S&P500

Omicron statistics for February 9

The US market showed strong gains on Tuesday.

Major US indices rose by the close: the Dow added 1.1%, the NASDAQ went up 1.4%, the S&P500 increased by 0.8%.

Asian markets on Wednesday morning: Japan stock indices went up 0.7% and China indices rose by 1.2%.

The Russian market showed strong gains yesterday. Its indices were up more than 3% after tensions between Russia and Ukraine eased following the meeting between Putin and Macron in Moscow.

Energy: Oil was down about $1.5 yesterday. Brent crude oil is trading at $90.90 on Wednesday, the first considerable drop since January 25. The market has probably started to be sluggish after a long rise. The drop in oil may also be due to some improvement in relations between the US and Iran after Biden said he was ready to return to a nuclear deal with Iran.

The S&P500 is trading at 4521, the range is 4480 - 4560.

The US Department of Energy raised its oil production forecast by 190,000 bpd to 12.6 million bpd for 2022. The US Energy Department also raised its global oil demand forecast by 200,000 bpd to 102.5 million bpd for 2022. Current oil prices make US shale oil production profitable.

The US trade balance in January is negative - $80.7 billion according to the forecasts.

Pfizer's net income rose sharply by 2.4 times to $22 billion in 2021. The company earns high profits as the global market leader in COVID-19 vaccines.

China urged the US to abandon its policy of discrimination against Chinese companies and products in the US market. However, the US has just published another list of 33 Chinese companies to be sanctioned. The tensions between the US and China have persisted under Biden, beginning under Trump.

Despite US attempts to pressure imports from China, the US trade deficit has increased significantly by 26% in 2021 and hit a new high of $890 billion, far surpassing the previous high of $763 billion in 2006. Very strong growth in Americans' incomes in 2021, as well as government support during the coronavirus pandemic and rising wages are the reasons for it. On the other hand, it is a signal that the current growth cycle is about to end.

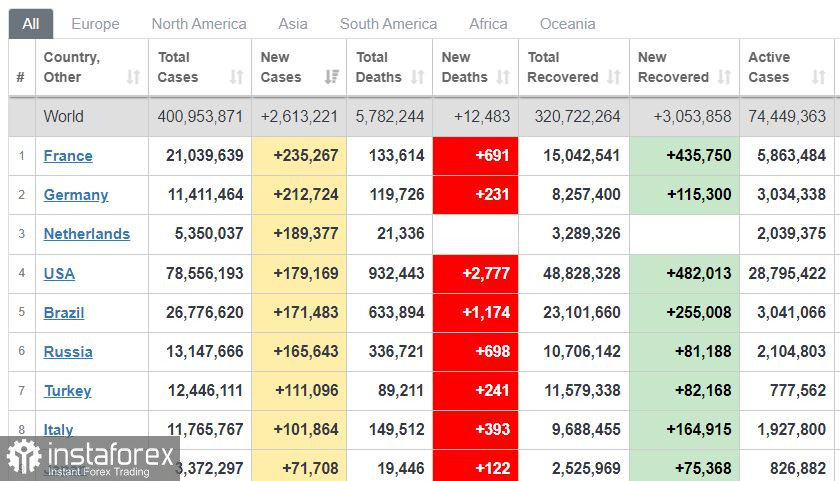

Omicron global statistics: New rise of Omicron cases is reported on Tuesday. However, the number of new cases remains about 30% below January's highs. 2.6 million new Omicron cases were recorded yesterday. France, the Netherlands, and Germany topped the list with about 200,000 new cases yesterday, followed by the US and Russia with around 170,000 cases.

The US Justice Department seized $3.6 billion worth of bitcoins. They were stolen during a cryptocurrency exchange hack. This is the largest-ever financial seizure. Two suspects in the hack have been arrested.

The USDX is trading at 95.50, the range is 95.20 - 95.80. The euro exchange rate stopped in a narrow range. ECB head Christine Laggarde said that the ECB had no urgent need to raise the euro rate. She hopes that inflation in the eurozone will decline. The ECB has been used to follow the Fed and the Bank of England. First, those central banks will raise interest rates, and then the ECB will raise it.

The USD/CAD pair is trading at 1.2700, the range is 1.2600 - 1.2800.

Conclusion. The market expects the US inflation report for January to be released on Thursday. Investors want to get the answer whether the Fed's reaction to high inflation will be strong. On the one hand, the US economy is currently very strong, hitting its multi-year highs. On the other hand, stock prices are very high and the market's upside potential is correspondingly low.