Demand is growing by leaps and bounds, supply is limited by technical capabilities, geopolitical risks are elevated... It's hard to argue that the oil market has rarely looked as strong as it does now. Brent has gained 12% since early 2022, and bulls, who are urging to push the price towards $100 a barrel, are getting stronger by the day. How long can all this go on? After all, when everyone is buying, someone has to sell.

The news of the resumption of negotiations over the Iran nuclear deal has caused some oil bulls to lock in profits. However, rumors that an agreement is ready and all that is left to sign may be exaggerated. Tehran is demanding the complete removal of sanctions and guarantees that they will not be renewed; Washington is hardly ready to agree with this. Although its position looks vulnerable: the White House desperately needs Iranian oil, which would catalyze a correction in Brent and WTI and, eventually, contribute to lower gasoline prices and slow down inflation in the US.

However, the nuclear deal with Tehran is not the only geopolitical risk. There is also Russia and its promise not to invade Ukraine, which few in the West believe in. According to Joe Biden, if an invasion happens, Nord Stream 2 will be stopped immediately, leading to a new surge in gas and oil prices. Only a flow of barrels from Iran and an end to the conflict in Eastern Europe could trigger a serious pullback in Brent and WTI.

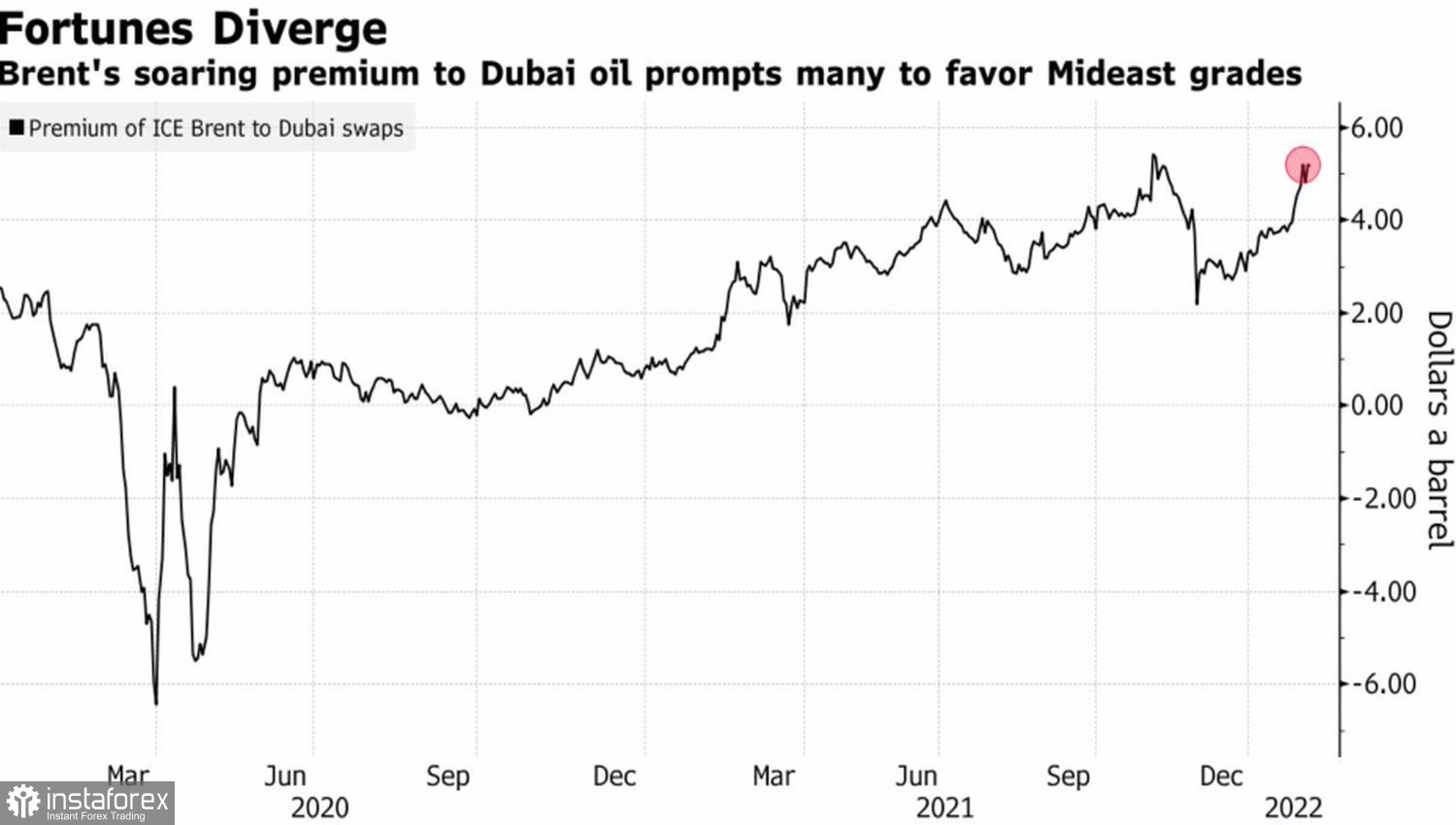

Currently, the positions of bulls seem stable. They are supported by positive news from the US, where due to the cold weather the second largest oil refinery was stopped and an increase in reserves of oil is expected. Saudi Arabia's increase in the price of its own oil for Asian customers signals its confidence in the bright future of the market. Indeed, the rapid growth of Brent has led to an increasing price differential with Middle Eastern oil, which Riyadh is effectively taking advantage of.

Brent spread compared with Middle East oil grades

This raises two questions. First, what will US producers and OPEC+ do when Brent exceeds $100 a barrel? Are they going to actively ramp up production? Secondly, is global demand so strong as it is commonly believed? Its growth rates are clearly behind those that were observed after the major consuming countries lifted lockdowns. If we add to this a massive tightening of monetary policy and the associated potential slowdown of the world economy, we can assume that the future of global demand for oil is not so bright.

All the above suggests that Brent may reach $100 a barrel, but the correction is likely to be very swift.

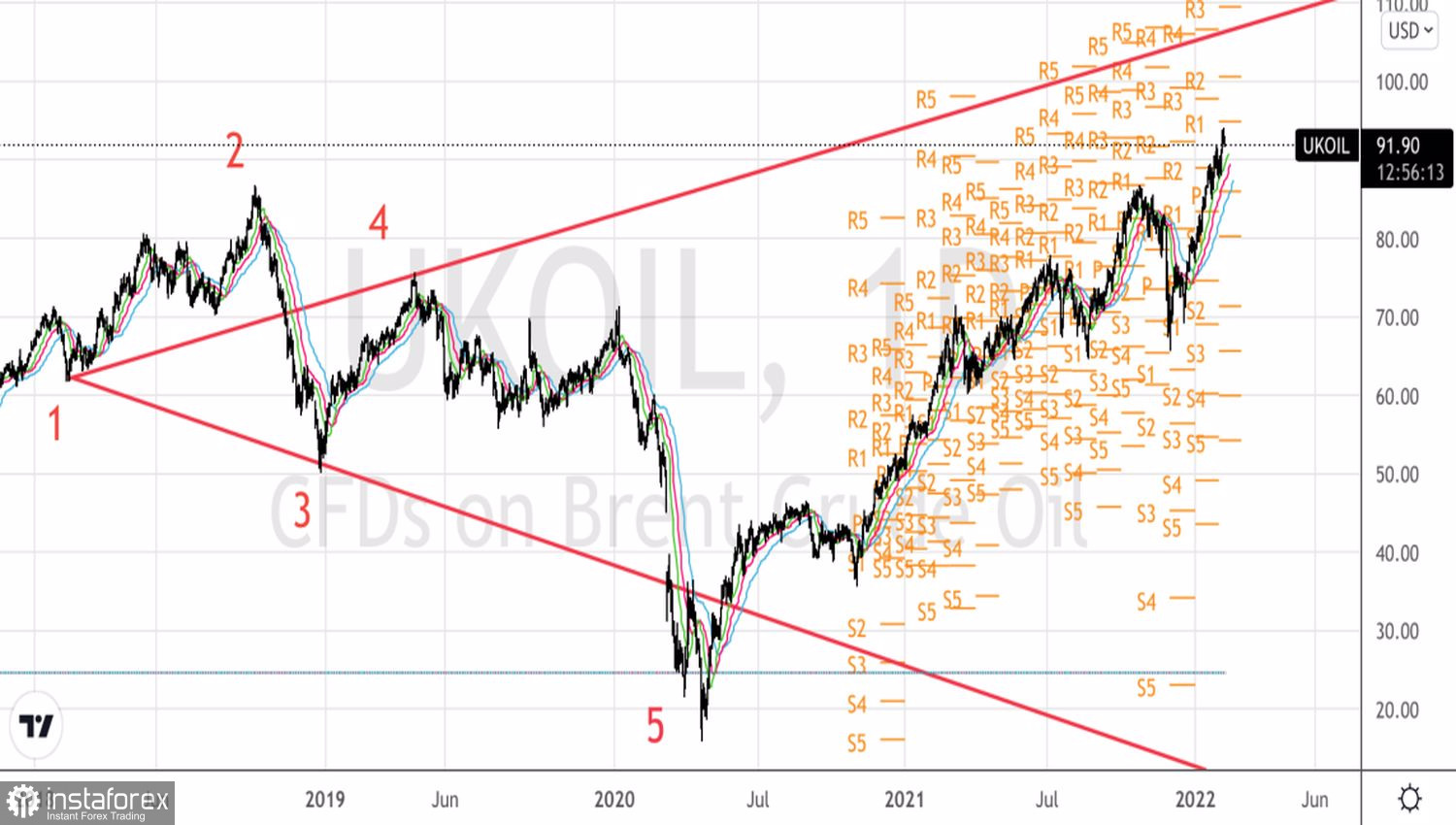

Technically, the uptrend is strong. Only a break through the moving averages and Brent falling below the pivot level of $86.15 may trigger a pullback. In the meantime, we continue to buy the asset with the targets at $100 and $108.

Brent, intraday chart