there are no signals on this chart now, so again we have to turn to the hourly, on which we have a single level of 1.3523. No indicator has any emerging divergences today.

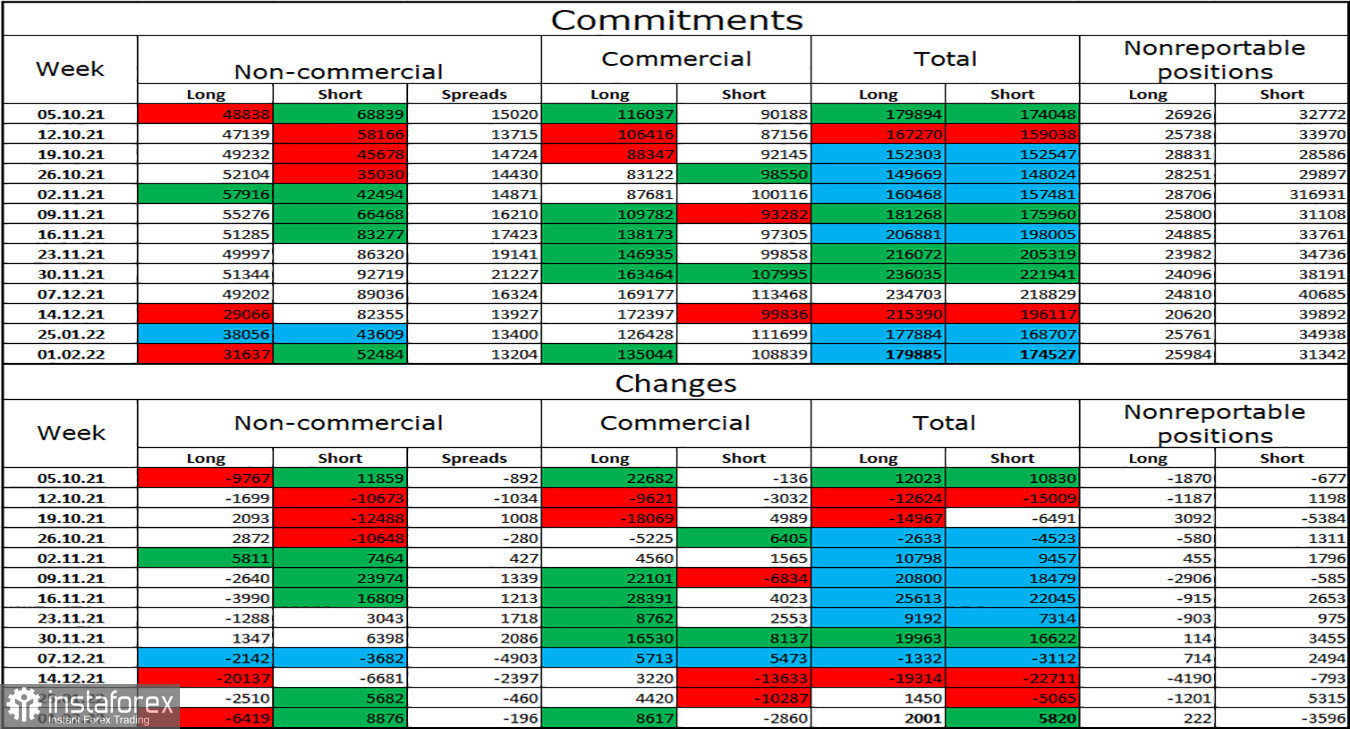

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically over the last reporting week. During this week, speculators opened 8,876 short contracts and closed 6,419 long contracts. Thus, if a week ago the total number of long and short contracts in the hands of the "Non-commercial" category of traders was almost the same, now it differs almost twice: 52484 - 31637. It follows from this that the mood of traders is now "bearish", which generally corresponds to the current picture, but only if you look at the daily chart. In the last few months, the mood of major players has changed quite often, as indicated by the figures of the first two columns of the table, so perhaps no long-term conclusions should be drawn now.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. Thus, today the information background will not have any effect on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound in case of closing below the level of 1.3523 on the hourly chart with targets of 1.3453 and 1.3384. I recommend buying the pound if there is a rebound from the 1.3523 level on the hourly chart, with a target of 1.3609. Since there is no information background today, I do not exclude inactive movements of the pound/dollar pair during the day in a limited range.