Gold rebounded in the short term but the bias remains bearish. After its massive drop, a bounce back was natural. Now, it was trading at 1,741 at the time of writing. Technically, it seems that the throwback ended and now the sellers took the lead.

Fundamentally, XAU/USD could register sharp movements tomorrow as the economic calendar is filled with high-impact events. The RBNZ is expected to increase the Official Cash Rate from 3.50% to 4.25%. Also, the UK, Eurozone, and US manufacturing and services data could be decisive in the short term.

XAU/USD could react aggressively after the FOMC Meeting Minutes as well. A dovish report could boost the yellow metal.

XAU/USD Rebound Ended!

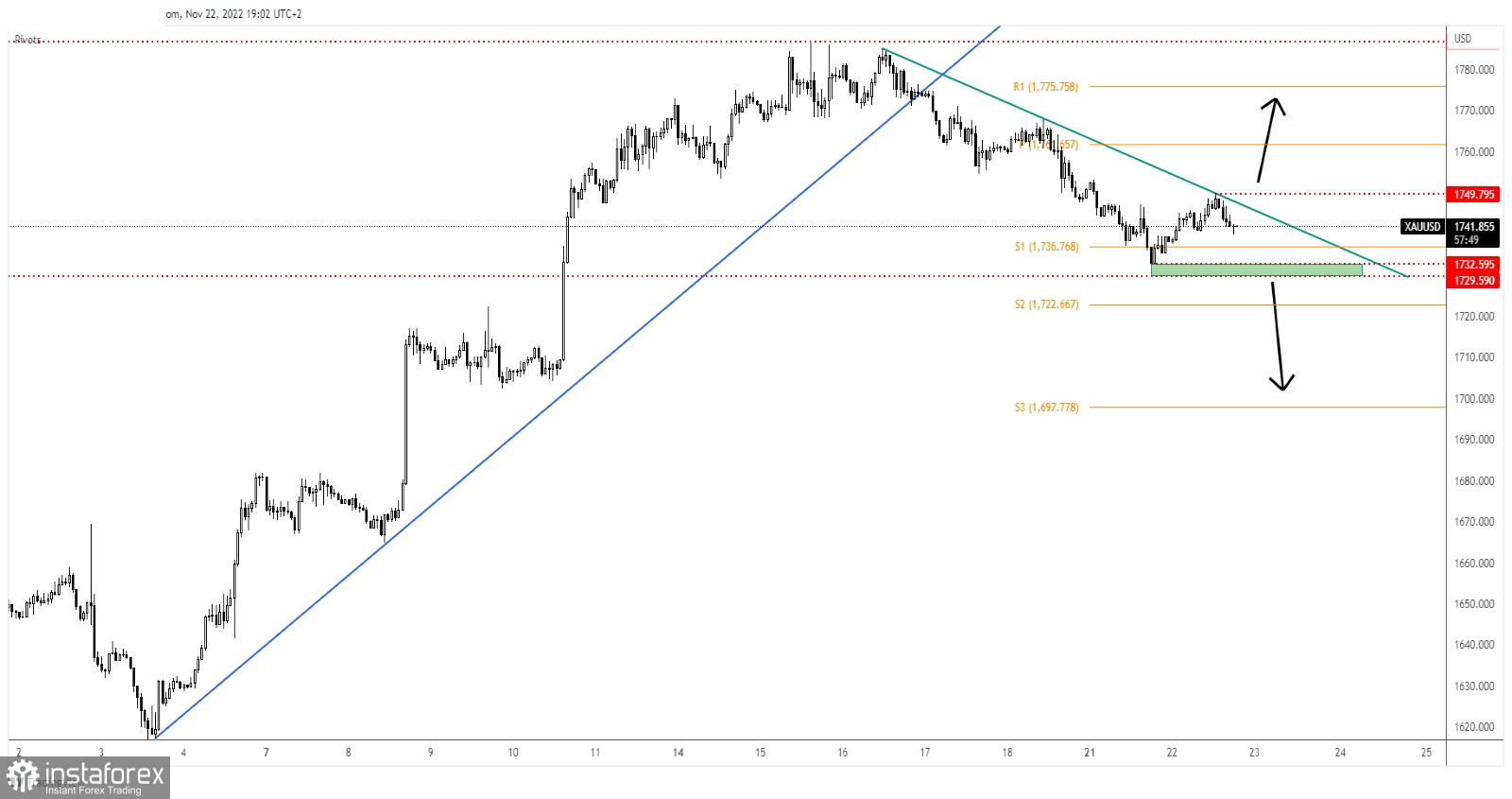

As you can see on the H1 chart, XAU/USD retested the downtrend line and now it has turned to the downside. So, the downtrend line and 1,749 represent upside obstacles.

On the other hand, the 1,732 and 1,729 are seen as downside obstacles. In the short term, the yellow metal could move sideways between 1,729 and 1,749. Escaping from this range could bring new opportunities.

XAU/USD Outlook!

A valid breakdown below 1,729 activates a larger drop. This scenario brings new selling signals. Only staying above the support zone and making a valid breakout through the downtrend line could announce that the retreat ended.