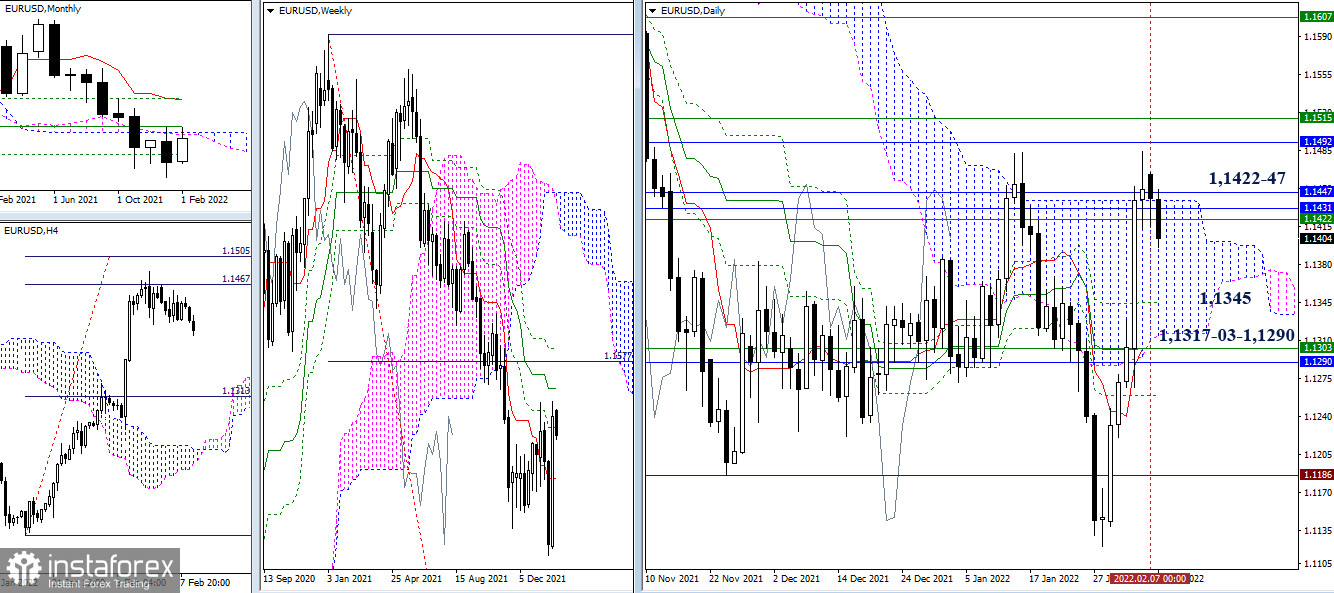

EUR/USD

The situation has not changed significantly over the past day – a slowdown has been maintained. What's relevant is the influence and attraction of the encountered levels of different timeframes at the borders of 1.1422-47. But despite the upward gap at the opening, the bears were more active and productive yesterday. They still retain their advantages today and tend to go below the support of 1.1422-47. The next downward pivot points are 1.1345 (daily Fibo Kijun) and the area of accumulation of levels 1.1317 - 1.1303 - 1.1290 (lower border of the daily cloud + weekly short-term trend + monthly Fibo Kijun).

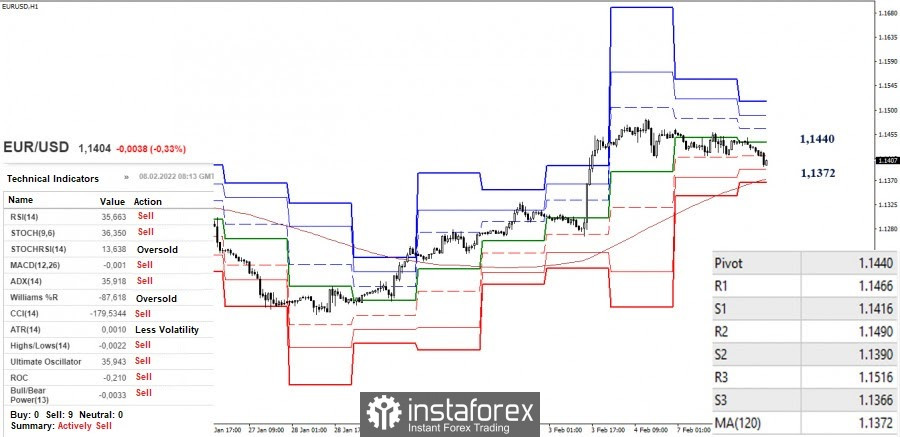

The pair in the smaller timeframes remains in the downward correction zone, according to the results of which it approaches the testing of the key level – the weekly long-term trend (1.1372). Catching this level and reversing it will allow the bears to gain a major advantage here. To change the situation, the bulls need to keep the weekly long-term trend (1.1372) as support, and then return the central pivot level (1.1440) and update the high (1.1484).

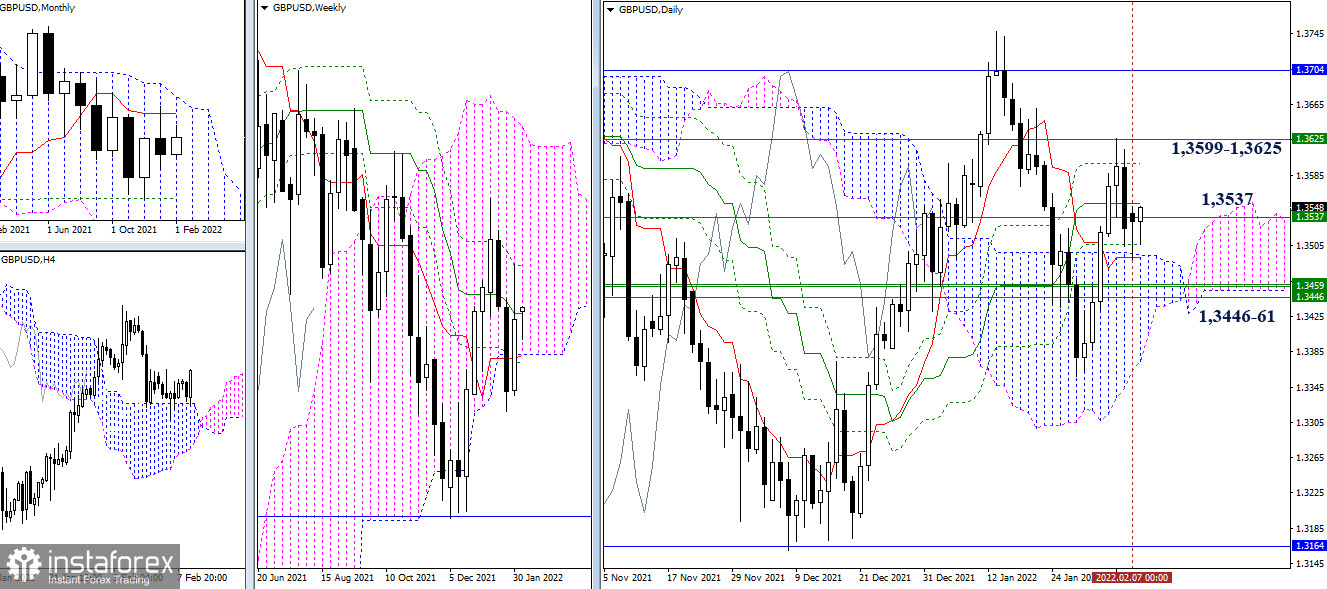

GBP/USD

Yesterday, the support level and the attraction of the weekly medium-term trend (1.3537) were broken on the daily chart. Today, these levels still exert their influence and restrain the development of the situation. They can be noted at 1.3553 - 1.3537 - 1.3506 - 1.3492-95. This wide range is limited by the final borders of the daily and weekly dead crosses (1.3599 - 1.3625) and the accumulation of weekly levels in the area of 1.3446-61. It is worth noting that going beyond these limits can change the situation in the longer term.

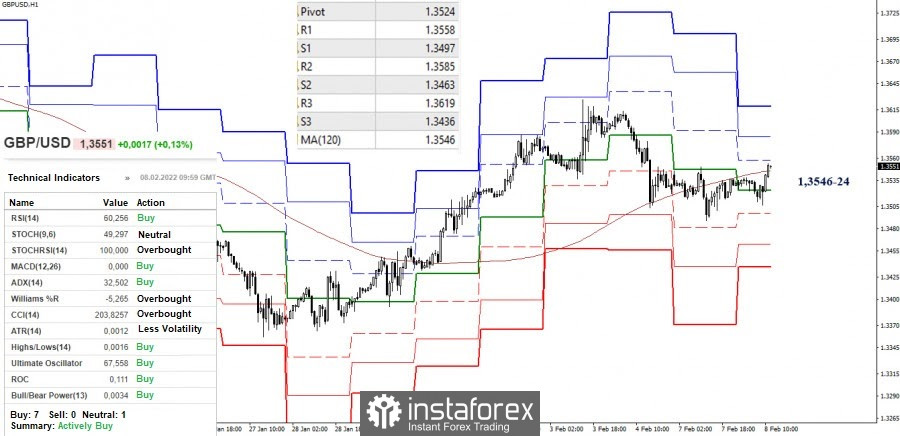

Sellers broke through the key level (weekly long-term trend) in the small timeframes yesterday, but they still fail to further fall and deploy the moving average. At the moment, they are retesting the weekly long-term trend, which is located at 1.3546. A consolidation above it will allow us to further restore the bullish positions. Today, the intraday upward pivot points are set at 1.3558 - 1.3585 - 1.3619 (classic pivot levels). However, ending the retest, returning below the levels of 1.3546-24 (weekly long-term trend + central pivot level), and reversing the moving average may restore the bears' activity and restore their opportunities to strengthen their sentiments. The supports of the classic pivot levels at 1.3497 - 1.3463 - 1.3436 can be considered.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.