Bitcoin continued to grow yesterday. A successful attempt to break through the level of $41,411 indicates investors' willingness to continue buying the first cryptocurrency. But how long will they last? It was already mentioned that the current wave pattern allows for several scenarios. One of them is the formation of another, fifth descending wave. After that, the current increase will be interpreted as wave 4 of an impulsive downward trend. In this case, Bitcoin's price may decline to $ 30,000. It will be very difficult for the market to find support for the news background in the first half of this year, which is assumed by many analysts who not only firmly believe that Bitcoin will grow strongly forever. Many note that the situation in the cryptocurrency market may deteriorate significantly in March when the Fed is expected to raise the interest rate for the first time. Then a whole cycle of increases should follow, and each of them will be a negative factor for all cryptocurrencies. It was already said that the tightening of monetary policy leads to the fact that the demand for protective assets is growing.

- Fed's refusal to raise rates will save Bitcoin

The Fed will not abandon its plan. However, the factor of when exactly the rate hike cycle will end plays a huge role. Markets are currently confident that the Fed will raise rates by 4 to 7 times in 2022, but things can be somewhat different. For example, the rate will be raised to 1.25-1.50% at the next four meetings, and then the regulator will take a break for several months. It is these few months when the rate will not grow, that can save Bitcoin. However, it should be noted that the cryptocurrency may be very low after four advances. Most analysts are sure that such a scenario is possible, but not earlier than the second half of 2022. Therefore, forecasts for the first half of the year remain negative. At this time, Bitcoin can increase until March, as no negative news background is expected soon.

- US inflation will locally support Bitcoin

At the beginning of this week, Bitcoin may further grow on the basis that the US inflation report is likely to rise again. Since the main digital asset is still being used as a diversification tool, the demand for it could rise in the upcoming days. The wave pattern does not contradict such growth, as it allows the formation of a corrective wave 4 (if the entire trend section is transformed into a five-wave). If inflation's growth is reported on Thursday, this will be a rather difficult moment for the market, since, on the one hand, investors' desire to buy bitcoin will only increase, and on the other hand, the probability of an interest rate hike at the next Fed meeting will increase many times over.

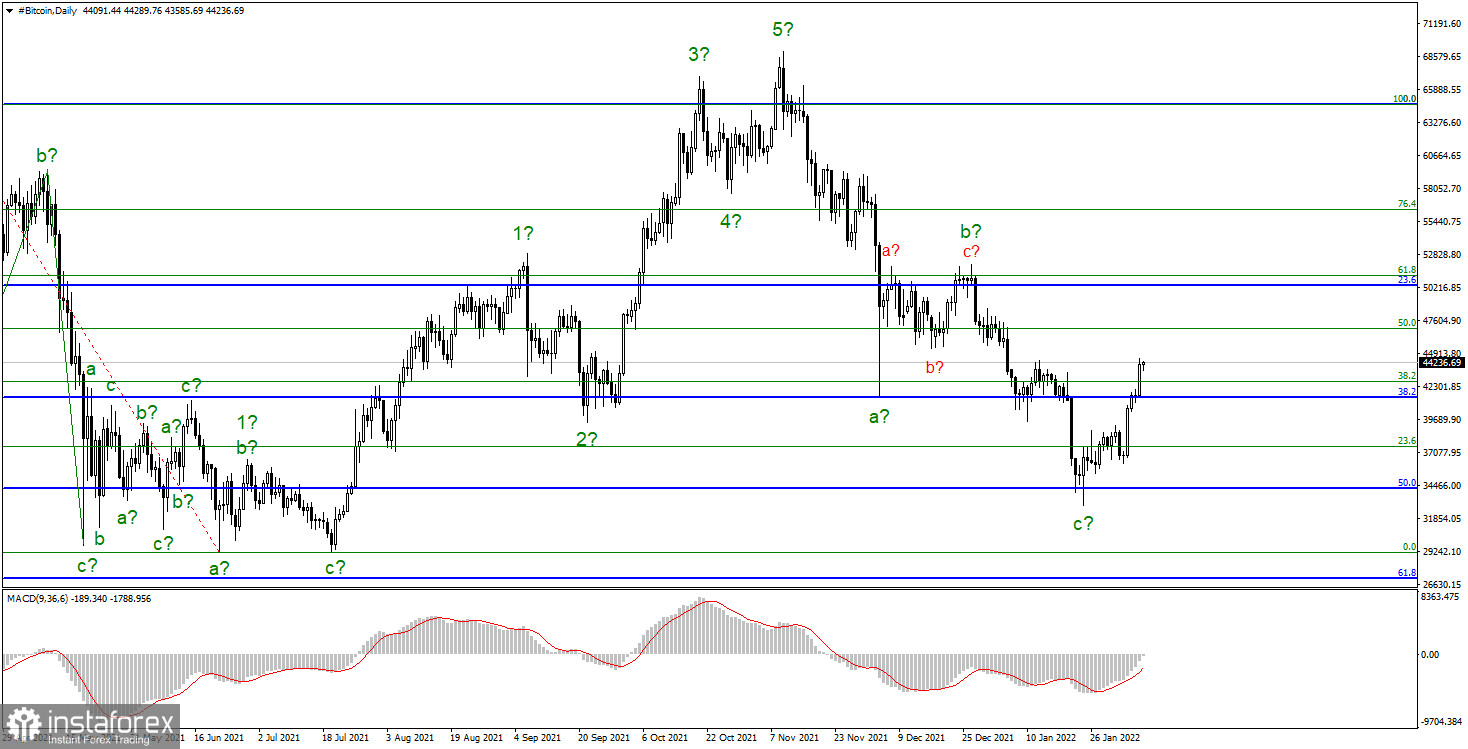

The downward trend section continues to form. An unsuccessful attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward section of the trend. It can take a five-wave form and continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e or waves 5 in c. So far, the internal wave counting of the expected wave c looks too holistic, the corrective waves are very small and difficult to distinguish. However, the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. To sell Bitcoin, new downward signals are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator. In general, any signs that the upward wave that is currently being built is already completed.