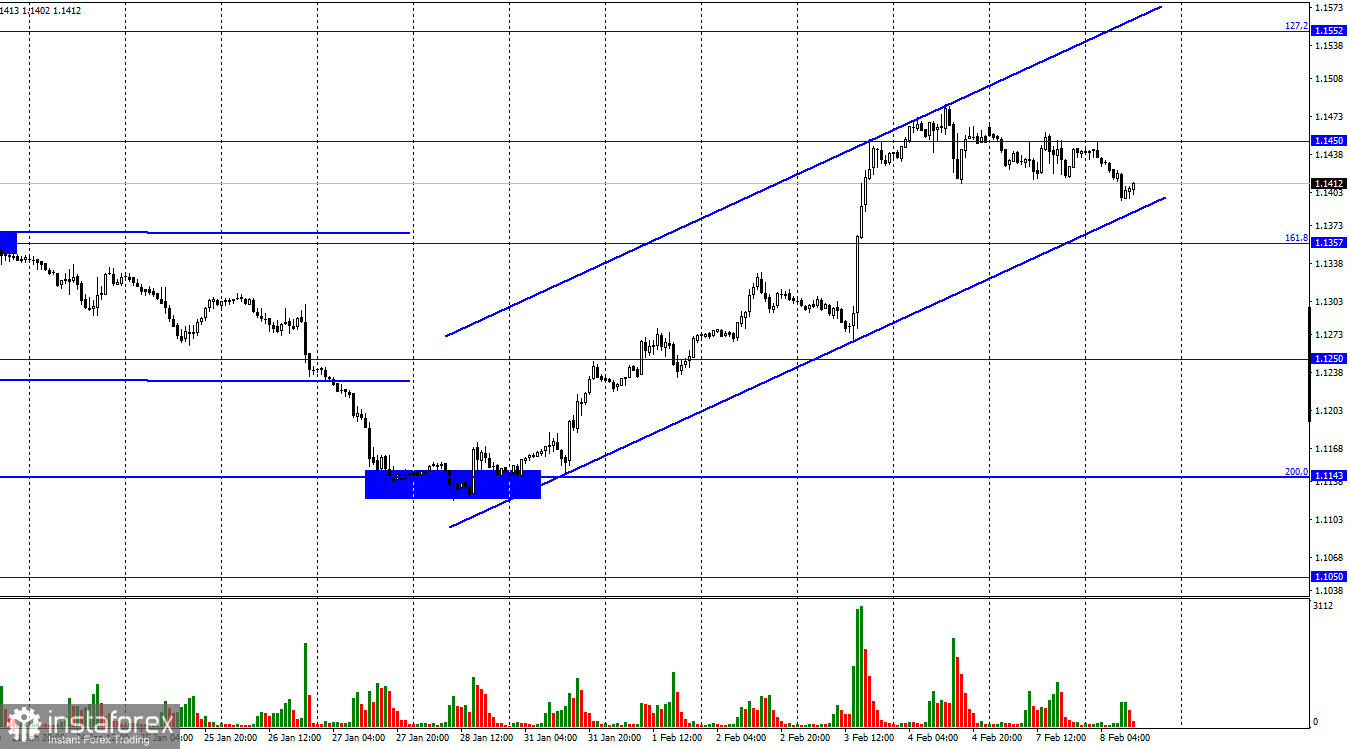

Hello, dear traders! On Monday, the EUR/USD pair continued its weak fall towards the lower boundary of the uptrend corridor. The pair's rebound from this line will favor the European currency and the growth resumption towards the correction level of 127.2% at 1.1552. The closing of the quotes below the corridor will support the US currency and further decline towards the level of 1.1250. At the same time, there was almost no news background on Monday. Therefore, there was little traders' activity yesterday. However, one significant event should be discussed. ECB president Christine Lagarde delivered a speech in the European parliament. Different mass media noted that Lagarde had said nothing important, focused on her own speculations and hints.

Notably, after the ECB meeting last week Christine Lagarde noted that the interest rate might be raised in 2022. However, she did not say when or under what conditions it might be raised. Yesterday, traders were expecting at least some clarification on Lagarde's rhetoric after the meeting. However, they did not get any information. Lagarde said that there were no signs of higher inflation in the short term. She also stated that the ECB could not affect demand growth, being the cause of rising prices for many goods and services. Traders did not react to these statements and were likely to be very disappointed in the ECB president. It is still unclear what action the ECB will take this year, when it occurs. Besides, uncertainty is not conducive to traders to buy the European currency. Thus, based on Lagarde's rhetoric, I can conclude that a rise in the US dollar is more likely during this year as the Fed's policy is currently evident.

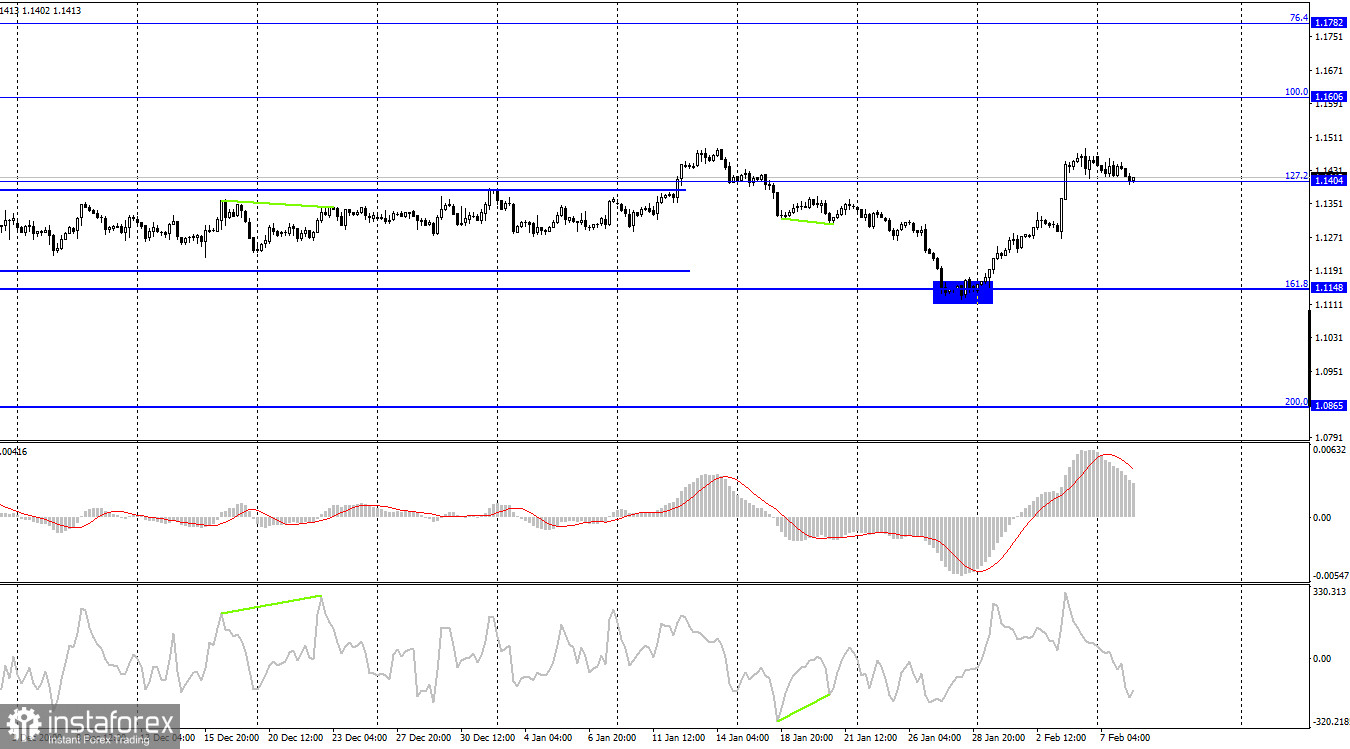

On the 4-hour chart, the pair consolidated above the correction level of 127.2% at 1.1404. Therefore, the rise may continue towards the next Fibo level of 100.0% at 1.1606. If the pair closes under the level of 127.2%, it will favor the US currency and the fall will resume towards the correction level of 161.8% at 1.1148. There are no emerging divergences in any of the indicators today.

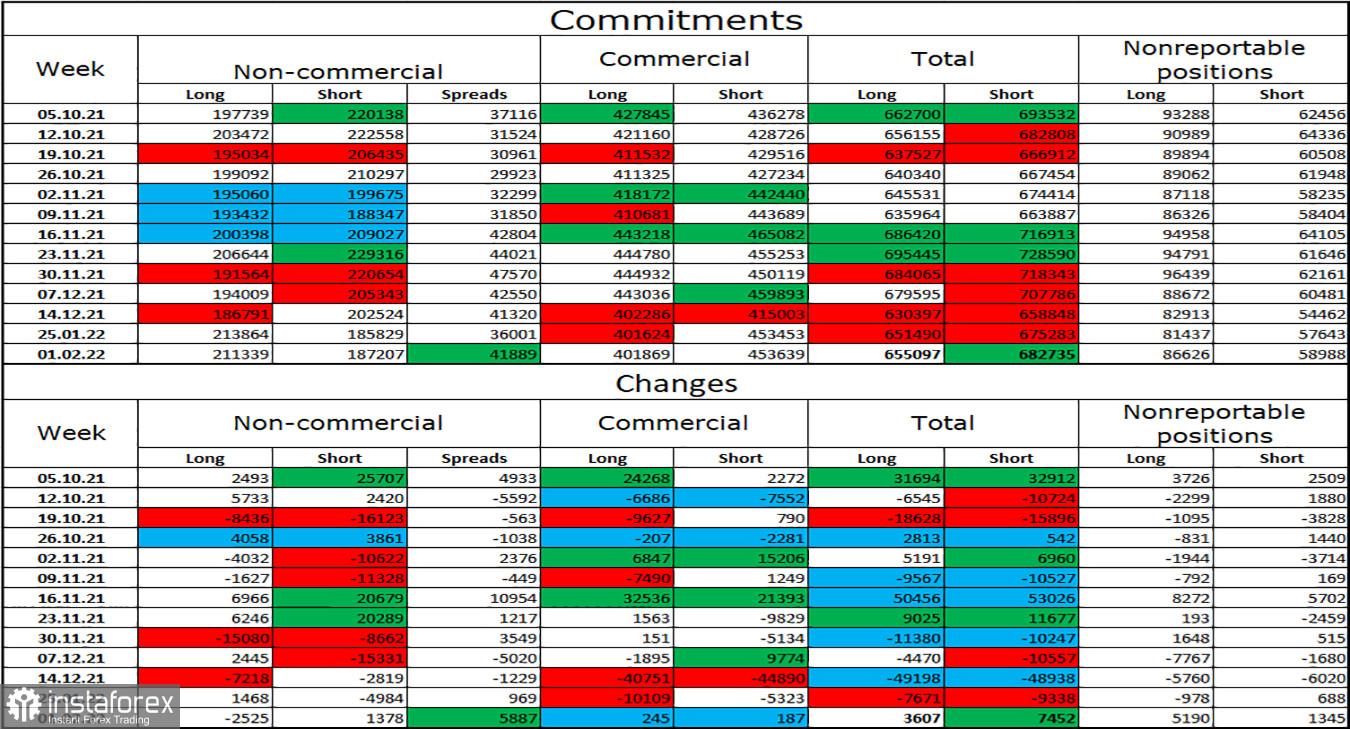

COT report:

Speculators closed 2,525 long contracts and opened 1,378 short contracts during the last reporting week. This fact indicates that their sentiment has become more bearish. The total number of long contracts held by them is now 211.000, while the number of short contracts amounts to 187.000. Therefore, the overall sentiment of "non-commercial" traders is considered bullish. Thus, further euro's growth is possible. Besides, the number of long contracts increased, while the number of short contracts decreased during the last weeks. Consequently, the sentiment of major players has changed, indicating a possible growth during the next months.

US and EU economic news calendars:

On February 8, the EU and US economic calendars contained no significant events. The news background will not affect traders' sentiment today. I do not expect the traders' activity to increase today compared to yesterday.

EUR/USD outlook and recommendations for traders:

I recommend selling the pair now with a target of 1.1357 as there was a close under 1.1450 on the hourly chart. I recommend buying the pair at a rebound from 1.1357 on the hourly chart or at a close above 1.1450. In the first case, the target is 1.1450, while in the second case, it is 1.1552.