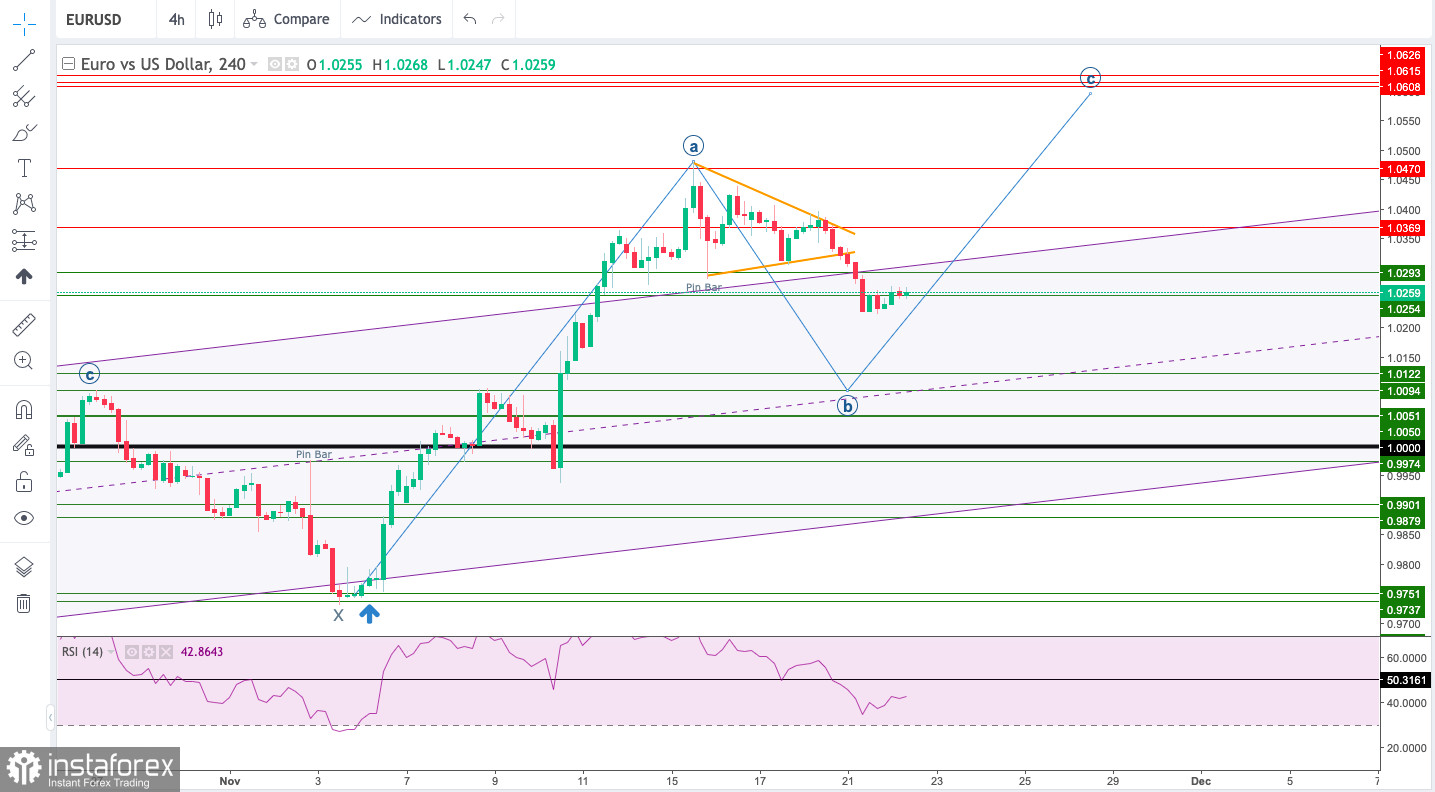

Technical Market Outlook:

The EUR/USD pair has completed the wave A to the upside as a part of the ABC-X-ABC complex corrective structure at the level of 1.0480. In a case of the rally continuation, the next target for bulls is seen at 161% Fibonacci extension located at 1.0523, which is only 43 pips away from the last local high, however, the breakout from the triangle pattern has been made to the downside already, so it looks like the wave B is now on progress. The market is back inside the channel and broke below the technical support seen at 1.0255. The next technical support is seen at 1.0122. The weak and negative momentum supports the short-term bearish outlook for EUR on the H4 time frame chart. The target for bears is seen at the level of 1.0094.

Weekly Pivot Points:

WR3 - 1.04173

WR2 - 1.03565

WR1 - 1.03195

Weekly Pivot - 1.02957

WS1 - 1.02587

WS2 - 1.02349

WS3 - 1.01741

Trading Outlook:

The EUR had made a new multi-decade low at the level of 0.9538, so as long as the USD is being bought all across the board, the down trend will continue towards the new lows. In the mid-term, the key technical resistance level is located at 1.0389 and only if this level is clearly violated, the down trend might be considered terminated. Please notice, there is plenty of room to the downside for the EUR to go, all of the potential technical support level are very old and might not be much reliable anymore.

Please be aware, that any sustained breakout below the technical support seen at 0.9737 will extend the down move even more and will put the level of 0.9669 in view. In the longer term, the key technical resistance level is located at 1.0389 (swing high from August 11th), so the bulls still have a long road to take before the down trend reversal is confirmed. It looks like the simple corrective ABC cycle might evolve into more complex and time consuming ABC-X-ABC cycle.